Benchmark Holds Steady on Uber as Institutional Interest Grows

Fintel reports that on October 25, 2024, Benchmark initiated coverage of Uber Technologies (WBAG:UBER) with a Hold recommendation.

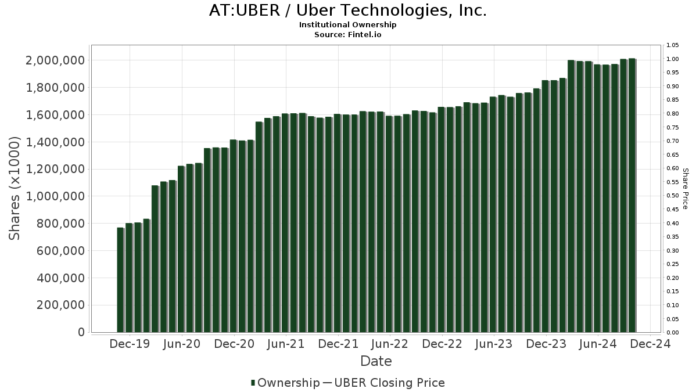

Growing Institutional Interest in Uber

Currently, there are 2,942 funds or institutions reporting positions in Uber Technologies. This marks an increase of 72 owners, or 2.51%, over the last quarter. The average portfolio weight of all funds dedicated to UBER now stands at 0.65%, reflecting a notable rise of 10.11%. Over the past three months, total shares owned by institutions have increased by 8.24%, reaching 2,014,372K shares.

Public Investment Fund holds 72,841K shares, translating to a 3.47% ownership stake in Uber, unchanged from the previous quarter.

Meanwhile, JPMorgan Chase owns 71,838K shares, equivalent to a 3.42% stake. In its last report, the firm listed 70,286K shares, showing an increase of 2.16%. However, it reduced its portfolio allocation in UBER by 6.30% in the latest quarter.

VTSMX – Vanguard Total Stock Market Index Fund Investor Shares has 62,727K shares, indicating 2.99% ownership. Previously, it reported 62,010K shares, marking a 1.14% increase. This firm also decreased its allocation in UBER by 7.14% during the last quarter.

VFINX – Vanguard 500 Index Fund Investor Shares holds 53,629K shares, representing a 2.55% stake. It previously owned 51,859K shares, showcasing a 3.30% increase, though it reduced its portfolio allocation by 7.59% over the last quarter.

Capital Research Global Investors possesses 53,030K shares, equating to a 2.52% ownership. The firm reported an ownership of 39,948K shares last period, which signifies a substantial 24.67% increase. Additionally, it raised its portfolio allocation by 21.53% in the latest quarter.

Fintel serves as one of the most thorough investing research platforms available for individual investors, traders, financial advisors, and small hedge funds.

Our data spans the globe and includes fundamentals, analyst reports, ownership details, and fund sentiment, among other features. Exclusive stock recommendations are driven by advanced, backtested quantitative models aimed at maximizing profits.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.