Amkor Technology Set to Announce Q3 2024 Results: Expectations and Insights

Amkor Technology (AMKR) is preparing to unveil its third-quarter 2024 financial results on October 28, after the stock market closes.

What to Expect in Revenue and Earnings

AMKR projects its third-quarter revenues will fall between $1.785 billion and $1.885 billion, with a mid-point of $1.835 billion, which indicates a sequential growth rate of 22% to 29%. In comparison, the Zacks Consensus Estimate for revenue stands at $1.83 billion, reflecting an increase of 0.6% from $1.82 billion during the same period last year.

For earnings per share, Amkor anticipates a range between 42 cents and 56 cents. The Zacks Consensus Estimate for earnings is currently at 50 cents per share, remaining unchanged for the past two months. This anticipated figure represents a decrease of 7.4% compared to last year’s earnings.

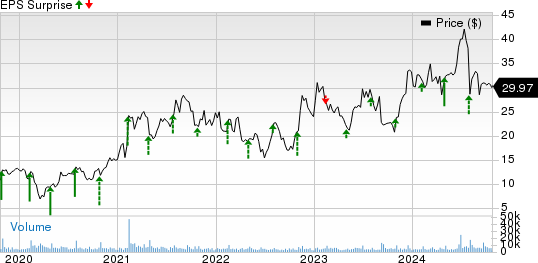

The company has consistently outperformed earnings expectations, beating the Zacks Consensus Estimate in each of the last four quarters with an average surprise of 45.4%.

Discover the latest EPS forecasts and earnings surprises on Zacks Earnings Calendar.

Key Drivers of Performance

Amkor’s performance for this quarter is likely bolstered by ramping up production of new products, particularly advanced system-in-package (SiP) technology and 2.5D technology. The demand for Internet of Things (IoT) wearables is expected to enhance sales in the Consumer market due to the adoption of SiP technology by various vendors.

Likewise, strong growth in artificial intelligence (AI) and robust demand for high-performance computing, as well as ARM-based personal computers, are anticipated to elevate revenues in the Computing segment. Additionally, advancements in packaging technology ahead of the premium smartphone launch season should benefit the Communications market.

Amkor’s established long-term partnerships and its expanding global presence are also expected to contribute positively to its revenue this quarter.

Amkor Technology, Inc. Price and EPS Surprise

Amkor Technology, Inc. price-eps-surprise | Amkor Technology, Inc. Quote

A recent partnership with Infineon Technologies to establish a dedicated packaging and testing center in Porto represents a significant development for Amkor. This long-term agreement enhances their collaboration, strengthening the traditional outsourced semiconductor assembly and testing business model.

However, challenges persist in the Automotive and Industrial markets, which are likely to negate the revenue gains seen in other sectors. Inventory corrections have been hindering performance in these areas, evidenced by a reported 2% decline in Automotive and Industrial revenues in the second quarter.

Analyzing Earnings Expectations

Zacks’ model indicates that a positive Earnings ESP combined with a Zacks Rank of #1 (Strong Buy), #2 (Buy), or #3 (Hold) systematically raises the likelihood of an earnings beat; however, this situation does not apply to Amkor right now.

Currently, AMKR has an Earnings ESP of 0.00% and holds a Zacks Rank of #3. Investors looking to identify promising stocks before earnings reports can use our Earnings ESP Filter.

Additional Stock Picks to Consider

Here are a few stocks that may have favorable earnings prospects according to our analysis:

Arista Networks (ANET) has an Earnings ESP of +0.96% and is currently rated #2 by Zacks. Notably, shares have surged 68.4% year to date. The company is set to report its Q3 2024 results on November 7, with earnings estimates at $2.08 per share, an increase of 13.7% year-over-year.

Onto Innovation (ONTO) boasts an Earnings ESP of +2.74% and holds a Zacks Rank #2. Its shares have increased by 34.7% this year, with earnings expected to be $1.31 per share, marking growth of 36.5% from the previous year. Results will be announced on October 31.

Meta Platforms (META) features an Earnings ESP of +2.83% and is also a Zacks Rank #2 stock. META shares have jumped 64.5% year to date, and earnings estimates for Q3 2024 are set at $5.17 per share, reflecting a 17.8% rise from the same quarter last year, with results expected on October 30.

Zacks Research Insights

Zacks experts have identified five stocks with the highest potential for significant gains, including a standout pick from Director of Research, Sheraz Mian. This stock may see substantial growth due to its innovative solutions and a rapidly growing customer base exceeding 50 million. While not every pick is guaranteed success, this selection holds promise, echoing prior Zacks winners like Nano-X Imaging, which appreciated by +129.6% within just nine months.

For the latest investment insights, download “5 Stocks Set to Double” for free now.

Amkor Technology, Inc. (AMKR): Free Stock Analysis Report

Arista Networks, Inc. (ANET): Free Stock Analysis Report

Onto Innovation Inc. (ONTO): Free Stock Analysis Report

Meta Platforms, Inc. (META): Free Stock Analysis Report

To read more from Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and may not reflect the views of Nasdaq, Inc.