Short selling stands as a thorn in the side of companies, yet it is the lifeblood of arbitrageurs and market makers in the ever-evolving world of investing.

The dread of companies and shareholders lies in the ability of short sellers to drive stock prices down, potentially hindering the issuance of capital and impacting investor returns.

Despite these concerns, U.S. regulators have implemented stringent rules to curb short selling, from mandatory disclosures to trading restrictions.

Defining Short Selling

The concept of short selling is simply the act of selling a stock that one does not possess.

Under this practice, borrowers must secure the stocks to facilitate settlement, thus incurring ongoing finance and borrowing expenses for investors involved in short positions.

The Players Involved in Short Selling

Short selling attracts a diverse array of participants, shedding light on the intriguing landscape of those engaged in these activities.

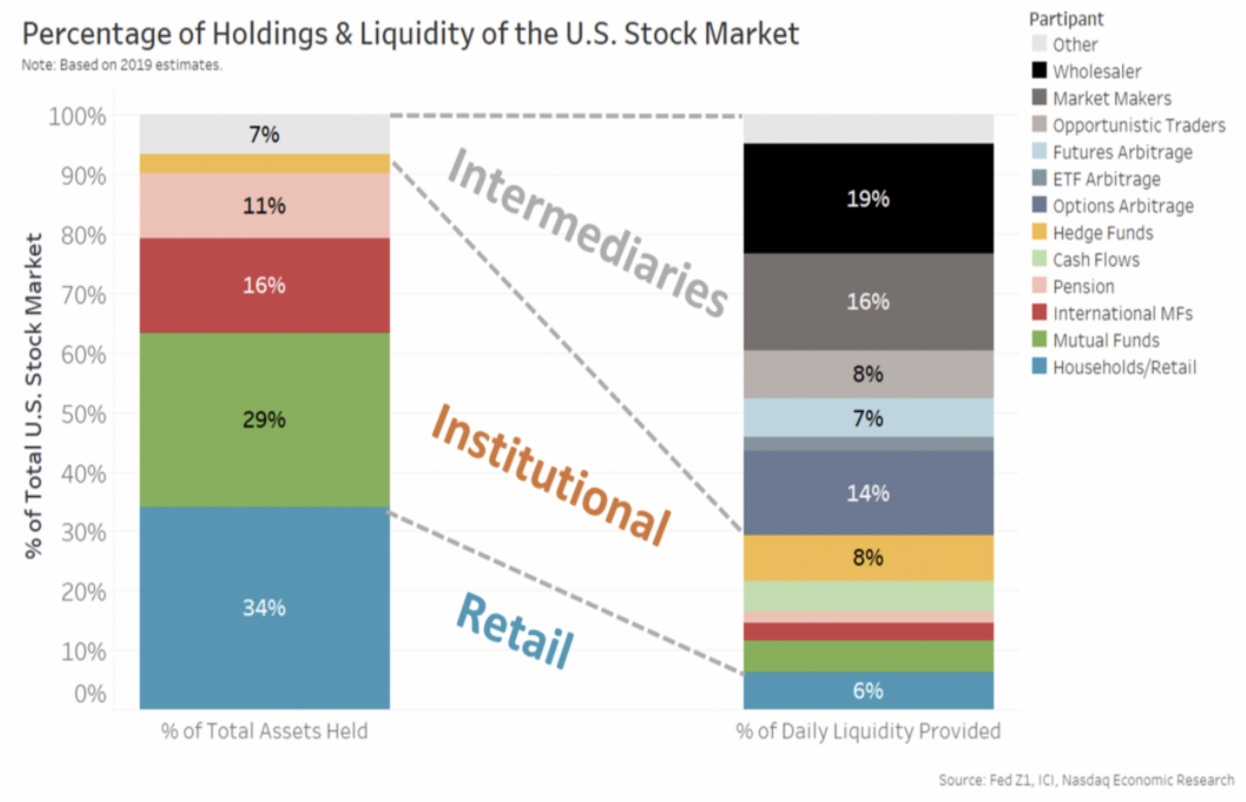

Research from a previous report indicates that while most investors are predominantly “long only” players in the market, a major chunk of trading is orchestrated by intermediaries, despite their seemingly modest net assets.

The symbiotic relationship between market liquidity providers and intermediaries is crucial for the efficient functioning of the stock market.

Chart 1: Emphasizing the Vital Role of Intermediaries in Market Efficiency

For instance:

- Market makers facilitate trade by providing continuous bids and offers, often finding themselves in short positions, thereby aiding buyers in finding sellers and tightening bid-offer spreads.

- Statistical arbitrageurs engage in short-term trading based on the relative performance of related stocks, spurring liquidity transfers that assist mutual funds in executing large orders.

- Futures or ETF arbitrage aligns ETF prices with the actual value of the underlying stocks, ensuring investors obtain fair value when investing in ETFs or Futures for stock exposure.

- Options market makers, both for on-exchange options and OTC derivatives, meticulously hedge their positions by adjusting their underlying stock hedges over time.

The majority of these strategies involve swift offsetting positions rather than accumulating substantial short positions. In essence, short selling by liquidity providers, arbitrageurs, and market makers plays a pivotal role in enhancing market efficiency and narrowing spreads – ultimately lowering the cost of capital for companies.

However, what about long-term investors such as hedge funds?

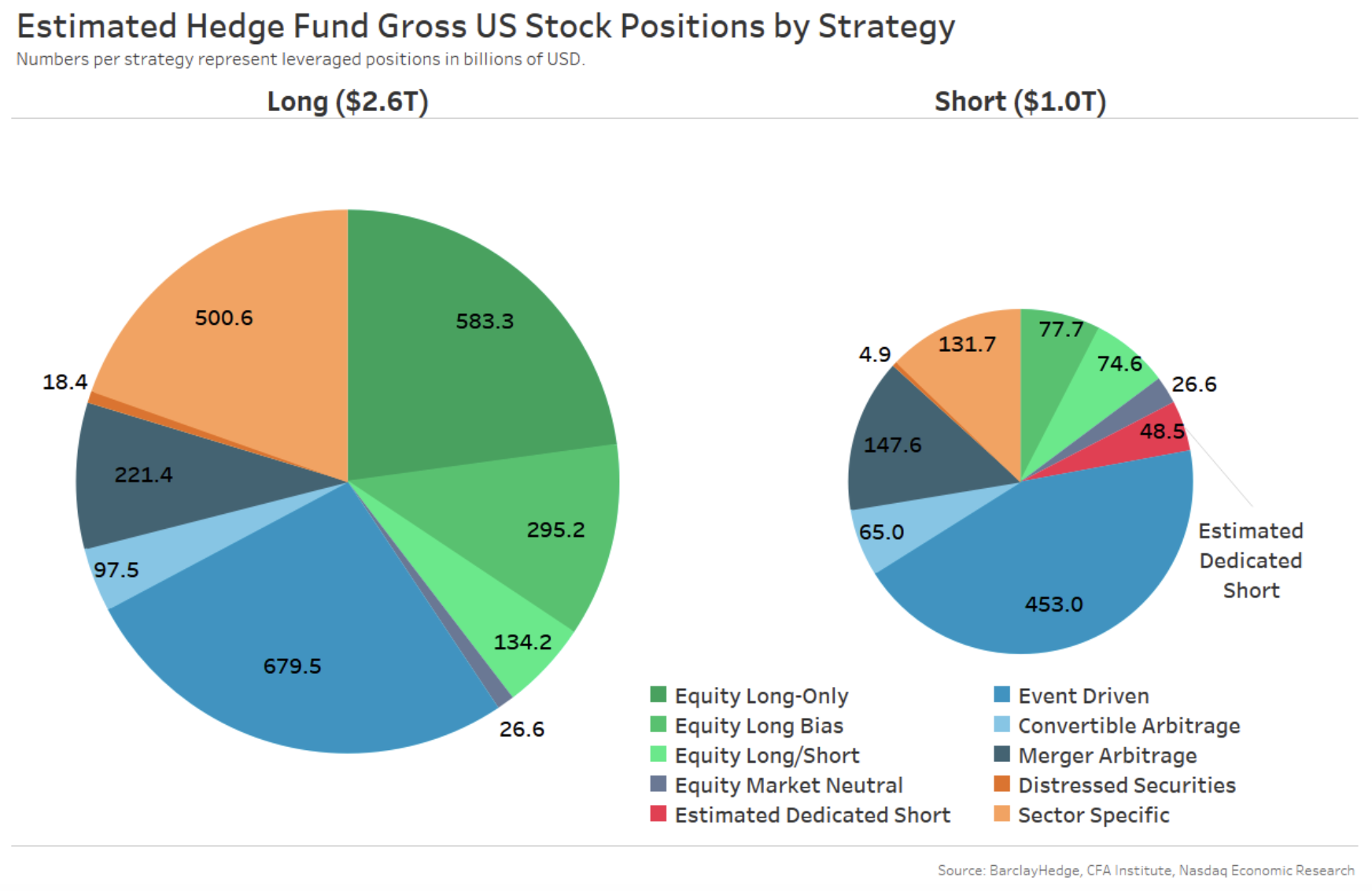

Long-term investors may also engage in short selling to capitalize on overvalued stocks, intending to repurchase them at a lower price in the future. Hedge funds, estimated to hold approximately $1.5 trillion in net assets for U.S. stock trading, employ hedging and leverage strategies based on their investment policies.

Industry data suggests that hedge funds’ gross U.S. stock exposures could be around $3.6 trillion, with short positions accounting for about $1.0 trillion. Despite actively shorting stocks, hedge funds typically maintain a net-long position.

Chart 2: Estimating Hedge Fund Assets – Long and Short Positions by Strategy

Dedicated short funds, focused solely on shorting companies based on weak fundamentals, constitute less than 1.3% of all hedge fund positions.

Exploring Short Position Data

Reported short position data differs from long position data, with a more frequent but aggregated reporting approach for short positions across the industry.

As a result, companies can identify shareholders but lack the means to identify parties holding short positions.

Table 1: Diverse Position Reporting Rules in the Market

Analyzing Short Position Data Insights

Historical data suggests that short positions across the market exhibit remarkable stability, showing minimal increments even during market downturns.

Further examination reveals that short interest tends to be higher in small- and mid-cap stocks rather than in large- or micro-cap stocks.

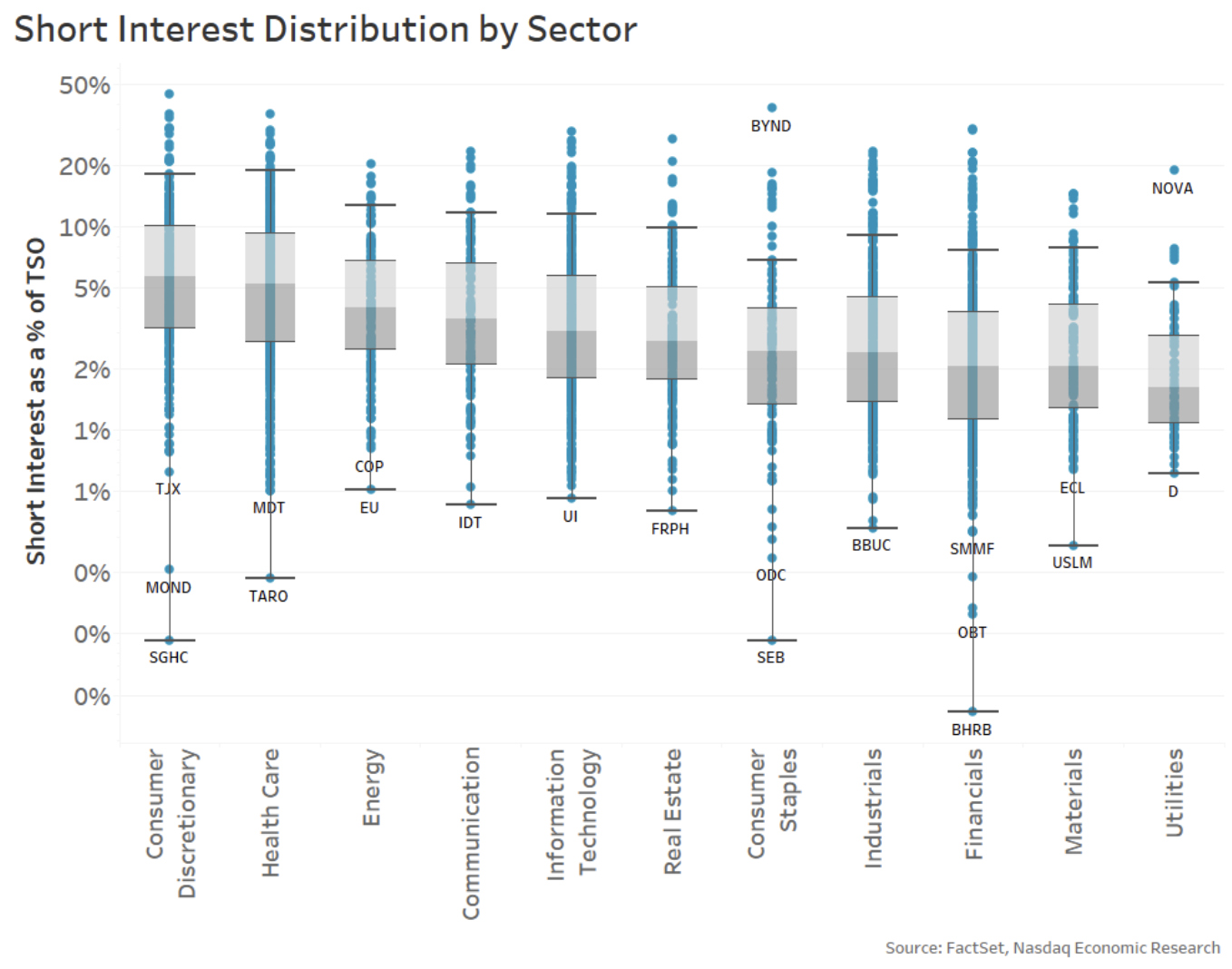

Short positions across various sectors indicate:

- The median short position stands at approximately 5% or less of shares outstanding for all sectors.

- Presently, there are more pronounced shortfalls in the consumer and healthcare sectors compared to others.

Chart 3: Short Positions as a Percentage of Market Capitalization by Sector

Additionally, a select few stocks exhibit short interest exceeding 25% of their shares outstanding. This scenario arises due to the utilization of borrowed stocks to settle new “long” purchases, leading to long positions surpassing 125% of their market cap.

Insights into Short Trade Data

Regulations mandate the disclosure of specific short trading data, encompassing real-time details on short sells, enhanced reporting on stock loan activities, and insights into failing trades – all integral components of the operational aspects of short selling.

Table 2: Overview of Rules Reporting Short Trading Activity

Understanding Short Trading Regulations

Regulatory frameworks govern the operational aspects of short selling, curbing this practice during market downturns and prohibiting naked shorting. These rules, primarily encapsulated within the SEC’s “Reg SHO” rule, oversee the conduct of trading activities.

Unpacking the Intricacies of Short Trading Rules in the Market

Understanding the Mechanics of Short Trading Rules

Exploring SEC Rule 200(g) unveils the intricate dance between long sell, short sell exempt, and short sell orders. The distinctions are crucial: a long sell rests on actual ownership, while a short sell necessitates borrowing stock from a sympathetic long owner open to lending (for a price). In times when short sell circuit breakers are active, the up-bid rule kicks in to regulate these orders.

Analyzing Short Trading Data Trends

Diving into short sale data reveals that approximately 40%-50% of daily trading volume constitutes short sells. Despite seeming substantial, this statistic aligns seamlessly with intermediary trading trends, showcasing remarkable consistency regardless of market cap or trading venue.

Emphasizing this is a graph illustrating short trades as a percentage of all transactions, cementing the notion of prevalent arbitrage trading in the market.

The Significance of Stock Loans in Short Selling

Stock loans enter the limelight due to their role in facilitating transaction settlements. Every trade mandates a corresponding security for closure, a process known as “delivery-versus-payment” or DVP. Buyers insist on stock transfer before releasing cash, particularly relevant in short sales where borrowed stock is imperative for settlement.

Illustrated in a chart, a long sale mandates simultaneous stock and cash transfer to ensure seamless transactions.

Anticipating the need to borrow, short sellers engage in stock loan arrangements, incurring costs for both collateral and lender fees. Typically, sellers secure stock borrowing on settlement dates to honor their short trades.

Demonstrated in a subsequent chart, long sale intricacies echo the necessity of synchronous stock and cash transfer for successful trades.

An exception to pre-location requirements exists for bona-fide market makers, although even they must source stock for settling outstanding short positions, consequently incurring borrowing costs.

Delving into the World of Fails in Short Selling

Failed trades, a rarity in short selling, occur when short sellers falter to secure borrowed stock before settlement dates. Data showcases that an overwhelming majority of stocks witness no shares failing on any given day, with nearly 96% of companies witnessing minimal fails below 10,000 shares.

Visualized through a chart, the prevalence of failing trades in relation to market capitalization remains markedly low, totaling below 0.01% and translating to a value between $2 billion and $5 billion.

Contrasting this against the colossal daily trading volume nearing $700 billion in U.S. company stocks accentuates the insignificance of failing trades, perpetuating the narrative that such hiccups rarely disrupt market efficacy.

Another chart underscores the minuscule impact of failing shares on overall market capitalization, cementing the negligible influence of these occurrences in the grand scheme of market operations.

Complementing fail reporting mechanisms, regulations against naked shorting and restrictions on setting new lows during significant price declines (triggered post a 10% drop) reinforce market stability. The introduction of buy-in rules post-credit crisis necessitates brokers to cover failing positions promptly or risk penalization under Reg SHO protocols.

With these stringent guidelines in place, market dynamics reflect a well-oiled machine where fails, though sporadic, are swiftly rectified to uphold market integrity.

The Truth Behind Short Selling Revealed

Research Indicates Short Selling Benefits the Markets

Studies have repeatedly shown that short selling plays a vital role in market dynamics. According to academic research, short selling contributes to tightening spreads, increasing liquidity, and enhancing valuation accuracy, especially after significant news events. These factors collectively lead to more efficient capital allocation, reduced capital costs for companies, and decreased trading expenses for investors. The consensus is clear – short selling is a force for good in the financial markets.

On the flip side, research has also demonstrated that short-term bans on short selling have adverse effects, such as reduced liquidity and wider spreads. Additionally, contrary to popular belief, such bans do not prevent stock prices from declining. Moreover, studies reveal that during major price reversals, long selling tends to have a more substantial impact on stock prices compared to short selling.

Regulatory Safeguards in Place to Manage Short Selling

Despite the positive findings on short selling, regulatory frameworks in the U.S. have implemented measures to moderate the impact of short selling during periods of extreme market volatility. An example of this is the “circuit breaker” rule, which temporarily hinders short sellers during sharp price declines. When a stock experiences a 10% intraday drop, the “modified uptick rule” comes into effect. This rule restricts short-sell trades from hitting the bid, preventing them from establishing new low bid prices and requiring them to wait for a buyer to pay to execute trades.

Dispelling Myths Through Data Analysis

There exists a common misconception that short sellers are detrimental to the market. However, an examination of the data reveals a different reality. Analysis of short positions shows that short selling tends to be limited and consistent over time for most stocks. Moreover, the scarcity of significant fails on a large scale suggests that the majority of short positions are closed out on the same day they are initiated.

Of particular significance is the observation that when an investor holding a heavily shorted stock decides to sell, they may recall loans on their shares, prompting short sellers to cover their positions. This leads to an increase in buying pressure in the market. In essence, the data points to the fact that short selling, on the whole, has a positive impact, and regulatory frameworks are in place to oversee and regulate short trading practices, ultimately benefiting investors by facilitating lower purchase costs and higher returns.