Analysts Predict Positive Moves for Vanguard ETF and Key Stocks

Examining the data from ETFs tracked by ETF Channel reveals interesting trends for the Vanguard S&P 500 ETF (Symbol: VOO). The current average analyst target price for VOO, based on its underlying holdings, is $582.10 per unit.

Current Trading vs. Analyst Expectations

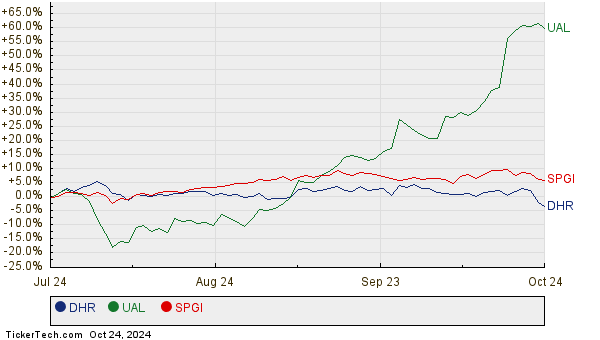

Currently, VOO trades around $531.27 per unit. Analysts predict a potential increase of 9.57% for this ETF based on their estimated target prices for its underlying stocks. Notably, three holdings show significant upside in their target prices: Danaher Corp (Symbol: DHR), United Airlines Holdings Inc (Symbol: UAL), and S&P Global Inc (Symbol: SPGI). DHR, recently valued at $256.00 per share, has an average analyst target of $292.79, implying a 14.37% upside. UAL shares, which recently traded at $73.45, could rise by 14.23% to reach the target price of $83.90. SPGI is expected to meet a target price of $582.47 per share, indicating a 14.00% potential increase from its recent price of $510.92. The chart below shows the past 12 months of stock performance for these companies:

Summary of Target Prices

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Vanguard S&P 500 ETF | VOO | $531.27 | $582.10 | 9.57% |

| Danaher Corp | DHR | $256.00 | $292.79 | 14.37% |

| United Airlines Holdings Inc | UAL | $73.45 | $83.90 | 14.23% |

| S&P Global Inc | SPGI | $510.92 | $582.47 | 14.00% |

Conclusions and Considerations

The question remains: Are analysts too optimistic about these future prices, or are they accurately representing market conditions? A high price target compared to a stock’s current price might signal optimism but could also suggest potential for downward adjustments if market trends shift. Investors should carry out further scrutiny to assess these predictions in light of recent developments.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

ETFs Holding MXWL

KFYP Options Chain

ROIC shares outstanding history

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.