Analyst Targets Indicate Potential Upside for Invesco S&P 500 GARP ETF

By analyzing the underlying assets of various ETFs, ETF Channel has assessed potential future performance based on analyst predictions. In the case of the Invesco S&P 500 GARP ETF (Symbol: SPGP), analysts project an implied target price of $119.75 per unit.

Current Performance vs. Analyst Expectations

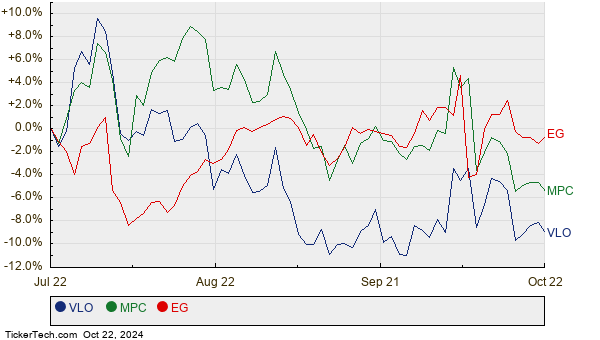

Currently trading at approximately $106.58 per unit, SPGP shows a promising upside of 12.36% based on analyst forecasts for its underlying assets. Key holdings within SPGP poised for notable increases in value include Valero Energy Corp (Symbol: VLO), Marathon Petroleum Corp (Symbol: MPC), and Everest Group Ltd (Symbol: EG).

For instance, Valero Energy Corp recently traded at $135.50 per share; however, the average analyst target stands at $154.89 per share, indicating a potential upside of 14.31%. Marathon Petroleum Corp shares have a recent price of $156.91, with a target price of $177.89—suggesting an upside of 13.37%. Everest Group Ltd is also projected to increase, with an average target of $436.69—12.94% higher than its recent price of $386.65. Below is a chart illustrating the twelve-month stock performance of these companies:

Summary of Analyst Projections

Here is a table summarizing the current analyst target prices for the discussed holdings:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Invesco S&P 500 GARP ETF | SPGP | $106.58 | $119.75 | 12.36% |

| Valero Energy Corp | VLO | $135.50 | $154.89 | 14.31% |

| Marathon Petroleum Corp. | MPC | $156.91 | $177.89 | 13.37% |

| Everest Group Ltd | EG | $386.65 | $436.69 | 12.94% |

Considerations for Investors

Are these analyst targets well-founded, or do they lean toward excessive optimism regarding future stock prices? Investors need to explore whether these price projections sufficiently consider recent developments in the respective industries. When a stock’s target price is significantly higher than its current trading price, it might signal optimism but could also set the stage for future downgrades if market conditions change. Thorough research is essential for making informed investment decisions.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Additional Resources:

• VOIS Insider Buying

• ECL Options Chain

• DHY Dividend History

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.