Stanley Druckenmiller Exits Nvidia: What’s Next for His Portfolio?

Stanley Druckenmiller has sold out of Nvidia (NASDAQ: NVDA). He expressed regret over selling the stake early, having exited the high-flying artificial intelligence (AI) stock in the $80-$95 range earlier this year. While watching from the sidelines, Druckenmiller enjoyed much of Nvidia’s impressive 500% growth over the past three years, contributing hundreds of millions in gains to his Duquesne Family Office portfolio.

So, what is he investing in now? His 13-F filing with the SEC reveals two significant bets made this summer for his portfolio. Here’s what Stan Druckenmiller is focusing on instead of Nvidia.

1. Coherent: A Unique Play on AI Growth?

Currently, Duquesne’s largest position is in Coherent (NYSE: COHR), which represents nearly 10% of the portfolio. Coherent specializes in photonics, lasers, and materials for the industrial market, serving various sectors including manufacturing, cloud communications, computer chips, and life sciences instrumentation.

All four sectors are experiencing strong growth, particularly in North America, where Coherent generates over half of its revenues. This might explain Druckenmiller’s interest, as the company is positioned to capitalize on increasing AI-related expenditures, particularly in manufacturing, cloud services, and semiconductors.

Over the past year, Coherent generated $4.7 billion in revenue, with a 9% increase last quarter. Notably, the Communications segment, which includes AI datacenter services, saw revenue grow by 19% and now constitutes the majority of Coherent’s sales. If this momentum continues, the company could experience significant revenue growth in the coming years.

At present, Coherent is reinvesting for growth, which limits its profit generation. However, it boasts solid gross margins nearing 40% from last quarter, offering potential for stronger profits at scale. If the company continues to expand its revenue in response to market tailwinds, it could be a rewarding long-term investment.

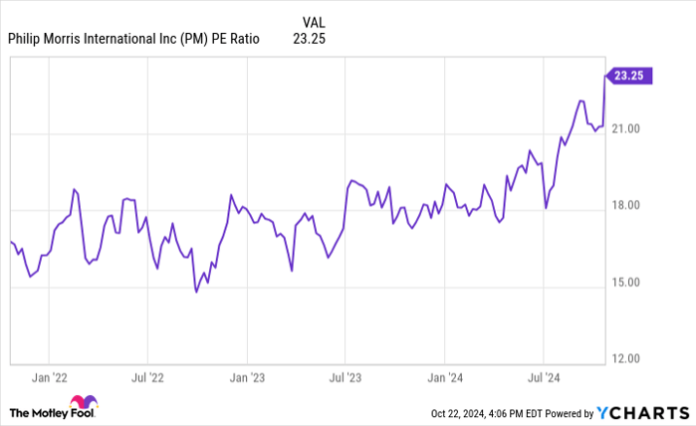

PM PE Ratio data by YCharts

2. Philip Morris International: A Rebounding Nicotine Sector

Druckenmiller’s other investment focuses on a sector outside of technology, which may be appealing for those cautious about the complexities of high-tech industries. This stock is straightforward for any investor.

Philip Morris International (NYSE: PM) stands as one of the largest tobacco companies worldwide. Unlike many of its peers, it has successfully transitioned towards less harmful nicotine products such as nicotine pouches and heat-not-burn tobacco. Druckenmiller holds both the underlying stock and call options, indicating a new position taken last quarter.

So far, this investment is paying off. On October 22, Philip Morris reported strong quarterly earnings, with shipment volume rising 2.9% year over year, revenue climbing 11.6%, and profit margins expanding. Unlike other tobacco companies, Philip Morris is experiencing volume growth, thanks to its focus on innovative new products like Zyn nicotine pouches.

This growth trajectory appears to be robust. Coupled with effective pricing strategies on traditional cigarette products, Philip Morris International has significant opportunities to enhance both volume and profits in the years ahead. The stock boasts a price-to-earnings ratio (P/E) of 23, below the S&P 500. It is positioned to grow earnings faster than the average market rate.

Additionally, the stock offers a dividend yield of 4.11%. It’s evident why Druckenmiller chose to add this stock to his portfolio last quarter; it represents a solid investment with considerable long-term upside.

Should You Consider Investing in Philip Morris International?

Before making a decision to invest in Philip Morris International, keep this in mind:

The Motley Fool Stock Advisor analyst team has recently identified what they believe to be the 10 best stocks for investors right now, and Philip Morris International did not make this list. The selected stocks are positioned for significant growth in the coming years.

Consider that when Nvidia appeared on this list back on April 15, 2005… if you had invested $1,000 at that time, it would now be worth $860,447!*

Stock Advisor offers investors a clear path to success, providing guidance for portfolio building, regular updates from analysts, and two new stock picks each month. This service has historically more than quadrupled its returns compared to the S&P 500 since 2002*.

See the 10 stocks »

*Stock Advisor returns as of October 21, 2024

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia, Coherent, and Philip Morris International. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.