Benchmark Begins Coverage of Uber Technologies with a Hold Rating

On October 25, 2024, Fintel reported that Benchmark has started monitoring Uber Technologies (XTRA:UT8) and has assigned a Hold rating to its shares.

Analysts Project a 15.62% Price Increase

The average price target for Uber Technologies, as of October 22, 2024, stands at 83.31 €/share. Projections vary, with a low estimate of 61.25 € and a high of 109.99 €. This target indicates a potential growth of 15.62% from the stock’s most recent closing price of 72.05 € per share.

Positive Revenue Forecasts

Uber Technologies expects an annual revenue of 44,644 million €, reflecting an increase of 11.45%. Moreover, the anticipated non-GAAP earnings per share (EPS) is 0.65.

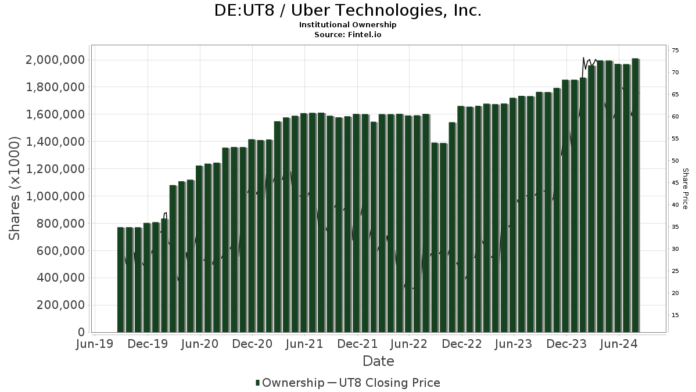

Institutional Investment Trends

Currently, 2,942 funds or institutions have reported holdings in Uber Technologies, marking an increase of 72 holders, or 2.51%, in just the last quarter. The average portfolio weight of funds invested in UT8 is 0.65%, which has increased by 10.14%. Over the past three months, total institutional shares owned have risen by 2.25% to reach 2,014,372K shares.

The Public Investment Fund retains 72,841K shares, accounting for 3.47% ownership, with no changes reported in the last quarter.

JPMorgan Chase holds 71,838K shares, representing a 3.42% stake. This is an increase from 70,286K shares previously, marking a growth of 2.16%. However, the firm has reduced its overall allocation in UT8 by 6.30% compared to the last quarter.

The Vanguard Total Stock Market Index Fund Investor Shares has 62,727K shares, equating to 2.99% ownership, which is an increase from 62,010K shares reported earlier—up by 1.14%. Nonetheless, it has decreased its ownership allocation in UT8 by 7.14% in the past quarter.

Vanguard 500 Index Fund Investor Shares currently holds 53,629K shares, or 2.55% of the company. This is an increase from last quarter’s 51,859K shares, calculated at a 3.30% rise, despite a decrease in its holding percentage by 7.59% in the same timeframe.

Lastly, Capital Research Global Investors significantly raised its stake, now owning 53,030K shares (2.52%), up 24.67% from the prior 39,948K shares. They also increased their portfolio allocation in UT8 by 21.53% over the last quarter.

Fintel is a comprehensive investing research platform tailored for individual investors, traders, financial advisors, and small hedge funds. It offers insights into company fundamentals, analyst evaluations, ownership data, fund sentiment, insider trading, and much more.

Click to Learn More

This article originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.