Amazon Partners with Dominion Energy to Explore Nuclear Power

Amazon (NASDAQ: AMZN) surprised investors last week by announcing a partnership with Dominion Energy (NYSE: D) aimed at exploring nuclear energy production in the United States. The financial details of this partnership remain undisclosed.

This unexpected move raises questions about how it affects Amazon’s stock, but many believe it suggests a cautious approach rather than a strong buy signal.

Amazon’s Motivations for Entering Nuclear Energy

To clarify, Amazon has not expressed a desire to become a full-scale energy provider. Rather, this initiative aims to tackle an urgent challenge: securing affordable electricity for its expanding data centers.

Goldman Sachs reports that data centers account for 1% to 2% of global electricity consumption. These facilities typically demand over 100 megawatts (MW), which can power 80,000 to 100,000 average homes. According to Grand View Research, the data center sector is expected to grow at a compound annual growth rate (CAGR) of 11% through 2030, meaning the number of data centers could double approximately every seven years.

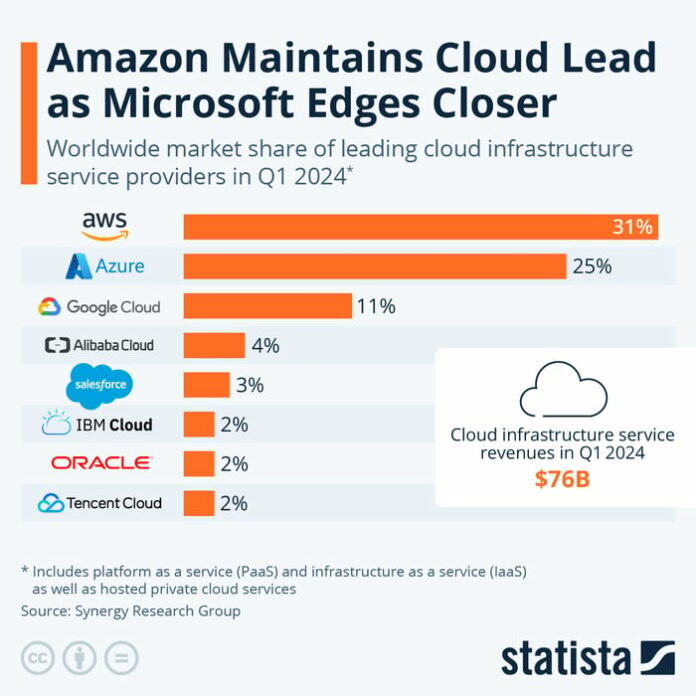

Electricity is vital to Amazon’s success, as Amazon Web Services (AWS) generates a majority of the company’s operating income. Maintaining this leadership in the cloud sector is essential for competing against rivals like Microsoft and Google‘s parent company, Alphabet.

Image source: Statista.

Additionally, the cloud industry plays a significant role in the growing demand for artificial intelligence (AI). Amazon must ensure that it meets electricity needs to retain customers in this competitive space.

A Closer Look at the Dominion Energy Partnership

This partnership with Dominion Energy makes sense given Amazon’s current need for reliable energy. The goal is to examine how small modular reactors (SMRs) could help generate clean energy for AWS operations.

Amazon selected Dominion because it operates 76 data centers in Virginia, where Dominion is located. Virginia hosts the largest concentration of data centers globally, with around 80% situated in Loudoun County, near Washington, D.C.

By collaborating closely, both Amazon and Dominion can build data centers and SMRs that meet Amazon’s specific needs. This approach lessens reliance on the stressed U.S. energy grid, reducing the risk of disruptions. Such adaptability could provide Amazon a competitive edge if other companies do not proactively manage their electricity requirements.

Understanding Amazon’s Investment Perspective

Ultimately, the Dominion partnership does not alter Amazon’s overall investment strategy. Instead, it reinforces it. Amazon is now one of the few non-utility companies to directly engage in electricity generation, though this is unlikely to have an immediate effect on its bottom line.

This move appears necessary in light of the pressure that the data center industry places on the existing power grid. If left unaddressed, the electricity challenges could significantly hinder Amazon’s growth and prompt investors to reconsider their stake in the company.

If SMRs can deliver safe, clean, and reliable energy in sufficient quantities, Amazon can continue to pursue its cloud and AI ambitions. This proactive approach to energy needs helps ensure that Amazon’s investment story remains on course.

Is Now the Right Time to Invest $1,000 in Amazon?

Before making any investment decisions regarding Amazon, note the following:

The Motley Fool Stock Advisor team recently identified what they consider the 10 best stocks to invest in—Amazon was not included. Instead, these selected stocks may offer significant potential in the years ahead.

For context, consider Nvidia on April 15, 2005. A $1,000 investment would have grown to $845,679 by now!

Stock Advisor streamlines investment success with guidance on portfolio building, updates from analysts, and two new stock picks each month. Since its inception, Stock Advisor has more than quadrupled the returns of the S&P 500.*

See the 10 stocks »

*Stock Advisor returns as of October 14, 2024

John Mackey, former CEO of Whole Foods Market—an Amazon subsidiary—serves on The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is also on the board. Will Healy does not hold any positions in the stocks mentioned. The Motley Fool holds positions in and recommends Alphabet, Amazon, Goldman Sachs Group, Microsoft, Oracle, and Tencent. They also recommend Alibaba Group, Dominion Energy, and International Business Machines, and have options positions in Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.