Bernstein Gives Merck a ‘Market Perform’ Rating Amid Mixed Fund Sentiment

Overview of Fund Positions

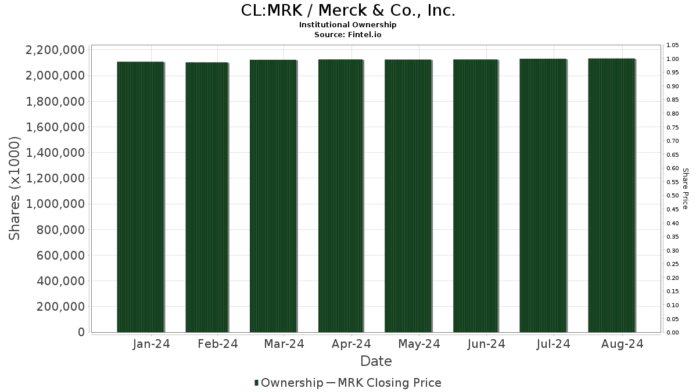

On October 17, 2024, Bernstein initiated coverage of Merck (SNSE:MRK), assigning a Market Perform rating. Interest in the pharmaceutical giant remains strong, with 5,087 funds or institutions reporting positions in Merck—an increase of 28 funds, or 0.55%, in the last quarter. The average portfolio weight for all funds dedicated to MRK has reached 0.74%, rising by 10.18%. Over the last three months, total shares held by institutions have grown by 3.55%, amounting to 2,164,637K shares.

Recent Changes Among Major Shareholders

The Vanguard Total Stock Market Index Fund Investor Shares (VTSMX) now holds 80,020K shares, representing 3.16% of Merck. This marks a slight increase from the previous total of 79,658K shares, reflecting a growth of 0.45%. However, the firm’s overall allocation to MRK has decreased by 8.35% over the last quarter.

Wellington Management Group LLP reports holding 72,482K shares, which equals 2.86% ownership. Previously, they owned 86,348K shares, demonstrating a significant drop of 19.13%. Their portfolio allocation in MRK fell dramatically by 88.82% this quarter.

The Vanguard 500 Index Fund Investor Shares (VFINX) holds 65,007K shares, or 2.56% ownership, up from 63,859K shares, which shows a 1.77% increase. Nonetheless, this fund also reduced its allocation in MRK by 9.59% recently.

Geode Capital Management has 57,021K shares, representing 2.25% ownership. Their previous amount was 56,411K shares, an increase of 1.07%, but they cut back their portfolio allocation in MRK by 53.01% in the last quarter.

Bank of America owns 39,280K shares, equating to 1.55% ownership. They reported an increase from 36,012K shares, reflecting an 8.32% rise, yet their allocation in MRK has significantly decreased by 76.01% over the last quarter.

Fintel is a leading investment research platform that provides vital data for individual investors, traders, financial advisors, and small hedge funds. This platform delivers essential insights covering fundamentals, analyst reports, ownership data, fund sentiment, and much more, all aimed at enhancing investment decisions.

This article originally appeared on Fintel, providing a concise overview of current fund activities related to Merck.

The views and opinions expressed herein belong to the author and do not necessarily reflect those of Nasdaq, Inc.