Analysts Signal Potential Gains for Vanguard S&P 500 Growth ETF and Key Holdings

In our analysis at ETF Channel, we examined the underlying assets of popular ETFs, comparing the current trading prices to average analyst projections for the next 12 months. For the Vanguard S&P 500 Growth ETF (Symbol: VOOG), the weighted average implied analyst target price is set at $385.71 per unit.

Market Performance of VOOG

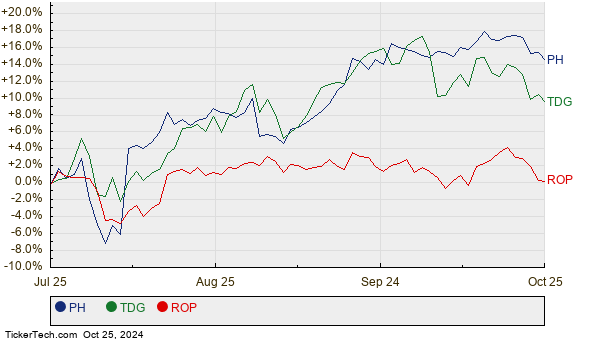

Currently, VOOG is trading near $350.02 per unit, indicating a potential upside of 10.20% based on analyst targets. Among VOOG’s notable holdings, three companies show significant growth potential compared to their respective analyst target prices: Parker Hannifin Corp (Symbol: PH), TransDigm Group Inc (Symbol: TDG), and Roper Technologies Inc (Symbol: ROP). While PH recently traded at $624.14 per share, its average analyst target is 11.91% higher at $698.50. Similarly, TDG, currently priced at $1,345.56, has a target of $1,501.00, reflecting an upside of 11.55%. Lastly, analysts are projecting ROP to reach a target price of $604.00 per share, which is 11.42% above its recent price of $542.10. Below is a chart tracking the past twelve months of stock performance for PH, TDG, and ROP:

Summary of Analyst Targets

Here’s a summary table detailing the current analyst target prices:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Vanguard S&P 500 Growth ETF | VOOG | $350.02 | $385.71 | 10.20% |

| Parker Hannifin Corp | PH | $624.14 | $698.50 | 11.91% |

| TransDigm Group Inc | TDG | $1,345.56 | $1,501.00 | 11.55% |

| Roper Technologies Inc | ROP | $542.10 | $604.00 | 11.42% |

Evaluating Analyst Predictions

As investors consider these upside targets, questions arise regarding the accuracy of these forecasts. Are analysts being realistic, or could their projections be overly optimistic? Investors will need to delve deeper into recent developments within these companies and their industries to understand the context behind these targets. High target prices can indicate confidence in future performance but may also lead to downgrades if circumstances shift. Careful analysis is crucial.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• MAIA Videos

• VIRL Videos

• CNQ Average Annual Return

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.