Monster Beverage Prepares for Q3 Earnings: A Closer Look

Monster Beverage Corporation (MNST), with a market capitalization of $56.3 billion, is a prominent player in the energy drink sector, offering a wide range of beverages. The company, headquartered in California, is scheduled to reveal its fiscal Q3 earnings results on Thursday, November 7.

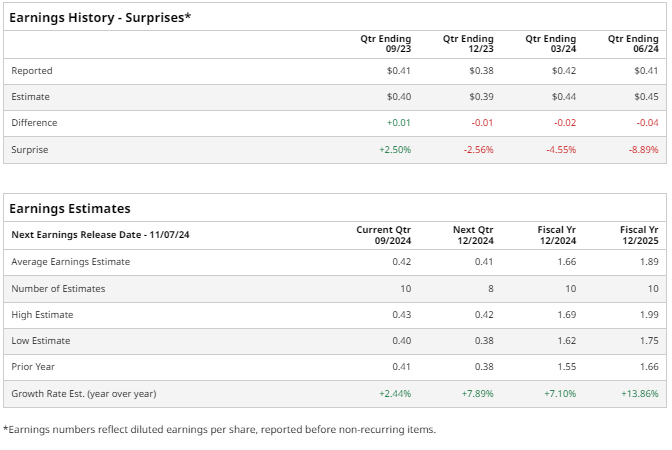

Profit Expectations and Historical Performance

Analysts predict that MNST will report a profit of $0.42 per share, representing a 2.4% increase from the $0.41 per share it reported in the same quarter last year. Over the past four quarters, the company has faced challenges, surpassing Wall Street’s earnings estimates just once while falling short on three occasions.

Looking Ahead: Fiscal 2024 Projections

For fiscal 2024, expectations remain positive with analysts forecasting an earnings per share (EPS) of $1.66, which marks a 7.1% increase compared to the $1.55 EPS in fiscal 2023.

Stock Performance and Market Comparison

Despite its strong market position, MNST’s stock has declined by 6.2% year-to-date, falling short of the broader S&P 500 Index’s gains of 23% and the Consumer Staples Select Sector SPDR Fund’s returns of 14.2% during the same period.

Recent Earnings Performance and Analyst Sentiment

In its Q2 earnings report released on August 7, Monster Beverage experienced a significant drop of over 10% in shares during the following trading session. The company reported $1.9 billion in revenue, which was below analysts’ expectations. Earnings per share reached $0.41, but this also missed the consensus estimate of $0.45. Management attributed this shortfall primarily to reduced customer traffic in convenience stores and a downturn in the energy drink market.

Current Analyst Ratings and Price Target

The overall sentiment toward MNST stock is cautiously optimistic, holding a “Moderate Buy” rating among analysts. A total of 20 analysts are tracking the stock, with 11 recommending a “Strong Buy,” one suggesting a “Moderate Buy,” six advocating for a “Hold,” and two proposing a “Strong Sell.” This analysis shows a slight decline in bullishness compared to three months ago, when the stock received 12 “Strong Buy” ratings.

Currently, the average analyst price target for MNST stands at $55.76, indicating a potential for slight gains from recent price levels.

More Stock Market News from Barchart

On the date of publication, Kritika Sarmah did not hold (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more details, please review the Barchart Disclosure Policy here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.