TSMC’s Stock Soars Thanks to AI: A Look at the Financials and Future Growth

Taiwan Semiconductor Manufacturing Company Limited (TSMC) has experienced a surge in its stock price, driven by an impressive increase in quarterly profits, largely fueled by demand for artificial intelligence (AI) technology.

Impressive Third Quarter Results Propel TSMC’s Shares

In the third quarter, TSMC reported a staggering 54.2% year-over-year increase in net profit, totaling 325.3 billion New Taiwan dollars ($10.1 billion), which exceeded analysts’ expectations. For the period from July to September, net revenues reached $23.5 billion, up 36% compared to the same quarter last year.

The significant revenue boost stemmed from sales of TSMC’s advanced semiconductors, especially those sized at 7nm or smaller. Notably, TSMC’s 3nm chips contributed to 20% of third-quarter revenues, while 5nm and 7nm chips represented 32% and 17%, respectively.

These cutting-edge 3nm chips are utilized in products like Apple Inc’s AAPL iPhones and high-performance computers. TSMC anticipates that revenues will continue to grow in the fourth quarter, driven by rising demand for these advanced chips. CFO Wendell Huang expects fourth-quarter revenues to fall between $26.1 billion and $26.9 billion, a 35% annual increase and a 13% rise from the third quarter.

Moreover, TSMC’s gross margins for the third quarter improved to 57.8%, compared to 54.3% a year prior. For the fourth quarter, margins are projected to stay between 57% and 59%, thanks to the heightened demand driven by AI applications.

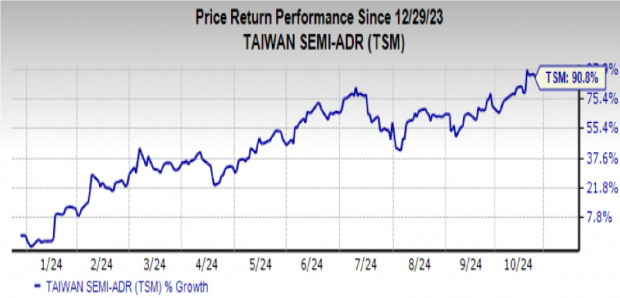

Due to these encouraging results and bright future projections, TSMC’s stock price surged, seeing a rise of 90.8% this year.

Image Source: Zacks Investment Research

Three Additional Factors Supporting TSMC’s Growth Potential

TSMC’s stock is poised for further growth due to its competitive advantages and efficient cost management. In addition, the overall growth of the AI industry, which appears robust, is expected to propel TSMC’s stock price higher.

With a market share exceeding 50% among contract manufacturers, TSMC enjoys a solid economic moat that deters new competitors. This long-standing position has allowed the company to establish strong customer relationships.

Significantly, all data center components for NVIDIA Corporation (NVDA) are manufactured by TSMC. This competitive edge has enabled TSMC to achieve an operating margin of 47.5%, indicative of its ability to retain nearly half of its revenues as profits before taxes.

In contrast, TSMC’s immediate competitors face challenges. Samsung is grappling with various issues in its memory business, while Intel Corporation (INTC) is undergoing a restructuring process focused on revamping its foundry division.

Despite these challenges, TSMC has managed to achieve a net profit margin of 39.6%, surpassing the Semiconductor – Circuit Foundry industry average of 39.1%. Any profit margin above 20% is generally categorized as high.

Image Source: Zacks Investment Research

Rising demand related to AI technology is a strong tailwind for TSMC. Wendell Huang stated that the need for 3nm and 5nm technologies driven by AI applications is substantial and will sustain production demands for the foreseeable future, dispelling any fears of an AI market bubble.

To cater to this booming demand for AI applications, TSMC has established three plants in Arizona alongside additional facilities in Europe and Japan, focusing on manufacturing their most advanced chips.

Consider TSM Stock for Potential Investment

Given these growth prospects, investing in TSMC, the world’s leading advanced chip manufacturer, appears to be a prudent choice. Analysts project an average short-term price target of $216.14 for TSM stock, suggesting a 7% increase from its last closing price of $201.95. The highest short-term estimate reaches $250, indicating a possible growth of 23.8%.

Image Source: Zacks Investment Research

Additionally, the Zacks Consensus Estimate forecasts TSMC’s earnings per share to be $6.63, reflecting a 14.3% growth year-over-year. With this outlook, TSMC holds a Zacks Rank #2 (Buy).

Zacks’ Research Chief Names “Stock Most Likely to Double”

Experts have identified five stocks with the potential to gain 100% or more in the coming months. Among these, Director of Research Sheraz Mian has singled out one stock positioned for the highest growth.

This top pick belongs to a leading financial firm boasting a rapidly growing customer base (exceeding 50 million) and an innovative suite of solutions. While not all of our elite picks are successful, this one could far exceed previous Zacks Stocks Set to Double, such as Nano-X Imaging, which increased by 129.6% within just over nine months.

Free: See Our Top Stock And 4 Runners Up.

For the latest insights from Zacks Investment Research, you can download “5 Stocks Set to Double.” Click to access this free report.

Intel Corporation (INTC): Free Stock Analysis Report

Apple Inc. (AAPL): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Taiwan Semiconductor Manufacturing Company Ltd. (TSM): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect the opinions of Nasdaq, Inc.