Zimmer Biomet Prepares for Q3 Earnings with Positive Growth Predictions

Zimmer Biomet Holdings, Inc. (ZBH), based in Warsaw, Indiana, specializes in creating innovative orthopedic solutions. The firm, which serves orthopedic surgeons and healthcare providers, aims to enhance patient mobility and reduce pain. With a market capitalization of $21.6 billion, Zimmer operates in over 25 countries and markets its products in more than 100. The company is scheduled to release its Q3 earnings report prior to the stock market opening on Wednesday, Oct. 30.

Positive Earnings Outlook for Q3 and Beyond

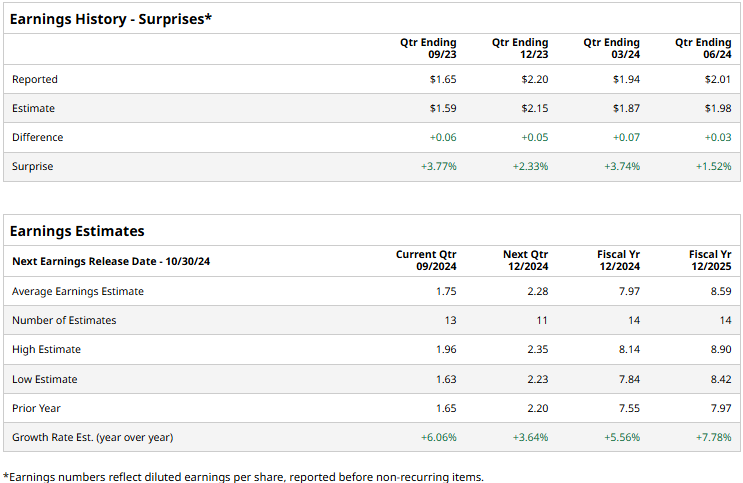

Analysts forecast that Zimmer will report earnings of $1.75 per share for the upcoming quarter, reflecting a 6.1% increase from the $1.65 per share reported in the same period last year. Zimmer has consistently surpassed adjusted earnings per share (EPS) expectations for the past four quarters. In the last reported quarter, the adjusted EPS rose 10.4% year-over-year to $2.01, beating consensus estimates by 1.5%.

Future Projections Show Steady Growth

For fiscal 2024, analysts are predicting adjusted EPS of $7.97, up 5.6% from $7.55 achieved in 2023. Looking ahead to fiscal 2025, the anticipated adjusted EPS is set to increase by 7.8% to reach $8.59.

Stock Performance Lags Behind Major Indices

Despite its growth prospects, ZBH stock has seen a 13.8% decline this year, markedly trailing behind the S&P 500 Index’s 22.5% growth and the Health Care Select Sector SPDR Fund’s (XLV) 11.7% return during the same period.

Market Reaction to Recent Earnings Report

Even with positive earnings and revenue results in its Q2 earnings report released on Aug. 7, Zimmer Biomet’s stock fell by 3.4%. The company adjusted its full-year revenue growth forecast downward, attributing the change to fluctuations in foreign currency exchange rates. Nonetheless, Zimmer reported a solid 3.9% year-over-year increase in net sales, totaling $1.9 billion, which surpassed Wall Street expectations. Additionally, effective cost management improved the net margin by 1.3% to 12.5% compared to the previous year, resulting in a notable 15.8% rise in net earnings, amounting to $242.8 million.

Analysts Maintain a Moderately Bullish Outlook

The consensus rating for ZBH stock is “Moderate Buy.” Among the 28 analysts monitoring the stock, seven recommend a “Strong Buy,” two a “Moderate Buy,” 17 suggest “Hold,” and two advocate for a “Strong Sell.” The average price target is $123.80, indicating potential growth of nearly 18% from the current price levels.

More Stock Market News from Barchart

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information, please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.