Analyst Targets Show Potential Upside for Vanguard Large-Cap ETF

In a recent analysis conducted by ETF Channel, the Vanguard Large-Cap ETF (Symbol: VV) showcases promising growth potential based on its underlying holdings. The ETF’s implied analyst target price is set at $290.92 per unit.

Current Valuation and Analyst Outlook

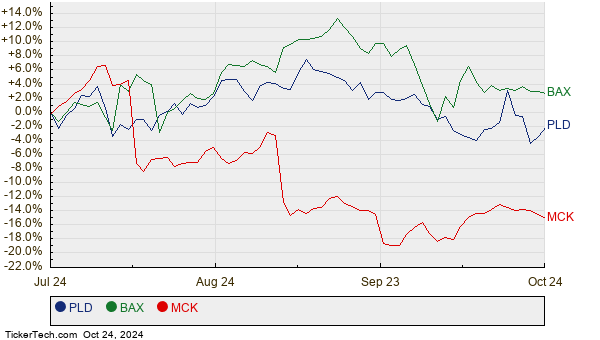

VV is presently trading around $265.20 per unit, signaling a potential upside of 9.70%, based on the average target price forecast by analysts. Noteworthy underlying holdings include Prologis Inc (Symbol: PLD), Baxter International Inc (Symbol: BAX), and McKesson Corp (Symbol: MCK), all of which show significant potential to reach their target prices.

Key Holdings and Their Growth Prospects

For example, Prologis Inc is currently trading at $120.83 per share, but analysts predict an 11.84% increase, targeting $135.14 per share. Baxter International Inc also has room to grow, with a recent price of $36.47 compared to an anticipated target of $40.75, representing an 11.74% upside. McKesson Corp is forecasted to reach $560.47 per share, which suggests an 11.70% increase from its current trading price of $501.76. The chart below shows the performance of these stocks over the past twelve months:

Summary of Analyst Target Prices

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Vanguard Large-Cap ETF | VV | $265.20 | $290.92 | 9.70% |

| Prologis Inc | PLD | $120.83 | $135.14 | 11.84% |

| Baxter International Inc | BAX | $36.47 | $40.75 | 11.74% |

| McKesson Corp | MCK | $501.76 | $560.47 | 11.70% |

Critical Considerations for Investors

Investors may wonder whether analysts are justified in their price targets or if they are being overly optimistic. This raises important questions: Are the targets reflective of current market conditions, or could they be outdated? A high price target can signal optimism about future growth, although it can also lead to downward adjustments if they prove to be too ambitious. Research and critical analysis remain crucial for making informed investment decisions.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Holdings Channel

• Top Ten Hedge Funds Holding FWRG

• Altus Power Earnings Surprises

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.