Amazon’s Bold Move into Pharmacy: A Challenge for Walgreens and CVS

Amazon (NASDAQ: AMZN) has been increasingly focused on healthcare lately. In 2020, it launched an online pharmacy, and last year, it purchased the primary care company One Medical. Although Amazon briefly explored telehealth, it ultimately stepped away from that sector. Nonetheless, it’s clear that healthcare is a significant priority for the tech giant.

While retail pharmacy leaders Walgreens Boots Alliance (NASDAQ: WBA) and CVS Health (NYSE: CVS) have faced challenges, the impending competition from Amazon has not yet severely impacted their businesses. However, Amazon’s recent strategy could significantly disrupt their retail operations.

Amazon’s Expansion of Same-Day Prescription Delivery

On October 9, Amazon announced plans to increase its pharmacy locations nationwide, along with free prescription delivery in 20 new markets starting next year, effectively more than doubling its reach. By the end of next year, Amazon estimates that 45% of people in the U.S. will qualify for same-day delivery on prescriptions. In many instances, customers can place an order by 4 p.m. and receive their prescription the same day.

The company offers competitive pricing on medications and incentives for customers. For example, Prime members can enroll in RxPass, providing access to various common generic medications for only $5 a month, including free delivery. Expanding the availability of same-day delivery could encourage more customers to join Prime and sign up for RxPass.

Implications for Walgreens and CVS

Amazon’s advancements in prescription delivery could negatively impact foot traffic at Walgreens and CVS stores, which thrive on customers visiting their locations. During the pandemic, store visits surged as people sought vaccinations, boosting pharmacy sales.

As Amazon provides consumers with greater convenience through fast delivery, customers may find less need to visit local pharmacies. This shift could significantly reduce the traffic that both Walgreens and CVS depend on, particularly since obtaining prescriptions is often a primary reason for visiting these stores.

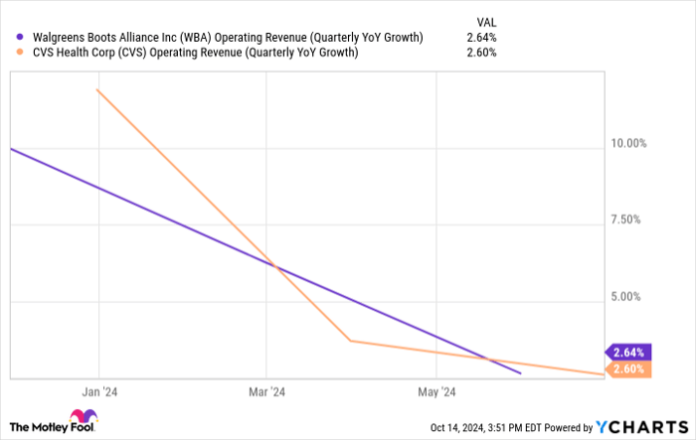

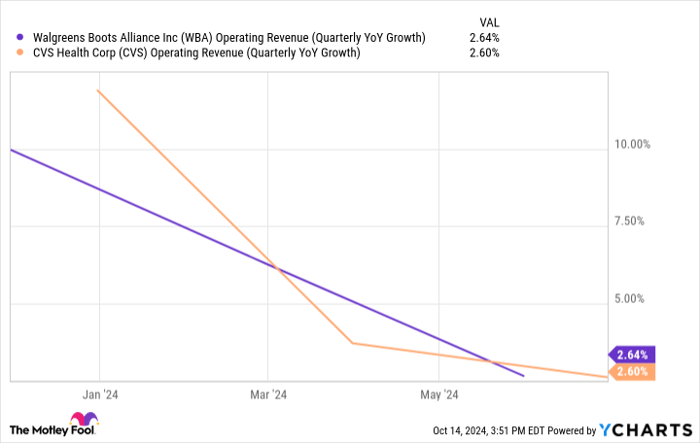

WBA Operating Revenue (Quarterly YoY Growth) data by YCharts

Is Amazon Outpacing Walgreens and CVS in Healthcare?

Walgreens share price is down over 65% this year due to challenges in retail pharmacy growth and narrow profit margins. CVS’ stock has decreased by 14%, but its diverse business model provides more stability compared to Walgreens. Both companies face significant obstacles, and Amazon’s intensified competition will add to their challenges.

With its streamlined operations and expanded pharmacy reach, Amazon has emerged as a compelling player in the healthcare market. Increasing Prime membership could also enhance significantly not just pharmacy revenue but overall growth for Amazon.

For investors seeking growth, Amazon currently appears to be the superior choice over CVS or Walgreens, even within the healthcare sector.

Is This Your Chance for Investment?

If you feel like you missed out on investing in top-performing stocks, opportunities may arise again.

Occasionally, our analysts identify a “Double Down” stock—companies poised for substantial growth. If you worry you’ve lost your chance, now might be the best time to act:

- Amazon: An investment of $1,000 when we doubled down in 2010 would be worth $21,139!*

- Apple: A $1,000 investment when we doubled down in 2008 would be worth $44,239!*

- Netflix: If you invested $1,000 after our recommendation in 2004, you’d now have $380,729!*

Currently, we have “Double Down” alerts for three extraordinary companies—don’t miss this potential opportunity.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 14, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, serves on The Motley Fool’s board of directors. David Jagielski has no position in any of the stocks mentioned. The Motley Fool holds positions in and recommends Amazon, while also recommending CVS Health. The Motley Fool follows a disclosure policy.

The views and opinions expressed herein are those of the author and may not reflect those of Nasdaq, Inc.