Analysts Predict Upside for Vanguard Small-Cap Growth ETF

Our analysis at ETF Channel reveals promising potential for the Vanguard Small-Cap Growth ETF (Symbol: VBK). Based on its underlying holdings, the ETF has an implied analyst target price of $303.89 per unit.

Current Price vs. Potential Growth

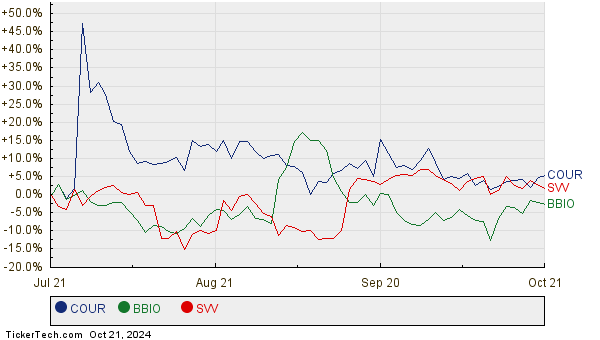

As VBK trades at around $273.70 per unit, analysts project an upside of 11.03% according to the average target prices of its underlying assets. Notably, three of these holdings exhibit significant growth potential: Coursera Inc (Symbol: COUR), BridgeBio Pharma Inc (Symbol: BBIO), and Savers Value Village Inc (Symbol: SVV). COUR currently trades at $7.67/share, but analysts set an average target of $15.92/share, representing a 107.51% increase. Similarly, BBIO, priced at $26.02, has a target price of $47.73/share, indicating an upside of 83.45%. For SVV, which trades at $10.15, the average target is $15.78/share, suggesting a potential rise of 55.44%. Below is a twelve-month price history chart comparing the performance of COUR, BBIO, and SVV:

Analyst Target Price Summary

A summary table of the mentioned analyst target prices is provided below:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Vanguard Small-Cap Growth ETF | VBK | $273.70 | $303.89 | 11.03% |

| Coursera Inc | COUR | $7.67 | $15.92 | 107.51% |

| BridgeBio Pharma Inc | BBIO | $26.02 | $47.73 | 83.45% |

| Savers Value Village Inc | SVV | $10.15 | $15.78 | 55.44% |

What Lies Ahead for These Stocks?

The key question remains: Are analysts justified in their targets, or overly optimistic about where these stocks might trade in the next year? The prices set by analysts could indicate optimism but may also lead to cuts if market conditions shift. Investors are encouraged to conduct further research to evaluate these claims and the market’s response to recent company and industry developments.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• Dividend Yield

• MYFW Historical Stock Prices

• AENT Average Annual Return

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.