“`html

Home Depot vs. Lowe’s: A Battle for the Home Improvement Market

As major players in home improvement retail, The Home Depot Inc. HD and Lowe’s Companies Inc. LOW have long captured investors’ interest. With decades of experience, both companies are well-respected names in the market.

Home Depot excels with its extensive Pro customer network and operational efficiency, making it the preferred choice for contractors and large projects. In contrast, Lowe’s emphasizes DIY customers with personalized service, tailoring its product offerings to meet the needs of homeowners.

As we look ahead to 2025, let’s explore the key statistics, market share, valuation, dividend strategies, and stock performances of both companies to evaluate which one might have better growth prospects.

Market Share and Key Statistics: Comparing LOW and HD

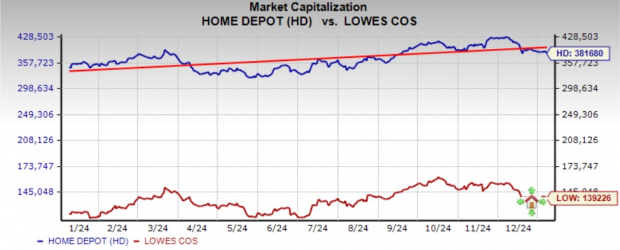

For over a decade, Home Depot and Lowe’s have competed for dominance in the home improvement sector. They share a similar customer base and product range, yet differ vastly in size, branding, and supply-chain methods. Home Depot, with a market cap of $381.7 billion, significantly outstrips Lowe’s market cap of $139.2 billion.

Home Depot leads the market, holding about 47% of it, while Lowe’s captures around 28%. In fiscal 2023, Home Depot reported revenues of $152.7 billion, compared to Lowe’s $86.4 billion. Despite its leading position, Lowe’s has made progress in closing the revenue gap through targeted strategies.

Image Source: Zacks Investment Research

Assessing Earnings Estimates for LOW and HD

Looking forward, Home Depot anticipates modest growth in revenues and earnings per share (EPS), in contrast to Lowe’s which expects year-over-year declines.

Home Depot’s fiscal 2024 revenues are expected to grow by 3.9% to $158.6 billion, with EPS projected to rise by 0.1% to $15.12. In the last 60 days, Home Depot’s EPS estimates rose by 0.7%. For fiscal 2025, annual earnings are expected to reach $163.9 billion, with EPS anticipated to grow 3.5% to $15.65 per share.

Home Depot Earnings Estimate Revision Trend

Image Source: Zacks Investment Research

On the other hand, Lowe’s fiscal 2024 revenues are expected to fall by 3.5% to $83.3 billion, with EPS likely to drop by 10% to $11.88. Estimates for Lowe’s EPS decreased by 0.7% in the past two months. For fiscal 2025, Lowe’s annual earnings are predicted to increase by 1.1% to reach $84.3 billion, while EPS is expected to grow by 5.7% to $12.56.

Lowe’s Earnings Estimate Revision Trend

Image Source: Zacks Investment Research

This data clearly shows that Home Depot’s analysts have been raising their estimates, while Lowe’s has experienced a downward trend. The projected revenues and earnings for Home Depot indicate growth, whereas Lowe’s forecasts suggest declines.

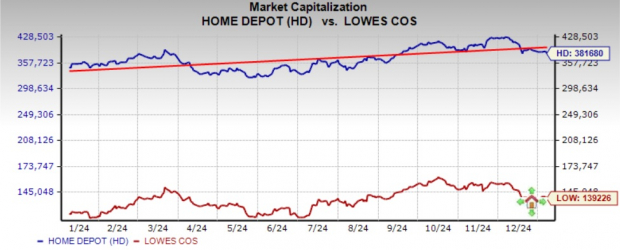

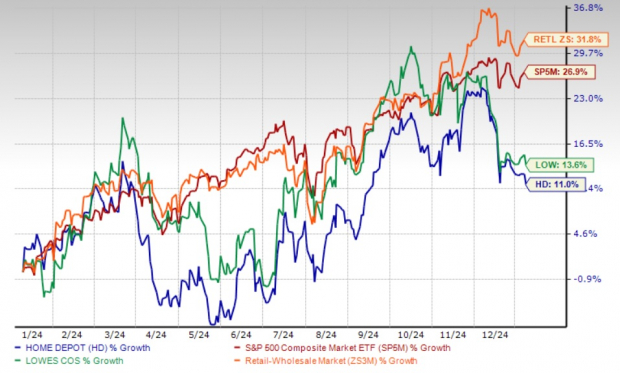

Stock Performance and Valuation: A Comparative Look

In the past year, Lowe’s stock outperformed with a total return exceeding 13%, including dividends. This lags behind the S&P 500’s 26% rise but surpasses Home Depot’s 11% increase.

Both companies’ performances have notably underperformed compared to the broader Retail-Wholesale sector, which saw total returns of +31%.

One-Year Stock Price Performance: HD vs. LOW

Image Source: Zacks Investment Research

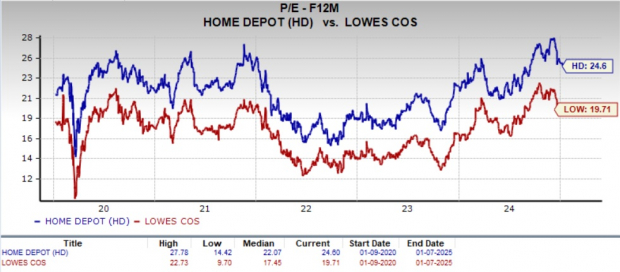

When it comes to valuation, Home Depot and Lowe’s share similar forward price-to-earnings (P/E) ratios. Home Depot trades at 24.6X, slightly above its 5-year median of 22.07X. Meanwhile, Lowe’s trades at 19.71X, exceeding its median of 17.45X.

Image Source: Zacks Investment Research

The broader Zacks Retail-Wholesale sector trades at a higher 24.8X forward P/E, indicating that both Home Depot and Lowe’s appear relatively cheaper than the average sector company.

Currently, both companies hold a Zacks Rank of #3 (Hold).

Dividend Analysis: Comparing Home Depot and Lowe’s

Investors often favor Home Depot and Lowe’s because of their consistent dividend payments. Both firms have a history of increasing dividends, reflecting their commitment to shareholder return and growth.

Home Depot offers a dividend yield of 2.3% with a 60% payout ratio, balancing shareholder rewards and business reinvestment. It has a five-year dividend growth rate of 11.2%. (Check HD’s dividend history here)

Lowe’s has a lower dividend yield of 1.8% and a payout ratio of 39%, allowing for greater potential dividend growth. Its five-year dividend growth rate stands at 20.3%. (Check LOW’s dividend history here.)

Conclusion: Which Stock Should You Choose: HD or LOW?

Home Depot boasts a larger market share, higher revenues, and a well-established Pro customer base. However, Lowe’s is gaining ground with strategic growth initiatives and operational efficiencies. Conservative investors may find Home Depot to be a safer option, while those willing to take on more risk might see potential in Lowe’s for significant growth in 2025.

Ultimately, the best investment choice hinges on individual financial goals and risk tolerance.

7 Best Stocks for the Next 30 Days

Recently released: Experts have narrowed down 7 elite stocks from an extensive list of 220 Zacks Rank #1 Strong Buys, predicting these stocks as “Most Likely for Early Price Pops.”

Since 1988, the full list has significantly outperformed the market, averaging a gain of +24.1% annually. Consider giving these selected stocks your immediate attention.

Lowe’s Companies, Inc. (LOW): Free Stock Analysis Report

The Home Depot, Inc. (HD): Free Stock Analysis Report

Read the full article on Zacks.com here.

The views expressed here are the opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

“`