Bernstein Rates Bristol-Myers Squibb with Market Perform, Modest Price Target

Analysts Forecast Slight Decline in Stock Price

Fintel reports that on October 17, 2024, Bernstein initiated coverage of Bristol-Myers Squibb (LSE:0R1F) with a Market Perform recommendation.

Price Target Details and Potential Downside

As of September 25, 2024, the average one-year price target for Bristol-Myers Squibb stands at 51.98 GBX/share. Predictions range from a low of 32.93 GBX to a high of 77.58 GBX. This average target indicates a potential decrease of 1.32% from its latest closing price of 52.67 GBX/share.

Explore our leaderboard showcasing companies with the biggest price target upside.

Financial Projections for Bristol-Myers Squibb

The projected annual revenue for Bristol-Myers Squibb is 48,638MM, marking an increase of 4.58%. Expected annual non-GAAP EPS is estimated at 8.29.

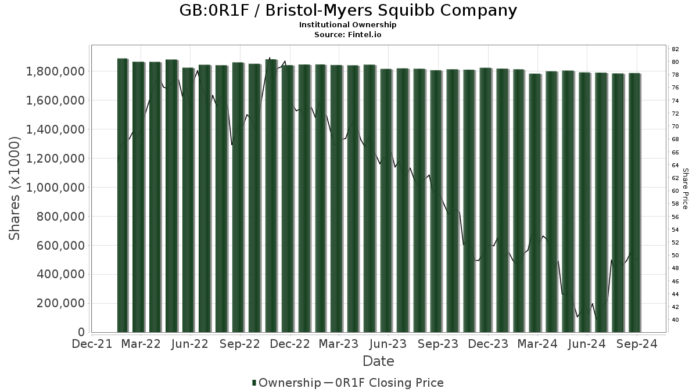

Over 3,357 funds or institutions report positions in Bristol-Myers Squibb, a decrease of 130 owners or 3.73% in the last quarter. The average portfolio weight for these funds is 0.35%, reflecting an increase of 11.42%. Total shares owned by institutions rose 1.58% to 1,787,185K shares in the last three months.

Institutional Investors’ Recent Moves

JPMorgan Chase holds 74,630K shares, accounting for 3.68% ownership, but reduced its stake by 19.01% from a previous 88,814K shares. The firm also decreased its portfolio allocation in 0R1F by 37.51% last quarter.

VTSMX – Vanguard Total Stock Market Index Fund Investor Shares owns 64,141K shares, representing 3.16% ownership, and increased its holdings slightly by 0.86% from 63,587K shares. However, its portfolio allocation in 0R1F decreased by 24.88% over the past quarter.

Charles Schwab Investment Management has increased its share count to 59,062K, up 9.05% from 53,716K shares, while also decreasing its portfolio allocation in 0R1F by 30.51% last quarter.

Capital International Investors holds 55,407K shares, reflecting a decrease of 26.71% from 70,204K shares previously and a 38.54% drop in portfolio allocation in 0R1F.

VFINX – Vanguard 500 Index Fund Investor Shares has 52,027K shares, showing a mild increase of 1.44% from its earlier 51,278K shares, although its allocation in 0R1F has decreased by 26.45% over the last quarter.

Fintel is a well-regarded investing research platform for individual investors, traders, financial advisors, and small hedge funds, offering comprehensive data on fundamentals, analyst reports, ownership data, and more.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.