Apple Shares Face Critical Price Decision: Will They Break Through Resistance?

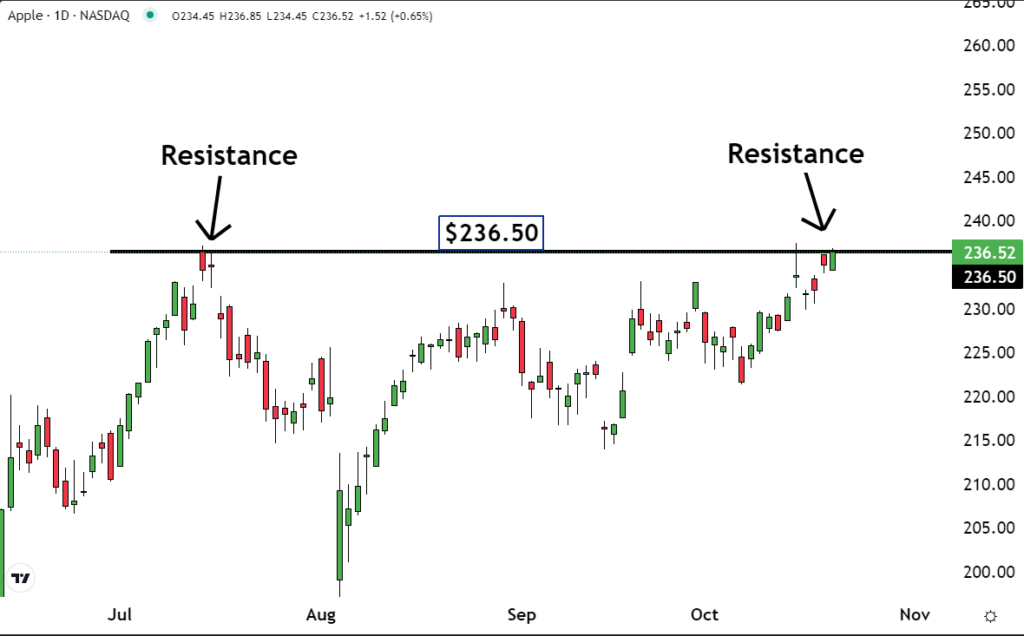

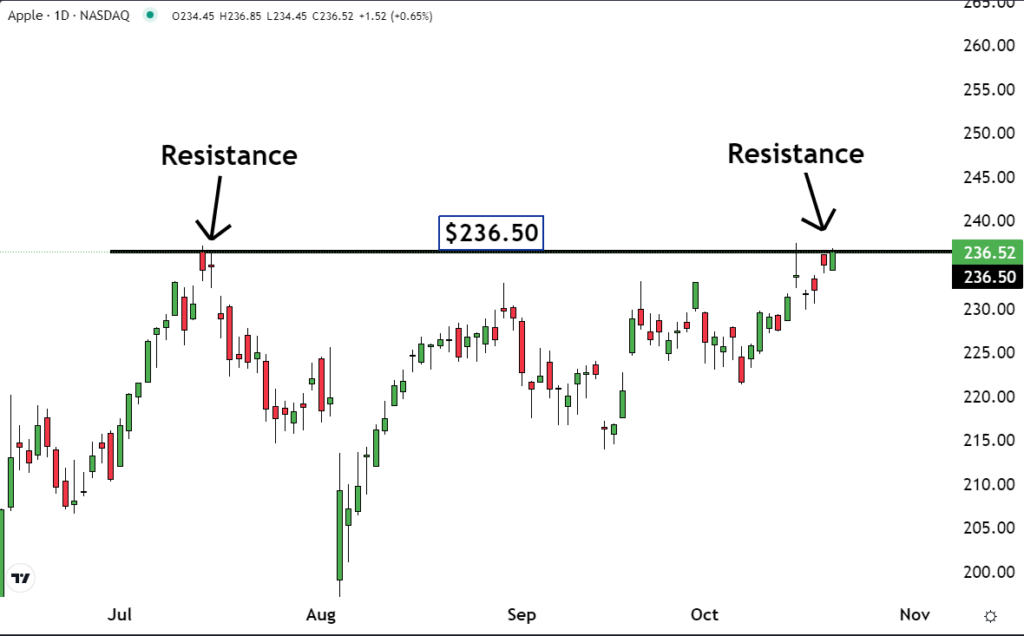

Apple Inc. AAPL has hit a price point of $236.50, which previously served as a peak. The likelihood of the stock remaining at this level for an extended period is low. Analysts anticipate a breakout to higher prices or a reversal heading downward.

Understanding Price Resistance in Apple Stock

Supply and demand, combined with investor emotions, drive market movements. The psychology of traders significantly impacts how price patterns form on charts.

For instance, stocks often struggle at previously established resistance levels. In July, Apple shares faced resistance at the $236.50 mark, which appears to be a hurdle again today. This situation isn’t coincidental; many investors who bought during this previous peak now view their choice as potentially flawed after the stock dipped shortly after their purchase.

The Impact of Sell Orders on Apple’s Future

Many of these investors are now eager to sell to avoid losses. They hope for Apple stock to return to their buying price of $236.50 to exit at breakeven. This formation of sell orders contributes to the current resistance the stock is facing.

If Apple can surpass this $236.50 resistance, it will indicate that those placing sell orders are either out of the market or have canceled their orders. In that case, buyers will likely need to pay higher prices, driving the stock into an uptrend.

Conversely, if the stock struggles to break through, a decline may follow. Some investors, anxious to sell, might start undercutting each other. Those eager to avoid missing a trade will often lower their prices, creating a possible domino effect and pushing the stock lower.

Market Sentiment and Price Movement

Apple’s current situation illustrates a key principle in trading: stocks rarely stay at significant price points for long. Instead, they are more likely to break out or reverse direction soon.

Read Next:

• Tesla Q3 Earnings Preview: Analyst Says 1.8 Million Unit Estimate ‘Hittable’ For 2024, ‘2 Million+ Number The Focus For 2025’

Photo: Shutterstock

Market News and Data brought to you by Benzinga APIs