On October 17, 2024, Bernstein initiated its coverage of Moderna (WBAG:MRNA) with a Market Perform recommendation.

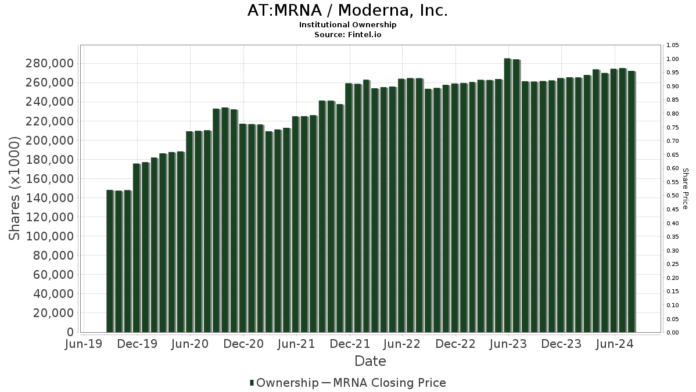

Fund Ownership Trends for Moderna

Currently, 1,638 funds and institutions have reported holding positions in Moderna, reflecting an increase of 33 owners, or 2.06%, over the last quarter. The average portfolio weight dedicated to MRNA across all funds stands at 0.28%, up by 2.30%. Additionally, total shares owned by institutions have risen by 2.74% in the past three months, reaching 276,199K shares.

Among major stakeholders, Baillie Gifford holds 43,449K shares, equating to 11.30% ownership of Moderna. In its previous filing, the firm reported ownership of 44,656K shares, marking a decrease of 2.78%. However, Baillie Gifford has increased its portfolio allocation in MRNA by 8.60% over the last quarter.

The Vanguard Total Stock Market Index Fund Investor Shares (VTSMX) holds 10,907K shares, representing 2.84% ownership. This reflects a modest increase from 10,801K shares, an increment of 0.98%, with a portfolio allocation rise of 9.44% over the last quarter.

Vanguard International Growth Fund Investor Shares (VWIGX) reported holding 9,029K shares, or 2.35% ownership, down from 9,151K shares, resulting in a decrease of 1.35%. Nonetheless, the firm has significantly increased its portfolio allocation in MRNA by 49.46% in the previous quarter.

Another significant holder, Vanguard 500 Index Fund Investor Shares (VFINX), possesses 8,558K shares (2.23% ownership), reflecting an increase of 2.31% from its prior 8,359K shares, with a portfolio allocation increase of 7.99% over the last quarter.

Lastly, the Vanguard Mid-Cap Index Fund Investor Shares (VIMSX) holds 7,388K shares, accounting for 1.92% ownership. This is a slight decrease from 7,456K shares, marking a drop of 0.91%, yet they boosted their portfolio allocation in MRNA by 14.00% in the last quarter.

Fintel provides one of the most comprehensive investing research platforms available to individual investors, traders, financial advisors, and small hedge funds. Our expansive data covers a wide range of topics, including fundamentals, analyst reports, and ownership data, among others. We also offer exclusive stock picks powered by advanced, backtested quantitative models aimed at improving profits.

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.