Analysts Predict Strong Growth for iShares Expanded Tech Sector ETF Amid Stock Evaluation

In a recent analysis conducted by ETF Channel, we examined the underlying holdings of the iShares Expanded Tech Sector ETF (Symbol: IGM). By comparing the trading price of each stock to the average analyst’s 12-month forward target price, we determined that the weighted average implied analyst target price for IGM itself stands at $108.51 per unit.

Current Trading Insights and Expected Growth

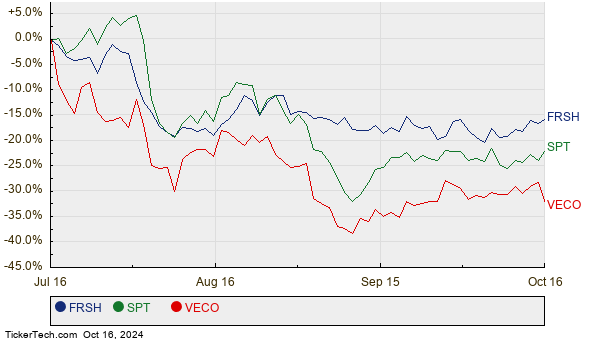

IGM is currently trading at approximately $97.48 per unit, indicating that analysts anticipate an 11.31% upside for this ETF based on their target predictions for its underlying stocks. Among IGM’s holdings, three companies show significant upside potential in their average analyst target prices: Freshworks Inc (Symbol: FRSH), Sprout Social Inc (Symbol: SPT), and Veeco Instruments Inc (Symbol: VECO). For instance, FRSH has a recent trading price of $11.51 per share, while the average analyst target is much higher at $17.07 per share, suggesting a 48.31% upside. Similarly, SPT, currently at $29.32, has an analyst target of $43.33, which represents a potential increase of 47.79%. Additionally, VECO is trading at $31.48 with a target price of $45.57, showing an attractive upside of 44.76%. Below is a chart detailing the twelve-month price history for FRSH, SPT, and VECO:

Summary of Analyst Targets

Here is a detailed summary table highlighting the current analyst target prices for the discussed stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| iShares Expanded Tech Sector ETF | IGM | $97.48 | $108.51 | 11.31% |

| Freshworks Inc | FRSH | $11.51 | $17.07 | 48.31% |

| Sprout Social Inc | SPT | $29.32 | $43.33 | 47.79% |

| Veeco Instruments Inc | VECO | $31.48 | $45.57 | 44.76% |

Considering the Future: Analyst Optimism vs. Market Realities

As we ponder these target prices, it raises questions about the validity of analyst expectations. Are these projections realistic, or are analysts overly optimistic about future trading? High price targets in relation to current stock prices can convey a sense of optimism, yet they may also lead to potential downgrades if they stem from outdated assessments. Investors should conduct their own research to determine whether these targets align with recent company performance and industry trends.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Largest BDCs by Net Assets

• RWX shares outstanding history

• WSBF Average Annual Return

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.