Bernstein Sees Potential in Moderna with Market Perform Rating

Fintel reports that on October 17, 2024, Bernstein initiated coverage of Moderna (XTRA:0QF) with a Market Perform recommendation.

Price Forecast Signals 80.55% Growth Opportunity

According to the latest data from September 25, 2024, the average one-year price target for Moderna is 94.99 €/share. Predictions vary significantly, with a low target of 42.44 € and a high of 228.28 €. This average price indicates a potential increase of 80.55% from the company’s most recent closing price of 52.61 €/share.

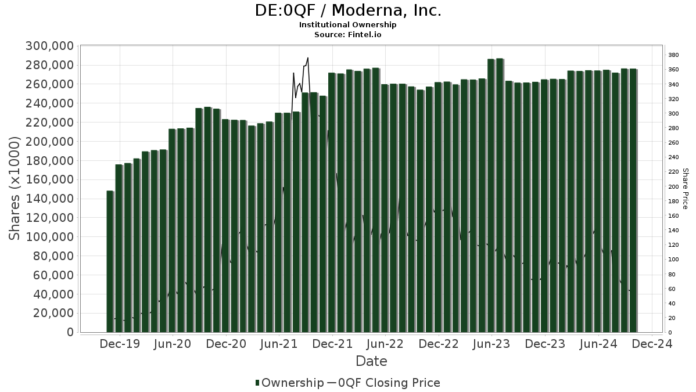

Strong Fund Involvement in Moderna

The sentiment among funds shows increasing interest in Moderna, with 1,638 institutions reporting holdings. This marks a rise of 33 new positions, or 2.06%, in the previous quarter. The average weight of all funds in Moderna is 0.28%, up by 2.30%. Moreover, total shares held by institutions increased by 2.74% over the past three months, now totaling 276,199K shares.

Institutional Investors Adjust Their Holdings

Baillie Gifford currently holds 43,449K shares, which is 11.30% of Moderna. This number reflects a decrease from 44,656K shares reported in the last filing, showing a decline of 2.78%. Despite this, the firm boosted its allocation in Moderna by 8.60% over the last quarter.

Meanwhile, VTSMX – Vanguard Total Stock Market Index Fund Investor Shares owns 10,907K shares, representing 2.84% ownership. This is an increase from the previous 10,801K shares, marking a growth of 0.98%, with a portfolio allocation rise of 9.44% in the last quarter.

VWIGX – Vanguard International Growth Fund Investor Shares holds 9,029K shares, which is 2.35% of Moderna. The earlier report showed that it owned 9,151K shares, reflecting a decrease of 1.35%, but the firm raised its portfolio allocation in Moderna significantly by 49.46% last quarter.

Also, VFINX – Vanguard 500 Index Fund Investor Shares holds 8,558K shares, equating to 2.23% ownership. This is an increase from the previous 8,359K shares, reflecting a 2.31% growth in holdings, alongside a 7.99% increase in portfolio allocation.

VIMSX – Vanguard Mid-Cap Index Fund Investor Shares owns 7,388K shares, making up 1.92% of the company. It reported a decrease from 7,456K shares (a drop of 0.91%) but raised its portfolio allocation by 14.00% this past quarter.

Fintel is recognized as one of the most comprehensive investing research platforms, serving individual investors, traders, financial advisors, and small hedge funds.

Our extensive data encompasses fundamentals, analyst reports, ownership details, fund sentiment, insider trading, options sentiment, and much more. Additionally, our unique stock picks leverage advanced, backtested quantitative models to enhance profitability.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.