Alcoa Receives Buy Upgrade: Analysts Predict 15.44% Price Increase

On October 23, 2024, Argus Research revised its stance on Alcoa (XTRA:185), changing their outlook from Hold to Buy.

Analyst Price Forecast Projects Significant Growth

As of October 21, 2024, analysts anticipate an average price target of 43,71 €/share for Alcoa over the next year. Predictions vary, with a low of 34,81 € and a high of 52,38 €. The average target signifies a potential increase of 15.44% from the company’s latest closing price of 37,86 € per share.

Strong Revenue Growth Expected

Alcoa’s projected annual revenue is estimated at 13,166MM, indicating a robust 19.65% growth. Expectations for non-GAAP EPS stand at 5.32.

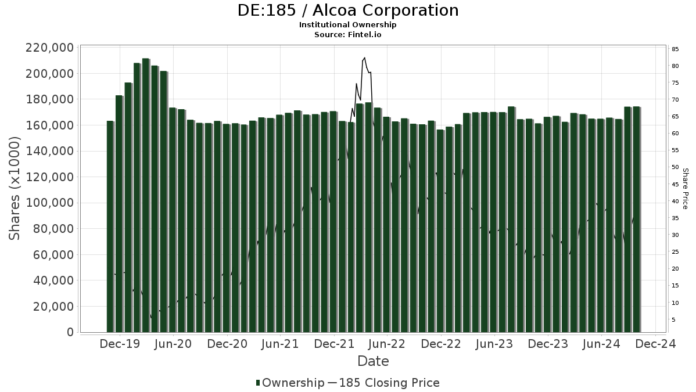

Investor Interest on the Rise

Currently, 890 funds or institutions are reported to hold positions in Alcoa, marking an increase of 36 investors or 4.22% from the previous quarter. The average portfolio weight allocated to Alcoa across all funds is 0.20%, reflecting a rise of 2.93%. Over the last three months, total institutional shares have grown by 5.13% to reach 174,396K shares.

Key Institutional Holders

Eagle Capital Management leads with 15,006K shares, accounting for 5.81% ownership of Alcoa. VTSMX – Vanguard Total Stock Market Index Fund Investor Shares follows closely with 5,643K shares (2.18% ownership). This fund has increased its stake by 0.43% in its latest filing, boosting its overall investment in Alcoa by 14.98% in the last quarter.

Furthermore, IJH – iShares Core S&P Mid-Cap ETF holds 5,585K shares, constituting 2.16% ownership and increasing its share count by 0.52%. The firm also raised its investment in Alcoa by 21.14% recently. Conversely, NAESX – Vanguard Small-Cap Index Fund Investor Shares reports 4,517K shares (1.75% ownership), reflecting a decrease from 4,579K shares, although it still increased its portfolio allocation by 21.82% this quarter. Lastly, Slate Path Capital maintains 3,731K shares, or 1.44% ownership, and increased its portfolio allocation by 7.05%, despite a prior decrease.

Fintel serves as a comprehensive investing research platform for individual investors, traders, financial advisors, and small hedge funds.

Our global data encompasses fundamentals, analyst reports, ownership data, and much more, facilitating informed investment decisions.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.