Taiwan Semiconductor’s Impressive Earnings Report Boosts Stock Performance

TSM Shares Rise After Strong Q3 Performance

Taiwan Semiconductor Manufacturing Co TSM saw its stock price increase following a positive earnings report on Thursday.

The company, a vital supplier for Nvidia Corp NVDA, recorded third-quarter revenue of 759.69 billion New Taiwan dollars (approximately $23.50 billion). This marks a 39% rise, exceeding its guidance of $22.4 billion to $23.2 billion and surpassing analysts’ expectations.

Demand for its advanced 3nm and 5nm technologies, largely driven by the smartphone and artificial intelligence (AI) markets, contributed to this robust performance.

Also Read: Nokia Q3: Earnings Miss, CEO Cites Telecom Weakness And Anticipates India Demand Rebound

The company’s gross margin grew to 57.8%, an increase from 54.3% a year earlier. Additionally, its operating margin rose to 47.5%, up from 41.7% last year. Looking ahead, Taiwan Semiconductor expects fourth-quarter revenues of between $26.1 billion and $26.9 billion, which is above the consensus estimate of $24.86 billion.

Needham analyst Charles Shi maintained a Buy rating on Taiwan Semiconductor with a price target of $210.

Analysis Insights: Shi indicated that the earnings reveal strong growth in 3nm technology, while 5nm performance has slightly weakened.

According to Shi, Apple Inc AAPL is primarily responsible for the improved 3nm results. Meanwhile, revenue from 5nm has leveled off following six consecutive quarters of growth.

Shi also remarked that Taiwan Semiconductor’s gross margins have improved, returning to the high 50s range. This recovery suggests that the company is navigating earlier challenges, such as costs related to 3nm dilution and rising energy prices.

Management had previously indicated that prebuilding 5nm and 3nm wafers contributed to this positive margin performance. Furthermore, Taiwan Semiconductor raised its full-year revenue growth target from “slightly above the mid-20s” to “close to 30%,” while keeping its ex-memory semiconductor growth outlook at 10%.

The company plans to triple its AI revenue this year, anticipating it will represent a mid-teens percentage of total revenue. From management’s insights, Shi estimates AI revenues at roughly $4 billion for 2023, with a projection of $13 billion for 2024.

Looking ahead, Taiwan Semiconductor aims for AI to comprise 20% of its total revenue by 2028, potentially exceeding $33 billion, provided a continued compound annual growth rate (CAGR) of over 15% is maintained.

Significantly, the company’s technology segmentation indicates that non-wafer revenue, which primarily comes from packaging, increased from $2.4 billion in Q2 to $3.2 billion in Q3—an impressive 36% growth. Much of this is attributed to Apple’s production ramp-up, alongside indications that Taiwan Semiconductor may have increased its CoWoS capacity in the third quarter.

As for future investments, Taiwan Semiconductor projects that its capital expenditures (CapEx) for 2024 will slightly surpass $30 billion, reflecting a $1 billion reduction from earlier forecasts. Following a tightening of its guidance range last quarter, the company reported that it needs to spend approximately $12 billion in Q4 alone to align with its buildout plans for 2nm technology.

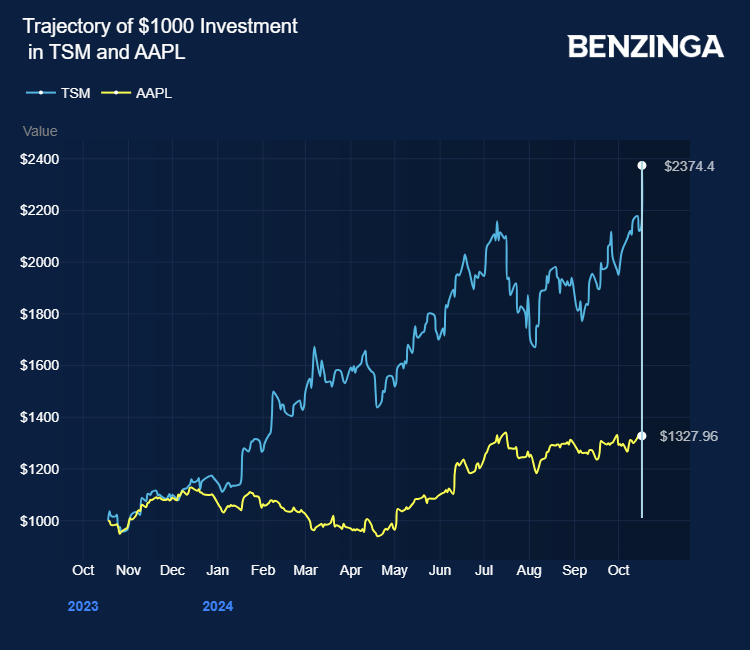

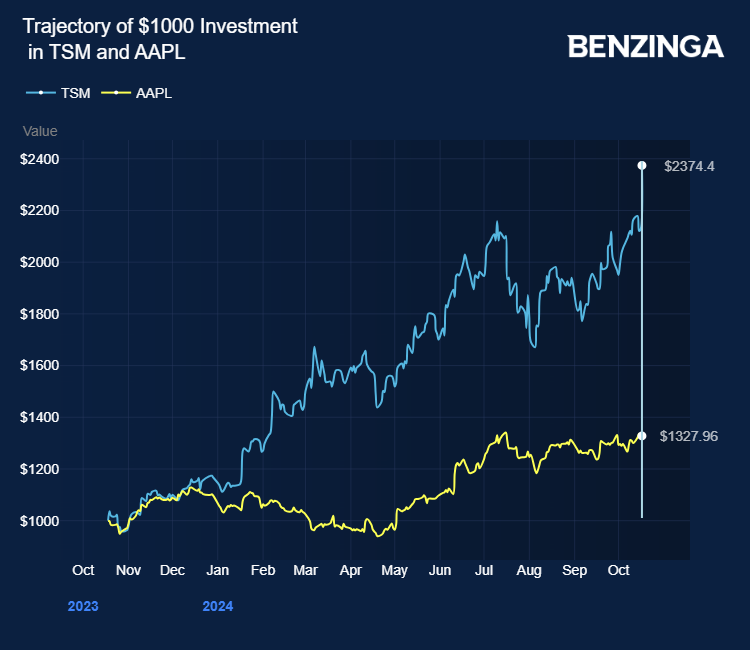

Current Stock Performance: As of the last update on Thursday, TSM shares rose by 11.7%, trading at $209.41.

Also Read:

Photo by wakamatsu.h via Shutterstock

Market News and Data brought to you by Benzinga APIs