Apple Prepares for Earnings Release Amid Mixed iPhone 16 Data

Apple (NASDAQ:AAPL) is set to announce its earnings for the September quarter next Thursday (October 31). As the world’s most valuable company, its report will undoubtedly draw significant attention from Wall Street.

Looking at the current outlook, Bernstein analyst Toni Sacconaghi notes that the data for fiscal Q4 has “come in relatively healthy,” crediting currency trends as an additional advantage.

Consequently, Sacconaghi has adjusted his revenue forecast upward to $94.7 billion for the quarter, up from his previous estimate of $93.7 billion and surpassing the consensus estimate of $94.2 billion. He also anticipates earnings per share (EPS) at $1.61, exceeding Wall Street’s average expectation of $1.59 and aligning with Apple’s range of $1.55-$1.61.

Despite these positive forecasts, Sacconaghi points out that fiscal Q4 results historically carry less weight compared to Apple’s outlook on the new iPhone cycle.

Regarding the upcoming iPhone 16, early data has shown mixed results. This has led Sacconaghi to lower his revenue expectations for fiscal year 2025. He now anticipates a revenue of $415.6 billion and an EPS of $7.28, which fall below analyst consensus of $421 billion and $7.47, respectively. He expects iPhone revenues to rise by 5.6%, projecting sales of about 246 million units, an increase of 5.5%.

“Given the slow rollout of Apple Intelligence, the iPhone 16 cycle may be more backloaded, or upgrades could be delayed until next year,” Sacconaghi explained.

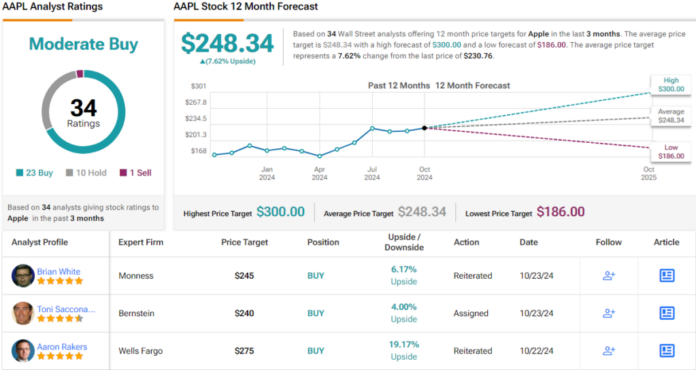

In conclusion, Sacconaghi rates Apple shares as Outperform (Buy) with a price target of $240, indicating that the shares are considered fully valued at this point.

Overall market sentiment shows that, out of 34 recent reviews for AAPL, 23 analysts recommend a Buy, 10 suggest holding, and only one rates it a Sell. This results in a Moderate Buy consensus. The average price target is currently at $248.34, indicating an expected gain of approximately 8% from current levels.

For stock trading insights and attractive valuations, visit TipRanks’ Best Stocks to Buy tool, which integrates TipRanks’ equity analysis.

Disclaimer: The opinions in this article belong solely to the featured analyst. This content is for informational purposes only. It’s essential to conduct your own analysis before making investment decisions.

The views expressed here are those of the author and do not necessarily reflect those of Nasdaq, Inc.