ON Semiconductor Set to Report Q3 Earnings Amid Market Challenges

With a market cap of $29.8 billion, ON Semiconductor Corporation (ON) stands out as a key player in the semiconductor industry. The company, which manufactures a variety of discrete and embedded components, provides solutions for intelligent sensing and power. ON, headquartered in Scottsdale, Arizona, is scheduled to announce its fiscal Q3 earnings results before the market opens on Monday, Oct. 28.

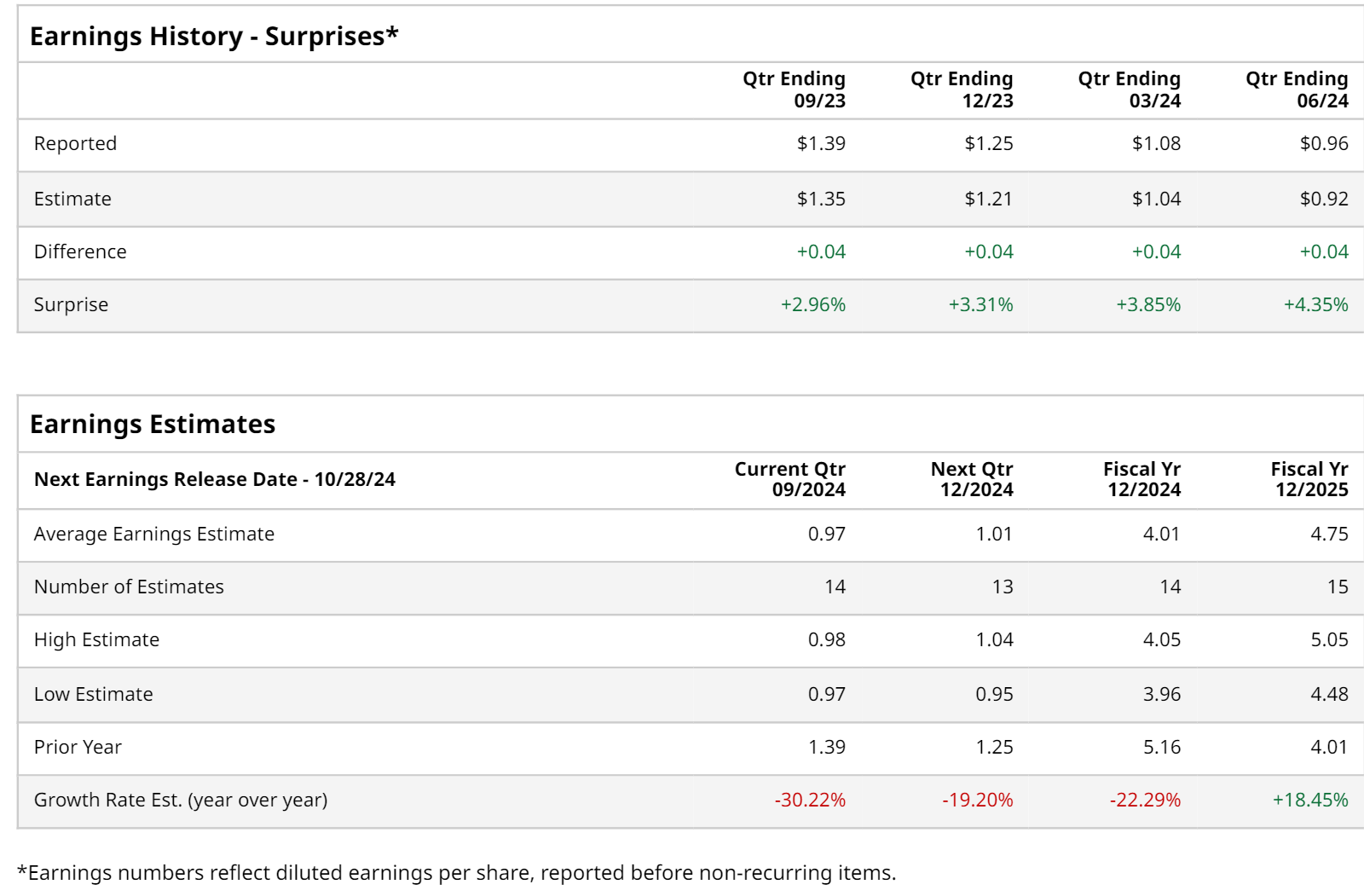

Analysts Anticipate Lower Profits

In anticipation of the upcoming earnings report, analysts expect ON to post a profit of $0.97 per share. This figure represents a significant decline of 30.2% from the previous year’s $1.39 per share. Despite this downturn, the company has a track record of beating Wall Street’s estimates, having exceeded expectations in the last four quarters. For instance, its adjusted earnings of $0.96 per share in the last quarter surpassed consensus estimates by nearly 4.4%.

Future Earnings Outlook

Looking ahead to fiscal 2024, analysts predict that ON will report earnings per share (EPS) of $4.01, a drop of 22.3% from the $5.16 reported in fiscal 2023. However, projections for fiscal 2025 are more promising, with an expected EPS growth of 18.5% to reach $4.75.

Performance Comparison

This year has been tough for ON, with shares declining 17.1% year-to-date. In comparison, the S&P 500 Index ($SPX) has surged by 22.5% and the Technology Select Sector SPDR Fund (XLK) has returned 19.5% over the same timeframe.

Factors Influencing Performance

The underperformance is largely attributed to high interest rates affecting key markets such as industrial and automotive. On July 29, shares rose by 11.5% following a better-than-expected Q2 earnings release. While revenue fell by 17.2% year-over-year to $1.74 billion, positive Q3 guidance and a multi-year supply agreement with Volkswagen may have driven investor optimism.

Recent Developments Impacting Stock Prices

Recent news has caused concern among investors. On Oct. 15, Bloomberg reported that the Biden administration is considering capping sales of advanced AI chips in certain countries. Investors reacted negatively, resulting in a 4.8% drop in ON’s share price.

Analysts Provide Mixed Ratings

The consensus among analysts regarding ON Semiconductor’s stock is moderately optimistic, indicating a “Moderate Buy” rating. In a recent survey of 29 analysts, 15 rated the stock as a “Strong Buy,” one as “Moderate Buy,” 11 as “Hold,” one as “Moderate Sell,” and one as “Strong Sell.” This sentiment has slightly shifted from three months ago when 16 analysts were more bullish, labeling it a “Strong Buy.”

The average price target set by analysts for ON is $86.97, suggesting a 25.6% upside potential from its current share price.

More Stock Market News from Barchart

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.