Analysts See Growth Potential in iShares U.S. Healthcare ETF and Key Holdings

At ETF Channel, we examined the underlying holdings of various ETFs to compare their trading prices with the average 12-month target prices set by analysts. For the iShares U.S. Healthcare ETF (Symbol: IYH), the projected target price based on these holdings is $71.59 per unit.

Current Trading and Upside Potential for IYH

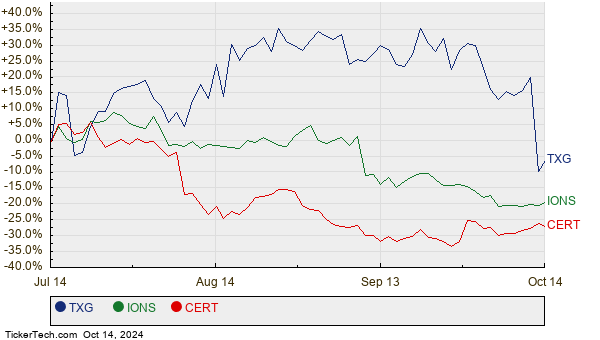

Currently, IYH is priced at approximately $64.88 per unit, indicating a potential upside of 10.34% based on analyst expectations for its underlying holdings. Notably, three companies within the ETF show significant upside potential: 10x Genomics Inc (Symbol: TXG), Ionis Pharmaceuticals Inc (Symbol: IONS), and Certara Inc (Symbol: CERT). For instance, TXG trades at $16.26 per share, but analysts predict it could reach an average target of $28.29 per share, reflecting an impressive upside of 74.01%. Likewise, IONS has a potential increase of 59.08%, moving from its current price of $38.44 towards a target of $61.15 per share. Similarly, CERT’s recent price of $11.45 suggests an upside of 48.95% to an anticipated target of $17.05 per share.

Below is a twelve-month price history chart showcasing the stock performance of TXG, IONS, and CERT:

Summary of Analyst Target Prices

Here’s a quick summary of the current target prices mentioned above:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| iShares U.S. Healthcare ETF | IYH | $64.88 | $71.59 | 10.34% |

| 10x Genomics Inc | TXG | $16.26 | $28.29 | 74.01% |

| Ionis Pharmaceuticals Inc | IONS | $38.44 | $61.15 | 59.08% |

| Certara Inc | CERT | $11.45 | $17.05 | 48.95% |

Questions Regarding Analyst Optimism

Are analysts being realistic in their target predictions, or might they be overly optimistic regarding future trading? It’s crucial to assess whether these targets are based on sound justification or if they overlook recent developments in the companies and the healthcare industry. While high target prices generally signal optimism, they can also lead to potential downgrades if based on outdated information. These considerations warrant further investigation by investors.

![]() Explore 10 ETFs With Most Upside To Analyst Targets »

Explore 10 ETFs With Most Upside To Analyst Targets »

Also see:

• RBB Insider Buying

• LGI Dividend History

• TII Split History

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.