Thor Industries, Inc. is grappling with a storm as higher interest rates dampen the RV market. This Zacks Rank #5 (Strong Sell) recently trimmed its fiscal 2024 earnings forecast.

THOR, the behemoth in the world of recreational vehicles (RVs), set sail on August 29, 1980, when it acquired the legendary Airstream brand.

A Rocky Road Ahead

On March 6, 2024, THOR reported its fiscal second-quarter 2024 earnings and fell significantly short of the Zacks Consensus. Earnings stood at $0.40, missing the Zacks Consensus estimate of $0.69 by a whopping 42%.

Surprisingly, it marked the company’s first miss in 4 quarters, hinting at turbulent times ahead.

THOR faced subdued retail demand, accentuated by cautious sentiments among dealers. The macro environment continued to weigh heavily on the top-line performance.

To navigate these choppy waters, THOR collaborated with independent dealer partners to align wholesale production with retail sales momentum. Moreover, promotional initiatives were rolled out to clear older inventory and stoke retail interest.

However, daunting floor plan financing costs have strained dealers, prompting constrained inventory levels. Despite this, consumer enthusiasm for the RV lifestyle remains buoyant, mirrored by robust show attendance.

Lowered Expectations

With treacherous waters ahead during the pivotal retail season, THOR proceeded with caution. Escalating interest rates have not only squeezed independent dealers but also curbed consumers’ willingness to splurge on discretionary expenses.

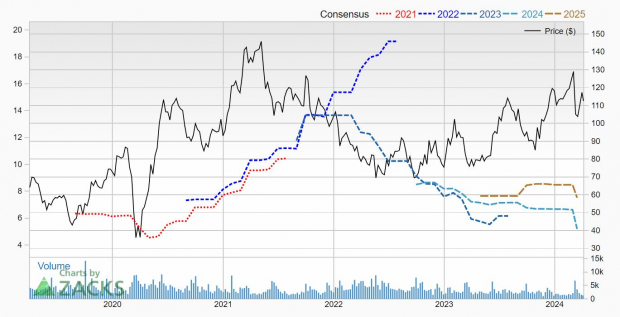

Consequently, THOR revised its full-year earnings outlook to a range of $5.00 to $5.50 from a prior range of $6.25 to $7.25. Analysts followed suit, with 4 revised estimates for fiscal 2024 in the past month, dragging the Zacks Consensus down to $5.19.

This revised guidance also translates to a 25.3% earnings decline from fiscal 2023’s $6.95, reflecting the turbulent waters THOR navigates.

Steady But Overvalued

Despite the stormy forecast, THOR’s shares have weathered the turbulence well. Merely down 12.8% over the last month, they are far from plumbing new depths.

Notably, on a Price/Earnings basis, THOR boasts a rather lofty forward P/E of 21.7. Nonetheless, it continues to appease shareholders with a dividend yield of 1.7%.

While the RV industry faces headwinds aplenty, investors eyeing THOR and the RV sector may find prudence in waiting on the sidelines until consensus earnings set sail towards calmer seas.