Clorox Set to Reveal Q1 Earnings: Expectations and Trends for the Future

Oakland, California’s Clorox Company (CLX) stands out in the consumer and professional products market. It operates through various segments, including Health and Wellness, Household, Lifestyle, and International, and boasts a market cap of $19.9 billion. Clorox’s extensive portfolio comprises many brands sold in over 100 countries. Investors are keenly awaiting its upcoming Q1 earnings release on Wednesday, Oct. 30, after market close.

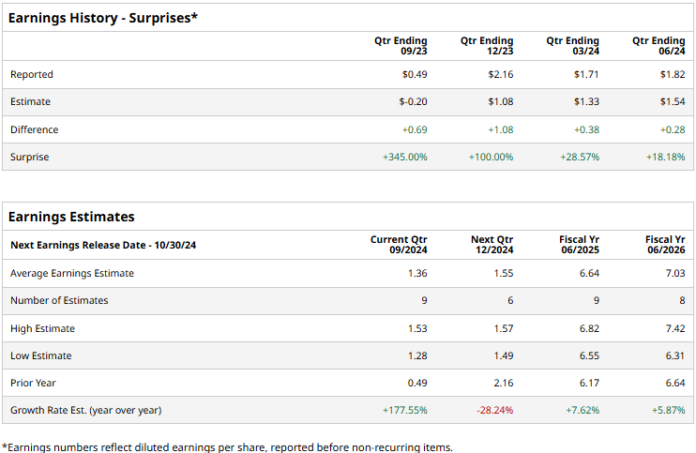

Optimistic Earnings Predictions Amidst Historical Context

Analysts predict that Clorox will announce a profit of $1.36 per share, reflecting a remarkable increase of 177.6% compared to last year’s $0.49 per share in the same quarter. Notably, Clorox has consistently exceeded Wall Street’s adjusted EPS forecasts for the past four quarters. The last reported quarter showed an adjusted EPS growth of 9% year-over-year to $1.82, surpassing consensus estimates by 18.2%. This high expected earnings growth is largely due to a significant 47.3% year-over-year decline in adjusted EPS during Q1 2024.

Future Projections and Adjusted EPS Growth

Looking ahead to fiscal 2025, analysts forecast Clorox’s adjusted EPS will reach $6.64, marking a 7.6% increase from $6.17 in fiscal 2024. The growth trend is expected to continue into fiscal 2026, with projections suggesting an adjusted EPS of $7.03, up 5.9% year-over-year.

Stock Performance and Market Comparison

Year-to-date, CLX stock has risen by 12.5%. However, it lags behind the S&P 500 Index, which has gained 22.7%, and the Consumer Staples Select Sector SPDR Fund (XLP), which has returned 13.2% during the same period.

Response to Recent Earnings and Analyst Sentiment

Following the release of its fiscal 2024 earnings on Aug. 1, Clorox shares jumped 7.4% despite missing Wall Street’s revenue expectations. The company reported a 4% year-over-year decline in net sales, totaling $7.1 billion, driven mainly by lower volumes and unfavorable foreign exchange rates, although a favorable pricing strategy provided slight mitigation. The most significant sales drops occurred in the Household and Lifestyle segments, which declined by 7.1% to $2 billion and 4.7% to $1.3 billion, respectively.

On a positive note, Clorox demonstrated excellent profitability growth, with a gross margin increase of 361 basis points to 43% and a net margin expansion of 193 basis points to 3.9%. This led to a significant 87.9% growth in net earnings, reaching $280 million.

Current Analyst Ratings and Price Targets

The consensus on CLX stock is neutral, with an overall “Hold” rating among analysts. Of the 20 analysts covering the stock, just one recommends a “Strong Buy,” while 13 suggest “Hold,” and six advocate a “Strong Sell” rating. Currently, CLX trades above its mean price target of $154.50, but the highest expected price target of $187 indicates a potential upside of 16.6%.

More Stock Market News from Barchart

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.