Kraft Heinz Prepares for Q3 Earnings Release Amid Mixed Performance

Pittsburgh, Pennsylvania-based The Kraft Heinz Company (KHC) stands as a major player in the food and beverage industry. The company’s product range includes sauces, cheese, meals, meats, refreshing beverages, coffee, and more. With a market capitalization of $43.1 billion, Kraft Heinz operates across North America and internationally. Investors are keenly awaiting the release of its Q3 earnings before the market opens on Wednesday, Oct. 30.

Analysts Expect Slight Profit Growth

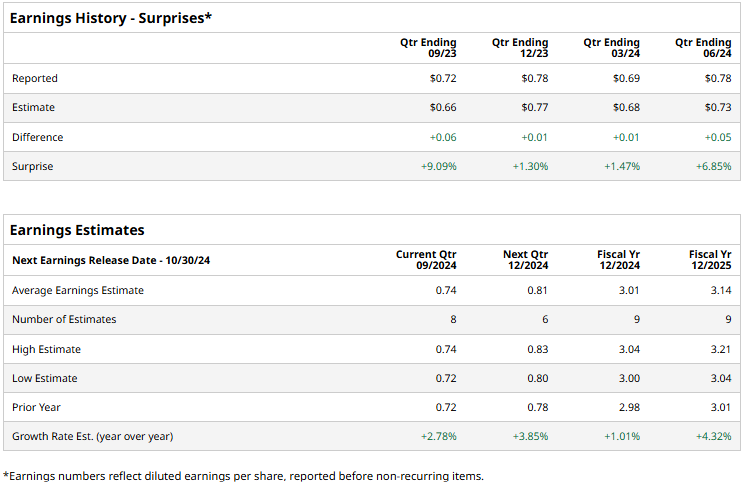

Analysts predict Kraft Heinz will report a profit of $0.74 per share, an increase of 2.8% from the $0.72 reported in the same quarter last year. Historically, Kraft Heinz has outperformed Wall Street’s adjusted earnings per share (EPS) expectations in each of the last four quarters. Though its adjusted EPS dipped 1.3% year-over-year to $0.78 in the last reported quarter, it still beat consensus estimates by 6.9%.

Future Outlook Looks Positive

Looking ahead to fiscal 2024, analysts expect Kraft Heinz’s adjusted EPS to reach $3.01, marking a 1% increase from $2.98 in fiscal 2023. Projections for fiscal 2025 suggest a further adjusted EPS growth of 4.3% to $3.14.

Kraft Heinz Stock Performance Lags Behind Competitors

Year to date, KHC stock has dropped 4%, significantly trailing behind the S&P 500 Index’s 22.7% gains and the Consumer Staples Select Sector SPDR Fund’s (XLP) 13.2% returns.

Q2 Results Reveal Mixed Outcomes

Despite falling short of top-line estimates, shares of Kraft Heinz jumped 4.1% following its Q2 earnings release on Jul. 31. The company reported net sales of $6.5 billion, down 3.6% from the previous year, driven by declines across all geographical segments. North American sales fell 3.1%, while International Developed Markets and Emerging Markets saw drops of 5% and 5.7%, respectively. Due to this weak performance, Kraft Heinz lowered its full-year organic net sales growth forecast, now anticipating a decline of 2% to flat compared to the previous year.

The company’s net income for shareholders plummeted from $1 billion in the prior year’s quarter to $102 million. This drop was largely influenced by a goodwill impairment cost of $854 million during the quarter. On a positive note, Kraft Heinz managed to improve its gross margin, which expanded by 178 basis points to 35.4%, generating a 1.5% growth in gross profit despite falling sales. This exceeded analysts’ earnings expectations and contributed to the stock price increase.

Analyst Sentiment and Price Target

The consensus view on KHC stock leans toward a “Moderate Buy,” with 17 analysts covering the stock: eight recommend a “Strong Buy,” eight suggest a “Hold,” while one analyst rates it a “Strong Sell.” The average price target of $38 indicates a possible upside of 7.1% from current levels.

More Stock Market News from Barchart

On the date of publication, Aditya Sarawgi did not hold (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article are for informational purposes only. For more information, please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.