Is Ford (F) Stock a Hidden Gem or a Risky Bet?

Currently, Ford F is regarded as undervalued, trading at a forward sales multiple of 0.26, which is lower than its five-year average. When compared to General Motors GM, Ford also appears attractively priced. It has achieved a Value Score of A, indicating strong financial potential.

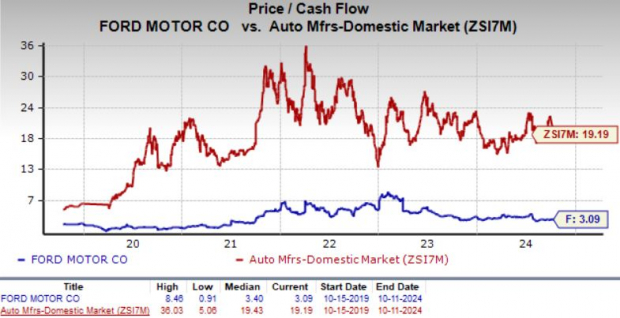

Evaluating Ford’s Attractive Valuation

Image Source: Zacks Investment Research

Furthermore, Ford’s cash flow shines, as the automaker recently raised its projected adjusted free cash flow (FCF) for 2024 by $1 billion, now expecting it to fall between $7.5 billion and $8.5 billion. The current price-to-cash flow ratio stands at 3.09, significantly lower than the industry five-year average of 19.19. Many investors prefer this ratio because cash flow is generally more reliable than net income.

Image Source: Zacks Investment Research

Given the current discounted valuation, it’s essential to explore the factors driving growth and potential challenges for Ford to assess whether it’s a suitable investment at this time.

Ford Pro’s Performance Bolsters Company Outlook

The Ford Pro segment, responsible for commercial vehicles and services, reported strong second-quarter results. Its earnings before interest and taxes (EBIT) increased by 7% to $2.6 billion, with a margin of 15%. This segment’s revenues grew by 9% to reach $17 billion, driven by a surge in demand for Super Duty trucks and Transit vans. Ford plans to open a third assembly plant in Ontario by 2026 to boost production by 100,000 Super Duty units. Subscriptions for Ford Pro software also skyrocketed, growing 35% in the last quarter.

The combination of strong order books and growing demand, along with the successful introduction of the Super Duty line, positions Ford Pro for continued success. Consequently, the EBIT forecast for this unit has risen from $8-$9 billion to $9-$10 billion.

Strong Financial Position and Dividend Commitment

As of the end of the second quarter of 2024, Ford boasted approximately $27 billion in cash and over $45 billion in liquidity, providing a solid foundation for investments in its Ford+ priorities. The company aims to realize $2 billion in efficiencies this year. Furthermore, Ford offers a dividend yield exceeding 5%, far surpassing the average yield of 1.23% offered by the S&P 500, showcasing its commitment to returning value to shareholders.

Ford Dividend Yield (TTM)

Ford Motor Company dividend-yield-ttm | Ford Motor Company Quote

Positioning of Ford’s Electric Vehicle (EV) Sector

Ford has made significant strides with its electric vehicles, such as the Mustang Mach-E, E-Transit vans, and F-150 e-pickup, leading to a 45% increase in EV sales during the first nine months of 2024. This places Ford just behind Tesla TSLA in the competitive U.S. EV market.

Sales of the electric F-150 Lightning more than doubled in the third quarter, while the E-Transit became the country’s best-selling electric van, seeing a 13% rise with 2,955 units sold. Looking ahead, Ford plans to introduce a new commercial electric van in 2026 and two additional pickup trucks by 2027, alongside beginning battery cell production in Tennessee in 2025.

Although these efforts aim to strengthen Ford’s EV market position, the near-term outlook presents challenges. The company has incurred losses of $4.7 billion in its EV division and anticipates losses could widen to $5-$5.5 billion this year due to pricing pressures and ongoing investments in next-gen vehicles.

Reasons to Approach Ford Stock Cautiously

Notably, along with the disappointing EV outlook, Ford reduced its 2024 EBIT forecast for its Blue unit—which focuses on combustion and hybrid cars—to a range of $6-$6.5 billion, down from around $7.5 billion in 2023, largely due to rising warranty costs. In the second quarter of 2024, warranty and recall expenses totaled $2.3 billion, up significantly from previous quarters. While focusing on enhancing the quality of recent models, it may take 12-18 months before warranty costs begin to decrease.

The Zacks Consensus Estimate for Ford’s 2024 earnings per share (EPS) reflects a projected year-over-year decline of 6.5%. As estimates for both 2024 and 2025 EPS have dropped slightly in recent weeks, caution is warranted.

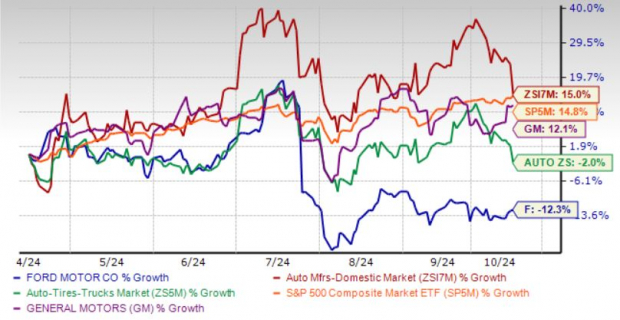

While Ford may appear attractively priced, having fallen 12% over the past six months and trailing both the overall market and General Motors, the near-term challenges suggest it’s not the ideal time to invest. For long-term holders, staying the course may be the best decision.

6-Month Price Performance

Image Source: Zacks Investment Research

Currently, Ford carries a Zacks Rank #3 (Hold), reflecting its cautious outlook. For those interested, the complete list of today’s Zacks #1 Rank (Strong Buy) stocks is available here.

Top 7 Stocks to Watch in the Coming Weeks

Experts have recently identified 7 elite stocks from a pool of 220 Zacks Rank #1 Strong Buys, which they believe are “Most Likely for Early Price Pops.”

Since 1988, this curated list has significantly outperformed the market, averaging a gain of +23.7% annually. Be sure to explore these recommended picks.

For the latest recommendations from Zacks Investment Research, download “5 Stocks Set to Double” at no cost.

Ford Motor Company (F) : Free Stock Analysis Report

General Motors Company (GM) : Free Stock Analysis Report

Tesla, Inc. (TSLA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.