Incyte Corporation Braces for Q3 Earnings Amid Market Challenges

Incyte Corporation (INCY), valued at $14.9 billion, is a prominent biopharma company based in Delaware. It focuses on discovering and developing treatments for hematology/oncology, as well as inflammation and autoimmunity. The company aims to address the needs of patients who face significant medical challenges. On Tuesday, October 29, before market opening, Incyte is set to announce its fiscal third-quarter earnings for 2024.

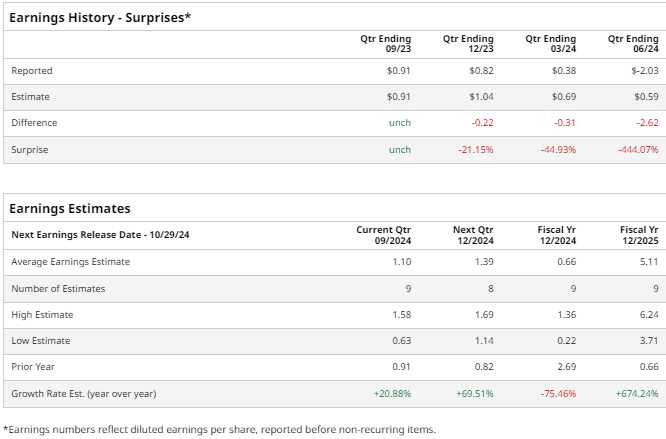

Analysts forecast that INCY will report a profit of $1.10 per share on a diluted basis, representing a 20.9% increase from $0.91 per share reported in the same quarter last year. Over the past year, Incyte has faced some headwinds, missing consensus estimates three out of the last four quarters, while only exceeding expectations once.

For the entire fiscal year, expectations are squarely focused on INCY’s earnings per share (EPS), projected at $0.66. This figure reflects a dramatic drop of 75.5% from $2.69 in fiscal 2023. However, analysts anticipate a significant recovery, forecasting an annual EPS increase of 674.2%, reaching $5.11 by fiscal 2025.

When looking at the stock performance, INCY has underperformed the S&P 500’s 21.9% gains year-to-date, with its stock only climbing 5.6%. In comparison, it also lags behind the Healthcare Select Sector SPDR Fund’s (XLV) 12.1% gains within the same timeframe.

The company’s recent struggles can be traced back to investor concerns regarding a significant decline in sales from its best-selling drug, Jakafi, alongside the halting of several cancer treatments. This anxiety was palpable, leading to a stock drop of over 1% on July 30 following the release of its Q2 earnings report. Even with a better-than-expected Q2 revenue of $1 billion, the reported loss per share of $1.82 overshadowed the positive news.

Despite these challenges, analysts maintain a relatively optimistic view on INCY stock, giving it a “Moderate Buy” rating. Out of 23 analysts, ten recommend a “Strong Buy,” 12 suggest a “Hold,” and one advises a “Strong Sell.”

Currently, the average analyst price target for INCY stands at $72.90, implying a potential upside of 10% from current price levels.

More Stock Market News from Barchart

On the date of publication,

Kritika Sarmah

did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy

here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.