Honeywell’s Stock Outlook Shifted as Baird Downgrades to Neutral

On October 25, 2024, Baird revised its outlook for Honeywell International (SNSE:HON), lowering it from Outperform to Neutral.

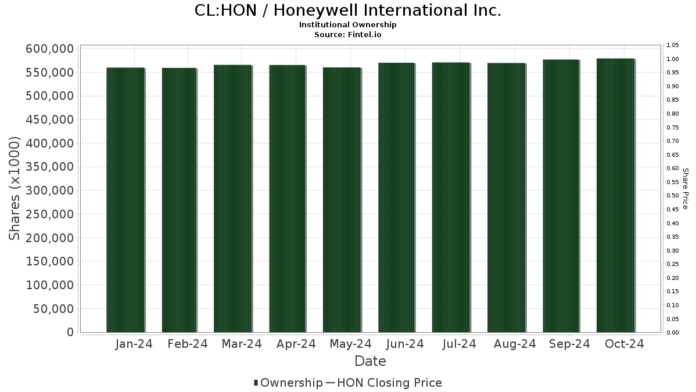

Fund Sentiment on Honeywell International

A total of 3,573 funds or institutions disclose their positions in Honeywell International. This number is up by 40 holders, marking a 1.13% increase in the last quarter. The average portfolio weight of all funds in HON sits at 0.45%, having risen by 0.91%. In the past three months, institutions increased their total shares owned by 5.17%, now totaling 579,373K shares.

The Vanguard Total Stock Market Index Fund Investor Shares (VTSMX) has 20,574K shares in Honeywell, translating to 3.17% ownership. Previously, the firm held 20,507K shares, representing an increase of 0.32%. The portfolio allocation in HON rose by 1.50% over the last quarter.

JPMorgan Chase owns 19,148K shares, or 2.95% of the company. This is an increase from 16,520K shares reported earlier, a notable increase of 13.73%. Their stake in HON grew by 17.11% last quarter.

The Vanguard 500 Index Fund Investor Shares (VFINX) holds 16,713K shares, equating to 2.57% ownership. This is a slight increase from the prior amount of 16,614K shares, up by 0.59%. However, the firm decreased its portfolio allocation in HON by 0.92% over the last quarter.

Wellington Management Group LLP holds 16,450K shares, amounting to 2.53% ownership. Previously, they reported 17,581K shares, reflecting a decrease of 6.88%. Their allocation in HON fell by 1.91% last quarter.

Newport Trust maintains 15,678K shares, representing 2.41% ownership, with no change in the last quarter.

Fintel is a premier investment research platform that caters to individual investors, traders, financial advisors, and small hedge funds.

Our expansive data set encompasses fundamentals, analyst reports, ownership statistics, fund sentiment, insider trading, options flow, unusual options trades, and more. Our unique stock selections leverage advanced, backtested quantitative models aimed at enhancing profits.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.