ArcelorMittal South Africa To Close Longs Business Amid Economic Struggles

ArcelorMittal’s MT division, ArcelorMittal South Africa, has announced that it will wind down its Longs Business. The company has been grappling with ongoing challenges such as slow economic growth, high logistics and energy expenses, and a surge of low-cost steel imports from China.

Closure Plans and Job Impacts

The Longs Business has proven unsustainable despite extensive discussions with government and stakeholders aimed at finding feasible solutions. Persistent high logistics and energy costs, coupled with inadequate policy support, have driven this decision. Transitioning to care and maintenance, production in the Longs Business is expected to halt by late January 2025, with all processes concluding in the first quarter of 2025.

Approximately 3,500 direct and indirect jobs will be affected, with significant implications for operations at the Newcastle and Vereeniging Works and AMRAS. While coke-making operations at Newcastle will continue, they will be scaled back due to reduced demand. The decision particularly impacts jobs in the Flat Business and certain roles within corporate support services. The company aims to reduce the impact on employees and suppliers while realigning its R1 billion working capital facility, secured last year.

Market Conditions and Financial Forecasts

Record-high steel exports from China have led to a drop in international steel prices, prompting many companies to suspend production and close plants. Weak domestic markets for long steel products and an oversupply of steel production, both locally and globally, have influenced ArcelorMittal South Africa’s decision.

The company anticipates a significant drop in earnings for the year ending December 31, 2024, with expected losses of R5.48-R6.21 per share, compared to the previous year’s loss of R3.52 per share. Revenue for 2024 is predicted to fall by over 5% year over year, driven by lower realized prices, reduced asset utilization, and ongoing challenges within the Longs Business.

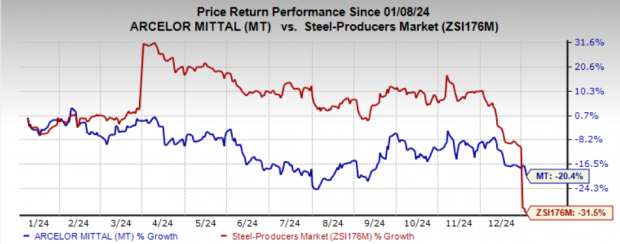

Over the past year, MT stock has decreased by 20.4%, in contrast to a 31.5% decline in the broader industry.

Image Source: Zacks Investment Research

MT’s Zacks Rank and Recommendations

Currently, MT holds a Zacks Rank #3 (Hold). In the Basic Materials sector, some notable stocks include Gold Royalty Corp. GROY, MAG Silver Corp. MAG, and Fortuna Mining Corp. FSM. GROY and MAG each enjoy a Zacks Rank #1 (Strong Buy), while FSM has a Zacks Rank #2 (Buy). For those interested, you can find the complete list of today’s Zacks #1 Rank stocks here.

Gold Royalty anticipates earnings growth of 66.7% for the current year, having beaten earnings estimates in three of the last four quarters, with an average surprise of 125%.

Currently, the Zacks Consensus Estimate for MAG Silver’s earnings stands at 75 cents per share. MAG’s earnings have surpassed estimates in each of the past four quarters, yielding an average surprise of 17.1%. The stock has experienced a 40.4% increase in the last year.

For Fortuna Mining, the current-year earnings estimate is 48 cents, indicating a robust projected rise of 118.2%. FSM has beaten estimates in two of the last four quarters while missing in the other two, producing an average surprise of 53.6%. The stock has risen by 23.3% over the past year.

Research Chief Announces Top Stock Pick

Zacks experts have identified five stocks they believe could skyrocket by 100% or more in the upcoming months. Among these, the Director of Research, Sheraz Mian, has chosen one stock as the strongest candidate for explosive growth.

This company caters to millennial and Gen Z markets, boasting nearly $1 billion in revenue last quarter. A recent dip in stock price offers a promising entry point. While not every pick on their elite list is guaranteed to succeed, this particular stock has the potential to exceed past performers like Nano-X Imaging, which gained 129.6% within just over nine months.

Free: See Our Top Stock And 4 Runners Up

ArcelorMittal (MT): Free Stock Analysis Report

Fortuna Mining Corp. (FSM): Free Stock Analysis Report

MAG Silver Corporation (MAG): Free Stock Analysis Report

Gold Royalty Corp. (GROY): Free Stock Analysis Report

Read the original article on Zacks.com here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.