AMD’s Promising Path Forward in the AI Sector

AMD (AMD) stock has surged 48% over the past 12 months, driven by growth in artificial intelligence (AI) and data centers. While the company’s gains are substantial, they fall short compared to Nvidia (NVDA), whose stock has skyrocketed 200% in the same period. Nevertheless, AMD’s strong forecasts and enhanced product offerings suggest potential for continued success, leading to a positive outlook for the company.

AMD’s Gains in the Data Center Arena

It’s important to note that AMD remains smaller than Nvidia in the data center and AI sectors, with only about one-tenth of Nvidia’s size. Nvidia’s graphics processing units (GPUs) have set the standard for AI applications, having been in the market for over a decade.

AMD is catching up, evidenced by a remarkable 115% year-over-year revenue increase in its data center division for Q2 2024, hitting a record $2.83 billion. This growth results from increased shipments of AMD Instinct™ GPUs and a boost in fourth-generation CPUs.

However, this growth contrasts sharply with a 59% plunge in gaming revenue and a 41% dip in sales from AMD’s embedded segment, indicating some struggles within the company despite its focus on the data center business.

Sustaining Data Center Growth: A Critical Question

To determine if AMD can maintain its growth in the data center market, we need to look at two main factors: the company’s offerings and the overall market dynamics.

AMD is enhancing its technology, with management confidently stating that it can compete with Nvidia. For example, AMD’s upcoming Instinct MI325X AI chip is reported to outperform Nvidia’s H200 in some tasks.

The MI325X is expected to start production by the end of 2024, with AMD positioning it as a competitor to Nvidia’s Blackwell chip. Furthermore, the company aims to introduce a new AI-focused chip each year, accelerating its innovation cycle.

Additionally, AMD has invested in creating a full-stack approach. This includes developing software to complement its hardware. Recent acquisitions, such as ZT Systems for $4.9 billion, as well as Nod.ai and Silo AI, are designed to bolster its AI capabilities across software, model development, and infrastructure.

Though the ZT Systems acquisition won’t finalize until late 2025, it may enhance AMD’s long-term product appeal in this competitive field.

Positive Industry Trends Supporting AMD

Examining broader industry trends reveals additional support for AMD’s prospects. Taiwan Semiconductor Manufacturing Company (TSM) recently reported strong third-quarter results that exceeded estimates and boosted its stock price, positively affecting other firms in the semiconductor sector, including both Nvidia and AMD.

Demand for advanced process technologies is a notable trend. TSMC’s 3nm process alone accounted for 20% of its total wafer revenue, with the 5nm process contributing 32%. This push towards advanced nodes is largely driven by the rising need for high-performance computing, particularly in AI.

AMD collaborates with TSMC to produce next-generation chips using 3-nanometer technology, with CEO Lisa Su indicating a commitment to utilize 3nm and even 2nm processes moving forward.

Another positive indicator is the sharp increase in capital expenditure within the semiconductor industry. TSM expects its capital expenditures to exceed $30 billion in 2024, signaling strong confidence in future demand and the necessity to scale production of cutting-edge technologies.

The Value of AMD Stock: An Analyst Perspective

These strong prospects have led to AMD’s high valuation, currently sitting at 46.2 times forward earnings, which represents an 89% premium compared to the internet technology sector. However, analysts predict an impressive earnings growth rate of 41% annually in the medium term, leading to a price-to-earnings-growth ratio of 1.1.

Analysts’ Consensus on AMD Stock

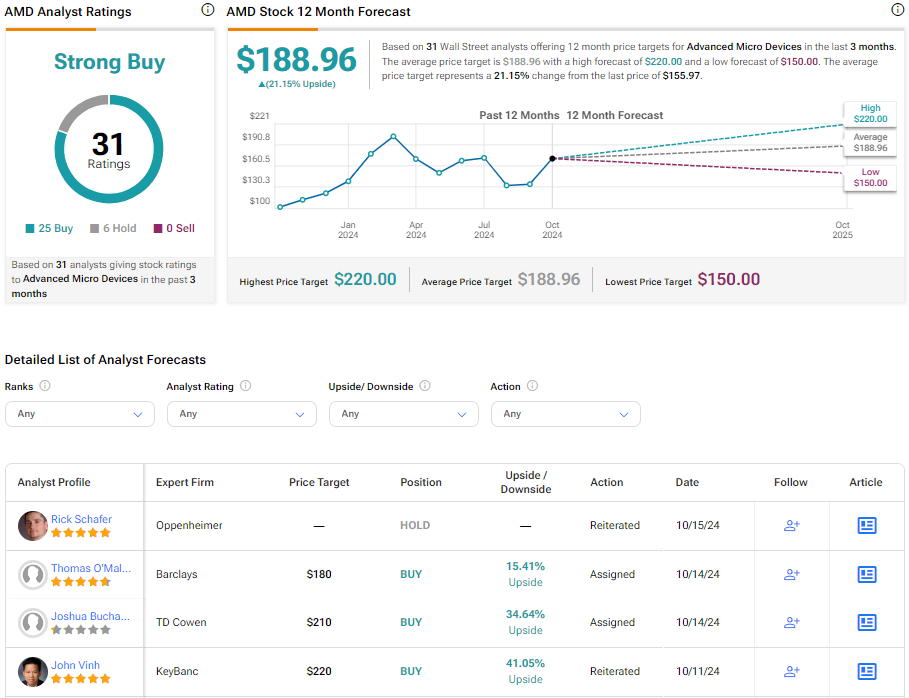

On TipRanks, AMD is rated as a Strong Buy based on 25 Buys, six Holds, and no Sell ratings from Wall Street analysts in the last three months. The average price target for AMD stock is $188.96, suggesting a potential upside of more than 21.15%.

Explore more AMD analyst ratings

Key Takeaways on AMD Stock

AMD presents a compelling opportunity for investors due to its growth potential, especially in AI and data centers. Although AMD’s market cap is significantly smaller than Nvidia’s, the company’s latest AI chip release and ongoing investments in software may contribute to robust future revenue growth. Analysts predict a remarkable compound annual growth rate of 41%, reinforcing my bullish stance on AMD.

(I have shares in AMD)

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.