Arch Capital Group Gears Up for Q3 Earnings Release With Promising Growth

Based in Pembroke, Bermuda, Arch Capital Group Ltd. (ACGL) specializes in various insurance, reinsurance, and mortgage insurance products. The company has a market capitalization of $40.6 billion and offers an array of services, including primary and excess casualty, workers’ compensation, professional indemnity, and employers’ liability insurance. Arch Capital is set to release its third-quarter financial results after the market closes on Wednesday, Oct. 30.

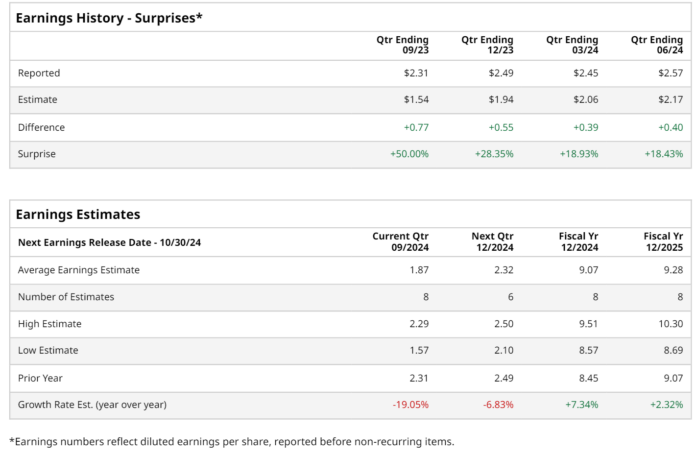

Before the earnings announcement, analysts forecast ACGL will report a profit of $1.87 per share. This marks a 19.1% decline from $2.31 per share in the same quarter last year. Despite this projection, Arch Capital has consistently outperformed Wall Street’s earnings estimates over the past four quarters. In Q2, the company recorded an EPS of $2.57, exceeding expectations by 18.4%. Overall, this performance reflects a 33.8% year-over-year increase, fueled by significant growth in underwriting income along with rising gross and net premiums written across all segments.

Future Earnings Forecasts Look Promising

Looking to fiscal 2024, analysts predict an EPS of $9.07 for ACGL, showing a 7.3% rise from $8.45 in fiscal 2023. Furthermore, earnings per share are expected to grow another 2.3% to $9.28 in fiscal 2025.

Stock Performance Outshines Industry Benchmarks

Year-to-date, ACGL’s stock has surged by 45.5%, greatly outpacing the S&P 500 Index’s rise of 21.9% and the Financial Select Sector SPDR Fund’s (XLF) 24.7% increase during the same period.

Diversified Strategy Fuels Company Success

ACGL’s success derives from its diverse product offerings and strategic acquisitions, such as the purchase of Allianz’s U.S. MidCorp and Entertainment Insurance Businesses. Additionally, the company leverages its “Insurance clock” model, which enhances its ability to adapt to changing market conditions. With a stable liquidity position and low leverage, ACGL is well-prepared for growth while minimizing exposure to market fluctuations.

Investment Community Shows Cautious Optimism

On July 30, Arch Capital’s shares rose by 1.2% following strong Q2 earnings. The company reported adjusted revenue of $3.94 billion, exceeding consensus estimates of $3.91 billion and reflecting a 22.6% increase from the previous year. A 25.7% rise in underwriting income to $762 million and a substantial 50.4% growth in pre-tax net investment income further bolstered investor confidence.

Analyst sentiment regarding Arch Capital’s stock is moderately positive, reflected in an overall “Moderate Buy” rating. Among the 18 analysts following the stock, 10 recommend a “Strong Buy,” two advocate a “Moderate Buy,” five suggest a “Hold,” and one indicates a “Strong Sell.”

Analyst Price Target Suggests Potential Upside

The average analyst price target for ACGL stands at $120.06, which indicates a potential upside of 9.6% from current stock levels.

More Stock Market News from Barchart

On the date of publication, Anushka Mukherjee did not hold (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article are provided solely for informational purposes. For more details, please refer to the Barchart Disclosure Policy here.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.