In our latest research at ETF Channel, we analyzed the iShares Expanded Tech-Software Sector ETF (Symbol: IGV) by comparing its underlying holdings’ trading prices to analysts’ 12-month target prices. The findings reveal an implied target price for the ETF of $100.29 per unit.

Current Trading Scenario for IGV

Currently, IGV is trading at approximately $90.79 per unit. This indicates a potential upside of 10.46%, based on analysts’ average targets for its holdings. Among these holdings, three stand out for their promising upside potential: Jamf Holding Corp (Symbol: JAMF), Workiva Inc (Symbol: WK), and E2open Parent Holdings Inc (Symbol: ETWO). For instance, JAMF’s recent price of $16.52/share is significantly below the average target price of $22.70/share, suggesting a 37.41% upside. Similarly, WK’s recent price of $78.67 implies a 27.75% increase if it reaches the average target of $100.50/share. Lastly, ETWO’s trading price of $3.04 has a 27.17% upside to its target price of $3.87/share.

Performance Insights

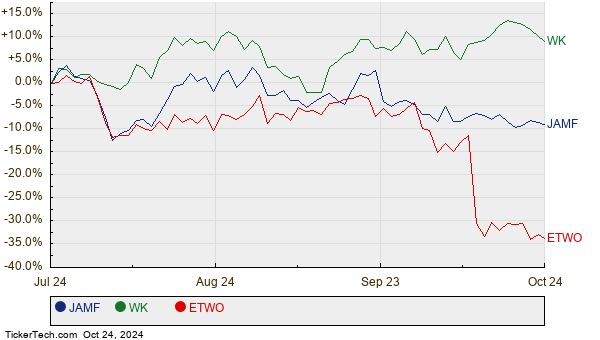

Below is a chart depicting the stock performance over the past twelve months for JAMF, WK, and ETWO:

Summary of Analyst Targets

Here’s a summary table detailing the current analyst target prices for the discussed stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| iShares Expanded Tech-Software Sector ETF | IGV | $90.79 | $100.29 | 10.46% |

| Jamf Holding Corp | JAMF | $16.52 | $22.70 | 37.41% |

| Workiva Inc | WK | $78.67 | $100.50 | 27.75% |

| E2open Parent Holdings Inc | ETWO | $3.04 | $3.87 | 27.17% |

Market Expectation Analysis

As we consider these target prices, questions arise: Are analysts being realistic in their projections, or are they overly optimistic about the future? It is essential for investors to conduct thorough research on the underlying company fundamentals and recent developments in the industry. High target prices relative to current trading can hint at potential future gains but may also lead to downgrades if targets do not align with new information.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• MLPs Hedge Funds Are Buying

• OCUP Videos

• BCDA Split History

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.