“`html

Robinhood’s Q3 2024 Earnings: What Investors Should Watch

Robinhood Markets HOOD is set to report its third-quarter 2024 results on October 30, following the market close.

Coinciding with Robinhood’s announcement is Tradeweb Markets Inc. TW, which will also reveal its quarterly figures on the same day. Keep track of all quarterly announcements: View Zacks Earnings Calendar.

Robinhood’s second-quarter results were strong, driven by a surge in trading activity, particularly in cryptocurrencies. This increase, coupled with higher net interest income and more Gold subscribers, boosted the company’s revenue.

Transaction revenues, which are the largest source of revenue for HOOD, spiked 69% year over year, mainly due to improved results in cryptocurrency trading. For the upcoming quarter, analysts expect that continued high client engagement and trading volumes will further increase revenues.

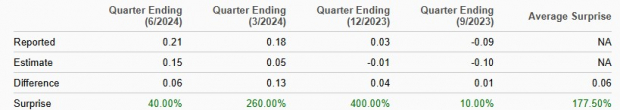

Surprise History

Image Source: Zacks Investment Research

The Zacks Consensus Estimate for revenues is $661.2 million, suggesting a 41.6% increase year over year. Analysts also maintained a consensus estimate for earnings at 18 cents, reflecting a significant 300% rise.

Estimate Revision Trend

Image Source: Zacks Investment Research

Should investors consider adding HOOD stock now? Let’s dive into the specifics that may affect this quarter’s performance.

Key Factors Influencing HOOD’s Q3 Results

Revenues: Client activity was strong in the third quarter, with major indexes reaching all-time highs, likely benefiting Robinhood’s transaction revenues. Its competitor, Interactive Brokers IBKR, reported a 30.6% increase in commissions for Q3, which may mirror Robinhood’s performance.

The Zacks Consensus Estimate for HOOD’s transaction-based revenues is $324.3 million, indicating a 75.3% year-over-year growth. This increase is expected to stem from heightened options, equity, and cryptocurrency transaction revenues.

The estimates for options transaction revenues stand at $190.5 million, representing a 53.6% growth. Furthermore, equity and cryptocurrency transaction revenues are projected at $44.5 million and $69.1 million, respectively, with equity revenues possibly surging by 64.7% and cryptocurrency revenues by an astounding 200.5% from last year.

Higher interest rates are anticipated to significantly boost Robinhood’s net interest income (NII) this quarter, even with the Federal Reserve lowering rates by 50 basis points to a current range of 4.75-5%. The consensus estimate for NII is $291.7 million, reflecting a 16.2% increase.

The Zacks Consensus Estimate for other revenues is set at $41.3 million, suggesting a 33.3% improvement from the previous year.

Expenses: Robinhood is likely to face increased operating expenses as it invests in enhancing its platform, driving product innovation, improving customer support, and reinforcing regulatory compliance. Furthermore, any restructuring related to the potential Bitstamp deal may also impact costs.

Market Insights for Robinhood

Forecasting an earnings beat this quarter is challenging. A blend of a positive Earnings ESP combined with a Zacks Rank of #1 (Strong Buy), #2 (Buy), or #3 (Hold) typically enhances the likelihood of exceeding expectations. Currently, Robinhood maintains an Earnings ESP of 0.00% and holds a Zacks Rank of #3.

For a comprehensive look at Zacks’ top-ranked stocks, check out today’s Zacks #1 Rank stocks here.

HOOD Stock Performance & Valuation

Shares of Robinhood have performed remarkably well this year, up 112.4%, while the industry has risen by 69.7%. Tradeweb Markets, HOOD’s competitor, saw its shares increase by 45.8%.

Year-to-Date Price Performance

Image Source: Zacks Investment Research

Examining current valuations, HOOD trades at 3.55X its 12-month trailing Price/Tangible Book (P/TB) ratio, significantly above its three-year average of 1.40X. Comparatively, the industry’s P/TB ratio is 3.30X, suggesting Robinhood might be considered expensive against the industry norm.

Price/Tangible Book TTM

Image Source: Zacks Investment Research

Notably, the stock trades at a lower P/TB ratio than Tradeweb Markets, which is at 12.14X right now.

Investment Outlook for Robinhood

Robinhood is making strides to expand and diversify its operations. Given recent volatility in the stock market linked to various macroeconomic factors, the company stands to gain from rising trading volumes.

Additionally, HOOD’s strategy to introduce new products and its ambition to expand globally, especially into European and Asia Pacific markets, enhance its growth potential. The company’s announcement in May of a share buyback plan, which allows for the repurchase of up to $1 billion in stock over the next two to three years starting from Q3 2024, underscores its commitment to returning value to shareholders.

Should You Invest in HOOD Stock Now or Wait?

Given the favorable operating conditions, targeted expansion plans, and efforts to diversify revenue streams, Robinhood is poised for strong third-quarter results. With optimistic earnings projections, HOOD appears capable of delivering sustained growth as it navigates an evolving financial landscape.

“““html

Investors Eye Future Growth Strategies for Robinhood Ahead of Q3 Earnings

As Robinhood Markets, Inc. (HOOD) approaches its upcoming quarterly earnings report, investors are keenly observing how the company plans to adapt to lower interest rates and future expansion initiatives. While the potential for growth exists, it is crucial for investors to thoroughly evaluate these factors against their own risk tolerance before acquiring HOOD stock.

For current shareholders, holding onto HOOD may be a prudent choice, as analysts believe it has a reduced chance of disappointing in the long run.

Unlock Valuable Stock Insights for Just $1

Yes, it’s true!

A few years back, we surprised our members by offering a 30-day trial to all our stock picks for just $1, with no further obligations. While many took advantage of this unique offer, some hesitated, fearing a catch that simply wasn’t there. Our aim is straightforward: we want you to explore our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators, which have collectively closed 228 positions with remarkable gains—some at double- and even triple-digit rates in 2023 alone.

Interactive Brokers Group, Inc. (IBKR): Free Stock Analysis Report

Tradeweb Markets Inc. (TW): Free Stock Analysis Report

Robinhood Markets, Inc. (HOOD): Free Stock Analysis Report

For the full article on Zacks.com, click here.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.

“`