Opportunity in Mining: Fitzroy Minerals Positioned for Growth

Source: Clive Maund 10/15/2024

Mining companies dealing in copper, gold, and silver are currently in a prime position. Fitzroy Minerals Inc. FTZFF is notably among them.

Upcoming Shortage Drives Copper Demand

A significant copper shortage is on the horizon. This heightened demand is largely driven by applications in batteries and solar panels, paired with a decrease in supply, as few major new copper producers have emerged recently. The evolving landscape may take considerable time to address.

Silver is also experiencing a surge in demand for industrial purposes and investment, especially amidst concerns about currency stability—this trend similarly affects gold prices. Fitzroy Minerals Inc. is thus strategically positioned at a favorable time.

Understanding Fitzroy’s Focus and Strategy

Before evaluating the company’s latest stock performance, it is essential to review its fundamentals, aided by slides from its recent Investor deck.

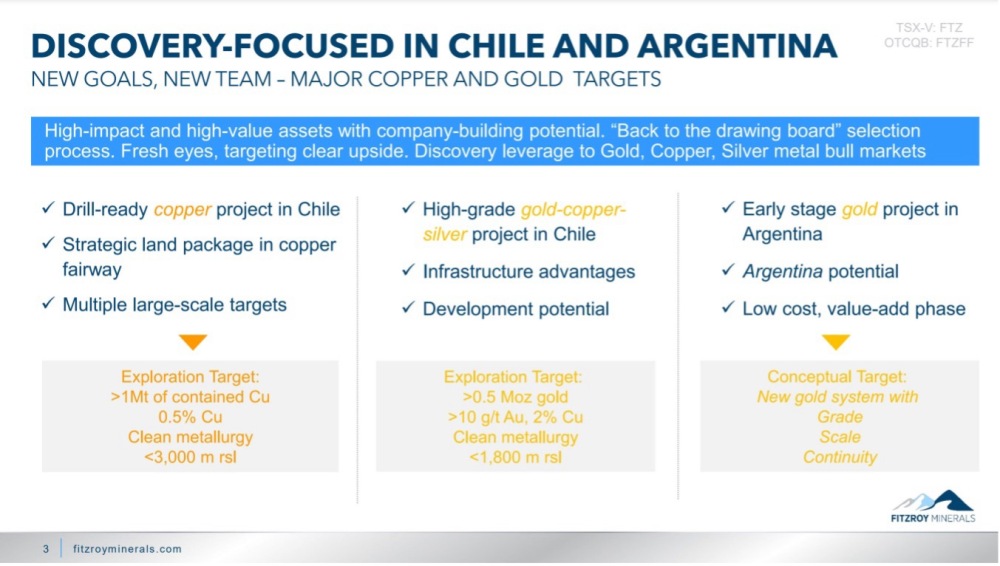

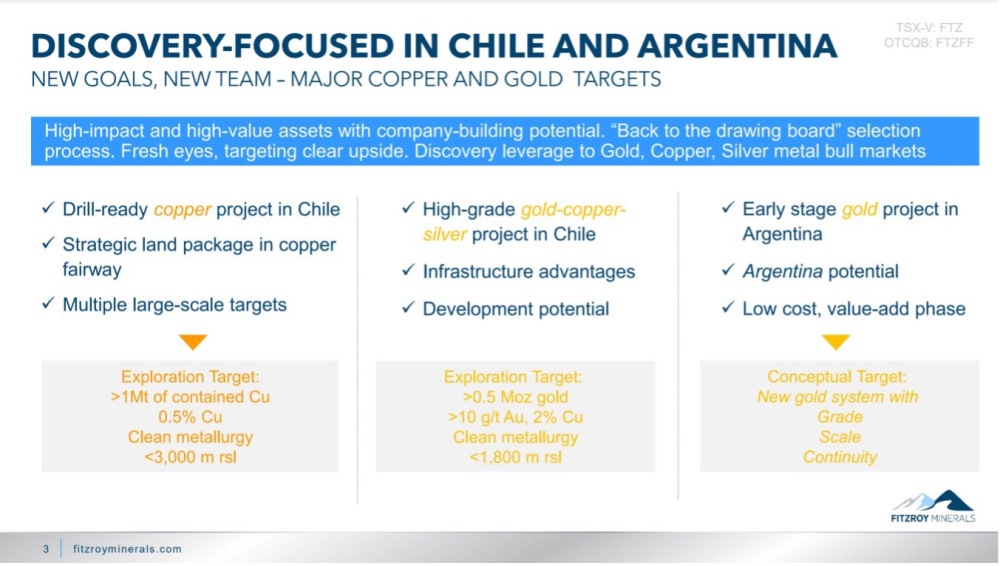

The first slide outlines Fitzroy’s focus on copper, gold, and silver projects located in Argentina and Chile.

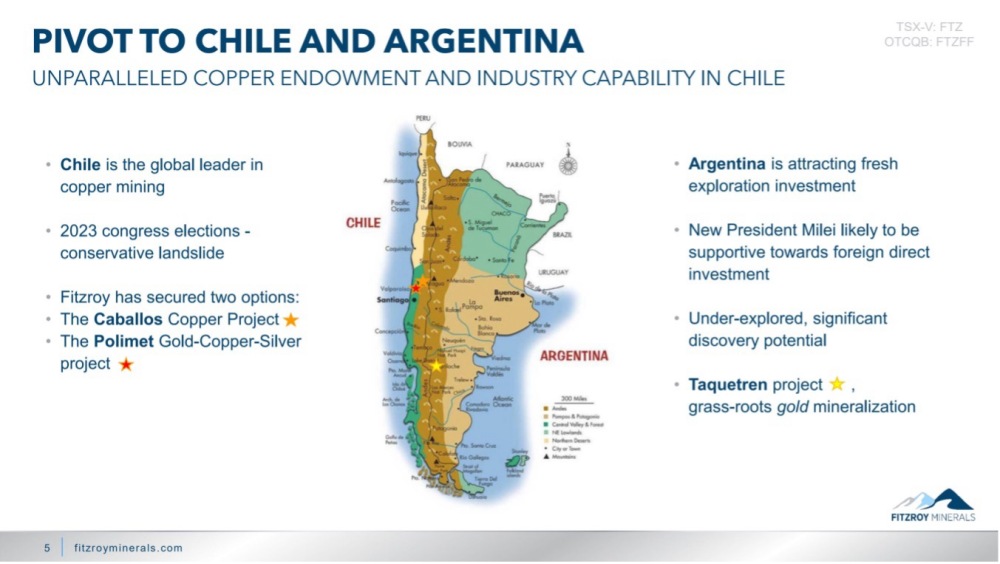

A subsequent slide shows a map of Argentina and Chile. The mining environment in both locations is improving, with Chile’s ongoing reputation as the leading copper producer providing a suitable investment backdrop. Notably, Fitzroy manages two properties in Chile and one in Argentina.

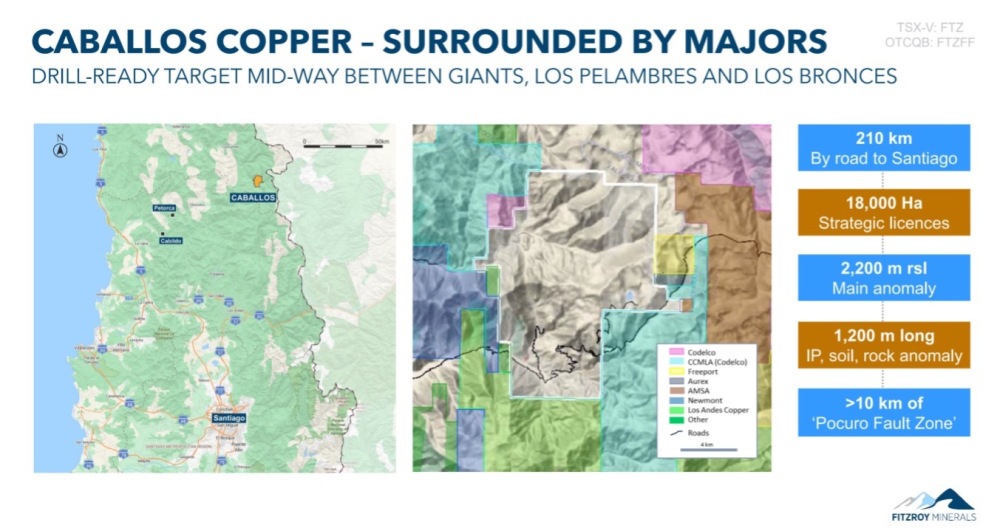

The location of the Caballos project in Chile, highlighted in the next slide, is just north of Santiago and near the Argentine border. It is surrounded by major mining companies like Codelco, Freeport, and Newmont, indicating strong potential for significant discoveries.

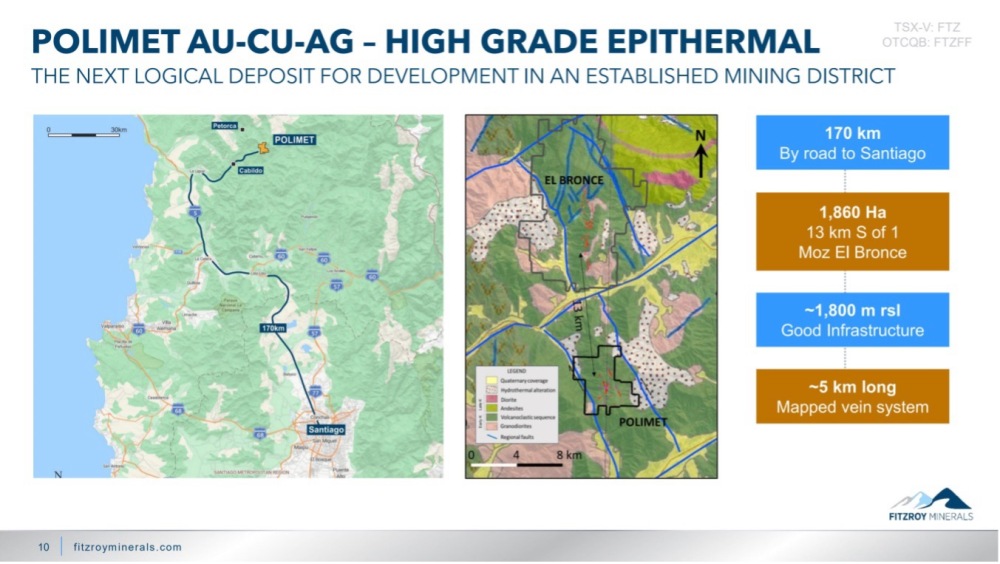

Fitzroy’s other Chilean project, Polimet, is situated west of Caballos. Its proximity to the substantial El Bronce copper mine owned by Anglo-American Sur enhances the prospects for valuable discoveries in the area.

In Argentina, the Taquetren Gold Project is targeted primarily for gold exploration, clearly identified by its name.

Growth Projections Through 2025

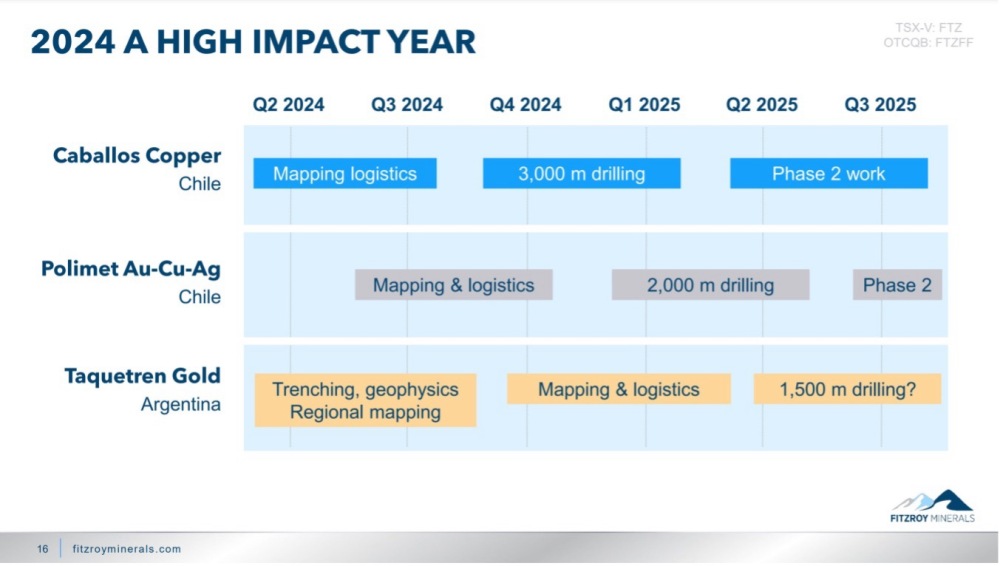

The next slide outlines Fitzroy’s planned advancements for its three projects for the remainder of the year and into 2025.

Currently, the company has 91.2 million shares outstanding as of August 23. This number will increase due to a newly announced financing plan that includes issuing about 13.3 million shares at CA$0.15, with a potential 10% increase depending on demand.

Analyzing Stock Performance and Future Potential

Fitzroy Minerals has shown an upward trend since October of last year, although it has yet to fully break out of a significant base pattern known as an upsloping Head-and-Shoulders bottom. This pattern can be seen in the long-term log chart.

The chart covering the last 54 months indicates the company is nearing a breakout after completing the H&S bottom phase, supported by aligned moving averages. If Fitzroy manages to surpass resistance levels, the minimum target for this upward trend is CA$0.76, matching its 2021 highs.

A notable decline in volume indicators last year appears to stem from a one-time “cross” trade, which can be disregarded for analysis purposes.

The 14-month chart provides a closer look at recent developments. It highlights the formation of an Ascending Triangle, driven by a rising trendline and supportive moving averages. The likelihood of a breakout above the Head-and-Shoulders resistance is increasing, particularly given recent upticks in trading volume.

A Strong Recommendation Going Forward

Given the company’s positive outlook, Fitzroy Minerals is rated as an Immediate Buy for all investment horizons.

Fitzroy Minerals Inc. closed at CA$0.195, equivalent to US$0.13, on October 14, 2024.

Important Disclosures

- This article was compensated by Street Smart, an affiliate of Streetwise Reports, in the amount of US$2,500.

- Officers and employees of Streetwise Reports LLC (including their households) may hold securities in Fitzroy Minerals Inc.

- Author Compensation: Clive Maund of clivemaund.com was hired to write this article as an independent contractor. He holds a UK Technical Analysts’ Diploma received in 1989. All recommendations and opinions are solely his own, reflecting his independent analysis.

- Opinions expressed are those of the author and not of Streetwise Reports or Street Smart. Accuracy of statements is the author’s responsibility. Streetwise Reports relies on authors to provide accurate information about their economic ties with companies discussed.

- This article does not constitute investment advice or solicitation. Readers should consult with financial advisors and conduct their own research before making investment decisions.

- Clivemaund.com Disclosures

The above reflects Mr. Maund’s opinions based on available data at the time of writing. As a qualified analyst, he emphasizes the importance of consulting a licensed investment advisor and performing due diligence.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.