Netflix Powers Ahead with Strong Q3 Performance: A Look at User Growth and Future Strategies

Netflix NFLX continues to excel in the competitive streaming landscape, achieving remarkable results for the third quarter of 2024. The company’s strong earnings and increased guidance signal positive growth potential for investors in the digital entertainment sector.

In a standout quarter, Netflix reported earnings of $5.40 per share, beating the Zacks Consensus Estimate by 6.09% and marking an impressive 44.8% increase year-over-year. This growth highlights Netflix’s ability to effectively generate revenue from its extensive content library and expanding subscriber base. Revenues hit $9.82 billion, reflecting a solid 15% rise compared to the previous year and surpassing the consensus mark by 0.6%.

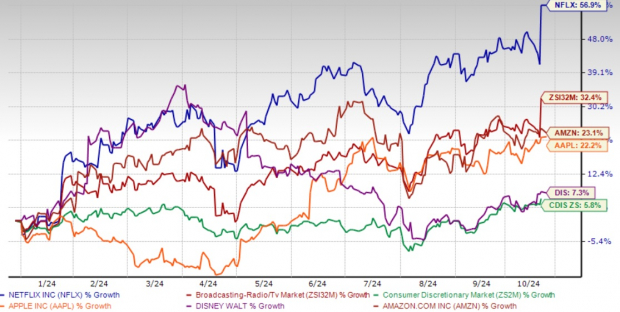

Investor sentiment has turned favorably towards Netflix, with NFLX shares climbing 56.9% year-to-date. This outperformance is notable, especially when compared to tech giants such as Apple AAPL, Amazon AMZN, and Disney DIS, as well as the broader Consumer Discretionary sector.

Year-to-Date Performance Overview

Image Source: Zacks Investment Research

NFLX Growth Continues: New Subscribers and Exciting Ventures

Netflix’s subscriber base shows robust growth, adding 5.07 million new subscribers in this quarter, bringing the total to 282.72 million across more than 190 countries. The average viewing time remains solid at about two hours per user per day, underlining the appeal of Netflix’s offerings.

Looking ahead, Netflix anticipates even higher paid net additions in the fourth quarter, driven by seasonal patterns and an exciting lineup of content. The Zacks Consensus Estimate predicts total paid memberships could reach 290.54 million by the end of 2024, a notable 11.6% year-over-year increase.

In a strategic move, Netflix is entering the live events space, with upcoming broadcasts of the Mike Tyson and Jake Paul boxing match on Nov. 15, along with two NFL games on Christmas Day. This venture into live content marks a significant expansion for the streaming giant.

Subscribe now for a diverse array of returning hits like Squid Game Season 2, Outer Banks Season 4, and Love is Blind Season 7. Viewers can also enjoy new dramas like Black Doves from the UK and comedies such as No Good Deed and Man on The Inside. Additionally, unscripted series like Aaron Rodgers: Enigma and season two of Rhythm + Flow come to the platform, alongside action-thriller Carry-On and war drama The Six Triple Eight.

Netflix’s advertising tier is gaining traction, with membership up 35% quarter-over-quarter. The anticipated 2025 launch of an in-house ad tech platform demonstrates the company’s commitment to maximizing this new revenue stream, expected to see ad revenues roughly double year-over-year by 2025.

Financially, Netflix is thriving, with operating income soaring 51.8% year-over-year to $2.9 billion. The operating margin rose 720 basis points to an impressive 29.6%. The company’s free cash flow reached $2.19 billion, up from $1.21 billion last quarter, providing a solid foundation for future investments and returns to shareholders.

Netflix has revised its guidance for 2024, now predicting revenue growth at the high end of its earlier forecast of 14-15%. The operating margin estimate also increased to 27%, up from 26%. For 2025, projected revenue growth remains strong at 11-13%, equating to $43-$44 billion with an operating margin of 28%.

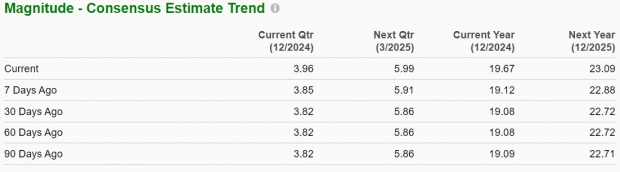

The Zacks Consensus Estimate for 2024 revenues is set at $38.89 billion, indicating a 15.33% growth year-over-year. Expected earnings are pegged at $19.67 per share, reflecting a substantial 63.51% rise compared to the prior year.

Image Source: Zacks Investment Research

Find the latest EPS estimates and surprises on Zacks Earnings Calendar.

Challenges Ahead for NFLX

Despite its strong earnings in Q3 2024 and raised forecasts, Netflix’s subscriber growth of 5.07 million is lower than the 8.76 million added in the same quarter last year. This slowdown can be partially attributed to the crackdown on password sharing that started in 2023. Currently, Netflix’s total debt stands at $15.98 billion, alongside streaming content obligations of $22.7 billion, indicating significant financial responsibilities.

An increase in Netflix’s stock price has driven up valuation multiples, which could restrict potential future gains for investors. The company’s forward 12-month sales multiple is 7.71, surpassing its five-year median of 6.44, suggesting that the stock might be overvalued relative to historical trends. Additionally, this multiple is higher than the Zacks Broadcast Radio and Television industry’s forward earnings multiple of 2.98, indicating a stretched valuation compared to peers.

Price-to-Sales (Forward 12 Months)

Image Source: Zacks Investment Research

Conclusion

For investors considering a purchase of Netflix stock after the third-quarter earnings results, the outlook is generally positive. Strong financial metrics, subscriber growth, and innovative content strategies point to a promising future. As Netflix adapts and fortifies its position in the global entertainment sector, it remains an appealing opportunity for those capitalizing on the shift towards digital content consumption. With solid projections for growth and strategic initiatives, Netflix stands out as a strong contender in the streaming entertainment market. Currently, Netflix holds a Zacks Rank #2 (Buy). Interested investors can find a complete list of Zacks #1 Rank (Strong Buy) stocks here.

Zacks Highlights #1 Semiconductor Stock

Although it’s just 1/9,000th the size of NVIDIA, which has seen remarkable gains of over +800% since our recommendation, this new top chip stock still has substantial upside potential.

This company shows robust earnings growth and is well-positioned to capitalize on surging demand in fields like Artificial Intelligence, Machine Learning, and the Internet of Things. The global semiconductor manufacturing market is estimated to grow from $452 billion in 2021 to $803 billion by 2028.

Want to learn more about this opportunity? Discover this stock now for free >>

To stay updated with the latest recommendations from Zacks Investment Research, you can download 5 Stocks Set to Double today.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Apple Inc. (AAPL): Free Stock Analysis Report

Netflix, Inc. (NFLX): Free Stock Analysis Report

The Walt Disney Company (DIS): Free Stock Analysis Report

To view this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.