By RoboForex Analytical Department

Australian Employment Boosts AUD/USD Amid Monetary Policy Expectations

AUD/USD saw a rebound on Thursday, ending a three-day slump. The uptick followed impressive employment figures from Australia, which strengthened the outlook for the Reserve Bank of Australia’s (RBA) monetary policy.

Strong Employment Numbers Signal Economic Health

- Job Creation: Australia added 64.1k jobs in September, well above the expected 25.0k, showing significant economic strength.

- Unemployment Rate: The rate remained steady at 4.1%, matching expectations and demonstrating a resilient labor market.

- Labor Force Participation: The participation rate climbed to a record 67.2% in September, up from 67.1% in August, surpassing the forecast of 67.1%. This increase indicates a growing workforce potentially supporting consumer spending and economic activity.

These positive labor market indicators suggest that the RBA may refrain from cutting interest rates soon. RBA Deputy Governor Sarah Hunter reiterated the central bank’s commitment to managing inflation, which remains a pressing issue. Analysts now predict that the RBA will likely hold off on rate cuts until at least mid-next year, given the current tight labor market conditions.

AUD/USD Technical Outlook

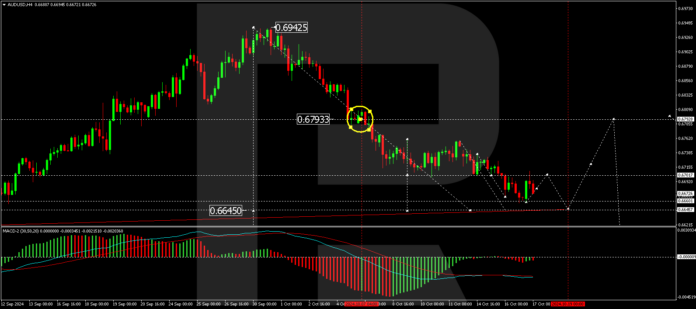

The AUD/USD pair is presently trending downwards towards a target level of 0.6645. After hitting resistance at 0.6700, the pair is continuing its decline. Upon reaching 0.6645, a new consolidation phase is anticipated above this point. A breakout past this range could signify a corrective movement towards 0.6790. This bearish sentiment is further supported by the MACD indicator, which remains below zero and is trending downwards, indicating persistent downward momentum.

On the hourly chart, AUD/USD has descended to 0.6660 before experiencing a small recovery to 0.6700. The trend is expected to continue its fall to the 0.6645 level. If this target is achieved, a potential reversal could raise prices towards 0.6710. This outlook is supported by the Stochastic oscillator, which currently shows its signal line below 50 and moving towards 20, implying further downside may occur before any substantial recovery.

Disclaimer

Any forecasts contained herein are based on the author’s opinion and should not be considered trading advice. RoboForex is not responsible for trading results based on any recommendations and analyses presented.

This article is provided by an unpaid external contributor. It does not reflect Benzinga’s reporting standards and has not been edited for content or accuracy.

Market News and Data brought to you by Benzinga APIs