Amazon (AMZN) Soars with Promising Growth Ahead

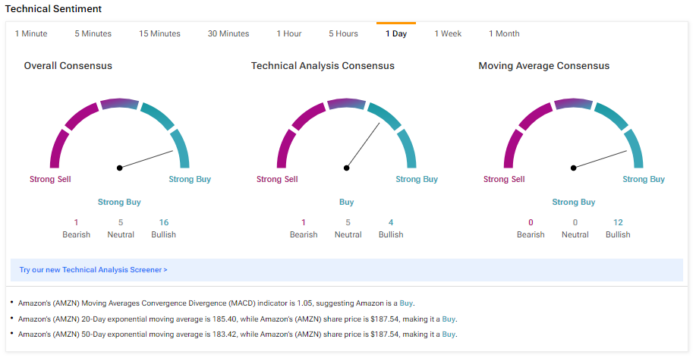

Amazon (AMZN) continues to shine as a leader in the e-commerce market, bolstered by its vast logistics setup and a wide array of products. The company’s smart investments in emerging fields like artificial intelligence and healthcare hint at substantial future growth. Over the past year, AMZN shares have surged more than 41%, surpassing the S&P 500 Index’s (SPX) 33% increase. Despite these gains, technical analysis suggests that Amazon remains a Strong Buy, indicating potential for further increases in stock value.

Decoding AMZN’s Technical Indicators

Using TipRanks’ user-friendly technical analysis tool, AMZN stock is showing an upward trend. The Moving Averages Convergence Divergence (MACD) indicator, which helps identify price momentum and potential shifts, currently suggests a Buy signal for Amazon.

Currently, the 50-day exponential moving average (EMA) for AMZN sits at 183.42, while the stock price is at $187.54, indicating a positive bullish signal. Moreover, the shorter 20-day EMA reinforces this upward momentum.

The Williams %R indicator, which helps traders assess whether stocks are overbought or oversold, is also sending a buy signal for Amazon. This suggests that the stock remains within a favorable range and has further growth potential.

What Are Analysts Saying About AMZN’s Price Target?

Wall Street analysts have reached a Strong Buy consensus for AMZN, with 45 Buy ratings and two Holds within the past three months. The average price target for Amazon stands at $224.38, indicating a promising upside potential of 19.64% from its current price.

See more AMZN analyst ratings

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.