Note: The following is an excerpt from this week’s Earnings Trends report. To access the full report with detailed historical data and estimates for the current and upcoming periods, please click here>>>

S&P 500 Q3 Earnings Report: Key Insights and Trends

Highlights from Earnings Results

- As of Wednesday, October 23rd, 120 S&P 500 companies have reported earnings for Q3, showing an increase of +1.9% in total earnings alongside +4.2% higher revenues. Notably, 79.2% of these companies surpassed EPS estimates, and 63.3% exceeded revenue expectations.

- The growth in earnings for this group marks a slowdown compared to the robust earnings witnessed in the first half of the year, while revenue growth aligns with recent trends.

- Combining results from these 120 members with estimates for remaining companies, total S&P 500 earnings are projected to rise by +3.0% year-over-year, with revenues expected to increase by +4.9%.

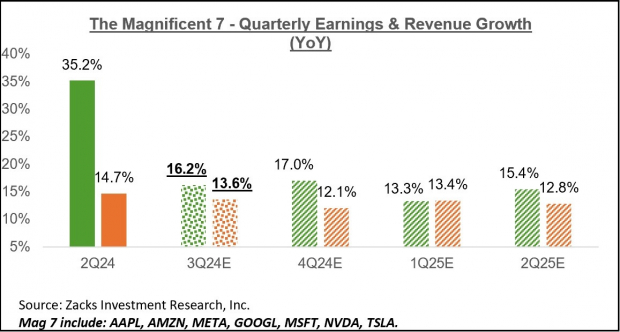

- The ‘Magnificent 7’ companies are anticipated to see earnings rise by +16.2% from last year, after achieving +35.2% growth in Q2. Excluding this group, Q3 earnings for other index companies would show a slight decline of -0.1%.

The Impact of the Magnificent 7 on Earnings

The focus shifts to Tech, particularly the Mag 7, as five of these major firms – Apple AAPL, Amazon AMZN, Meta META, Alphabet GOOGL, and Microsoft MSFT – will release Q3 results next week.

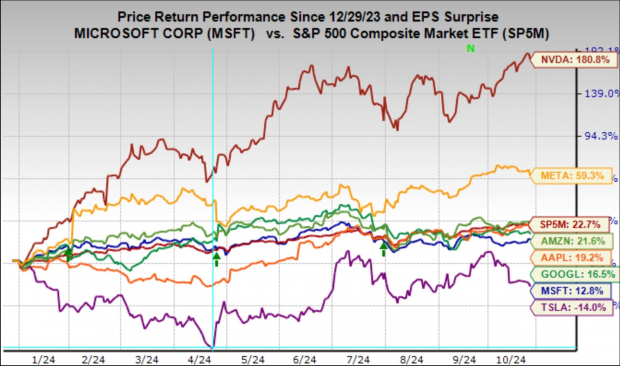

Recently, the Mag 7 stocks have faced challenges in maintaining their market leadership. This reflects concerns from investors regarding ongoing AI-focused capital expenditures, with no clear path yet on how these investments will yield profits.

This trend is evident when examining the year-to-date performance, where only Nvidia and Meta are keeping pace with market averages, while the others are lagging.

Image Source: Zacks Investment Research

The upcoming Q3 results will be crucial for these companies, especially Alphabet, Microsoft, and Amazon, with AI developments playing a pivotal role in their narratives.

Despite recent market volatility, the Mag 7 companies exhibit sustainable earnings growth, collectively expected to generate $112.4 billion in Q3 earnings on $487.3 billion in revenues. This equates to a year-over-year growth of +16.2% in earnings and +13.6% in revenues.

Image Source: Zacks Investment Research

The Mag 7 are set to contribute 21.3% of total S&P 500 earnings in Q3. Without their significant contributions, the earnings for the rest of the S&P would actually be in negative territory.

Analyzing the Broader Earnings Landscape

Overall, total earnings for the S&P 500 are projected to increase by +3.0% year-over-year, bolstered by +4.9% higher revenues.

If not for the Energy sector’s decline of -25.6%, the growth in earnings would rise to +5.3%. Excluding the Tech sector’s strong contribution could lead to a slight decline in overall quarterly earnings of -0.3%, despite the Tech sector showing a healthy earnings increase of +11.7%.

Looking forward, analysts expect earnings growth to improve next quarter, as illustrated in the chart below.

Image Source: Zacks Investment Research

For Q4 2024, S&P 500 earnings are anticipated to increase by +9.1% with +5.3% higher revenues. This earnings growth would reach +10.9% if not for the ongoing struggles in the Energy sector.

While estimates for this period have been adjusted downwards since the quarter began, the negative revisions have been less severe than those seen in Q3.

Image Source: Zacks Investment Research

The broader look at annual earnings growth reveals the following.

Image Source: Zacks Investment Research

This year, the S&P has seen +7.4% earnings growth alongside only +1.9% top-line revenue gains, largely due to a downturn in the Finance sector. If Finance is excluded, earnings growth becomes +6.4%, with revenue growth at +4.2%. Essentially, nearly half of this year’s earnings growth is attributed to revenue increases, complemented by margin improvements.

Unlocking Potential Growth: Stocks to Watch

Our expert team has identified 5 stocks with the highest potential for doubling in value in the near future. Among them, Director of Research Sheraz Mian highlights one standout stock expected to yield impressive gains. This company, recognized for its innovative financial solutions, boasts a rapidly growing customer base of over 50 million and holds great promise.

While past performance doesn’t guarantee future success, this top pick is poised for significant growth, similar to earlier successes such as Nano-X Imaging, which surged +129.6% within nine months.

Stay informed with our up-to-date stock analysis:

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Apple Inc. (AAPL): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Meta Platforms, Inc. (META): Free Stock Analysis Report

For the full article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.