Air Products Set to Announce Q4 Earnings: Analysts Optimistic on Profit Growth

Allentown, Pennsylvania-based Air Products and Chemicals, Inc. (APD) specializes in providing atmospheric gases, specialty gases, and essential equipment. With a market capitalization of $72.6 billion, the company is known for developing and operating some of the largest industrial gas projects globally, particularly those focusing on high-value power, fuels, and chemicals. Air Products is scheduled to release its fiscal fourth-quarter earnings for 2024 before the market opens on Thursday, Nov. 7.

Anticipated Earnings Metrics

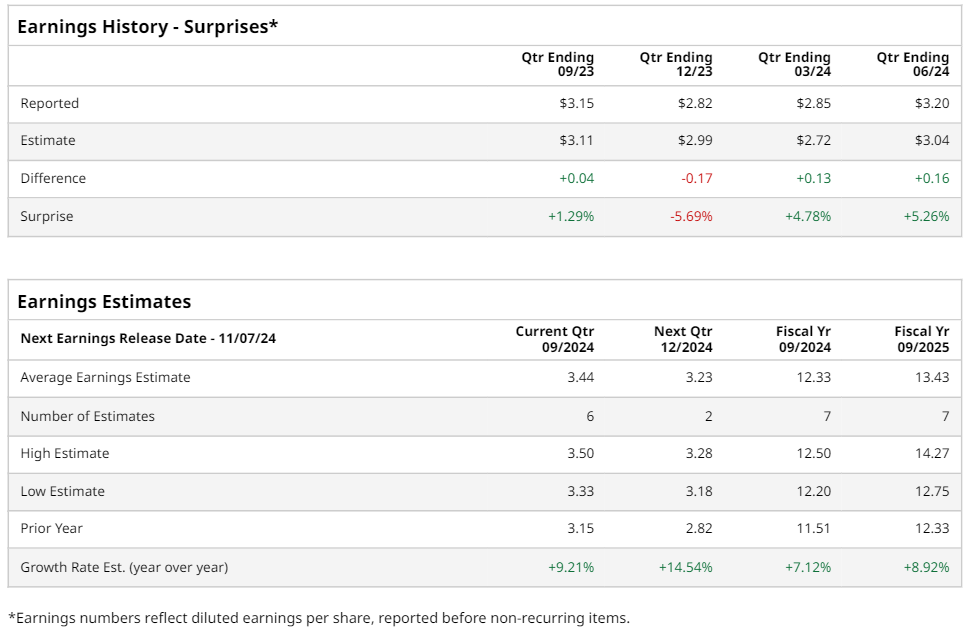

Analysts project that APD will report a profit of $3.44 per share on a diluted basis, reflecting a 9.2% increase from last year’s $3.15 per share. The company has exceeded consensus estimates in three of the last four quarters, although it did miss on one occasion.

Full Year and Future Projections

For the entire year, forecasts suggest APD will deliver earnings per share (EPS) of $12.33, which is a 7.1% increase from $11.51 reported in fiscal 2023. Additionally, EPS is expected to rise by 8.9% year over year to reach $13.43 in fiscal 2025.

Stock Performance Analysis

This year, APD’s stock has lagged behind the S&P 500’s ($SPX) impressive 22.5% gains, showing an increase of only 20.1%. However, it has outperformed the Materials Select Sector SPDR Fund’s (XLB) growth of 13.7% during the same period.

Recent Earnings and Adjusted Expectations

On August 1, APD shares jumped over 8% following a positive Q3 report, where its adjusted EPS was $3.20, surpassing the anticipated $3.03. The company’s revenue reached $3 billion, a slight decline of 1.6% compared to the previous year. For Q4, APD expects adjusted EPS to fall between $3.33 and $3.63, with full-year adjusted EPS projected between $12.20 and $12.50.

Analyst Ratings and Price Targets

The overall consensus on APD’s stock is relatively bullish, holding a “Moderate Buy” rating. Among 21 analysts, 11 recommend a “Strong Buy,” nine suggest a “Hold,” and one advises a “Strong Sell.” Although APD currently trades above its average price target of $324.50, the highest target of $385 implies a potential upside of 17.1%.

More Stock Market News from Barchart

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.