Brown-Forman Corporation (BF.B) has been riding high on the wave of success brought about by its premium brands portfolio and strategic brand investments. The company’s dedication to premium and super-premium brands has proven fruitful, with significant achievements in both categories. Noteworthy gains can be attributed to the exceptional performance of its premium and super-premium brands, with the iconic Jack Daniel’s family and strong Ready-to-Drink (RTD) category showing marked success.

BF.B has remained faithful to its long-term pricing strategy, aiming for yearly price increments to boost sales, which forms a key part of its sales growth management gameplan.

The Zacks Consensus Estimate for BF.B’s sales and earnings for the current financial year signals promising growth of 0.3% and 4.8%, respectively, over the previous year’s results.

Brave the Waves: Factors Fueling Growth

Reveling in its premiumization strategy, Brown-Forman is excelling in the premium and super-premium brands realm. The careful curation of its brand lineup over the past decades to focus on premium and super-premium brands has led to remarkable outcomes. Among the hallmarks of Brown-Forman’s portfolio are the legendary Jack Daniel’s and Woodford Reserve.

The uptick in volumes for Woodford Reserve and the super-premium American whiskey segment, buoyed by the growth in Woodford Reserve, the introduction of Jack Daniel’s American Single Malta and Jack Daniel’s Single Barrel, along with the acquisitions of Gin Mare and Diplomático, have been instrumental in driving sales growth in the Travel Retail sector over the initial nine months of fiscal 2024. Net sales in the Travel Retail domain surged by 3% on a reported basis and 1% organically.

The recent debut of Jack Daniel’s and Coca-Cola RTD has been a game-changer, underscoring the commitment towards elevating the overall quality of its portfolio. Brown-Forman is making steady progress in incorporating two new super-premium brands, Gin Mare and Diplomático, into the Rest of the Portfolio category. These brands posted an 11% year-over-year increase in reported sales for the first nine months of fiscal 2024 on an organic basis. The company anticipates these brands to be significant contributors to its long-term growth trajectory.

The Jack Daniel’s family of brands has been the heart and soul of Brown-Forman’s financial triumphs, leveraging its legacy of quality craftsmanship, innovation, and enduring customer loyalty. The diverse product line of Jack Daniel’s, replete with various expressions and limited editions, allows Brown-Forman to cater to a broad spectrum of consumer preferences and markets. The global footprint of Jack Daniel’s is a testament to its universal appeal, consistently constituting a substantial portion of the company’s revenues and acting as a pivotal force behind its sustained advancement. The brand’s remarkable agility in adapting to shifting market dynamics while preserving its core essence has been pivotal to its unwavering renown and profitability.

Brown-Forman’s prowess in innovation and adaptability shines through in its RTD portfolio development. The company has made significant strides in the RTD category, posting a phenomenal 17% organic sales growth in the initial nine months of fiscal 2024 due to consumer gravitation towards convenience and flavor. Infused with a blend of iconic brands and cutting-edge flavors, Brown-Forman’s RTD offerings have carved a niche in a dynamic market.

Weathering the Storms: Challenges Ahead

The market reception of Brown-Forman’s shares has seen a moderate slowdown in the last quarter, predominantly due to escalating input costs and challenging distributor inventory comparisons, which somewhat impacted the third quarter fiscal 2024 results. Anticipations of heightened compensation-related expenses have positioned the company to brace for higher SG&A costs in fiscal 2024.

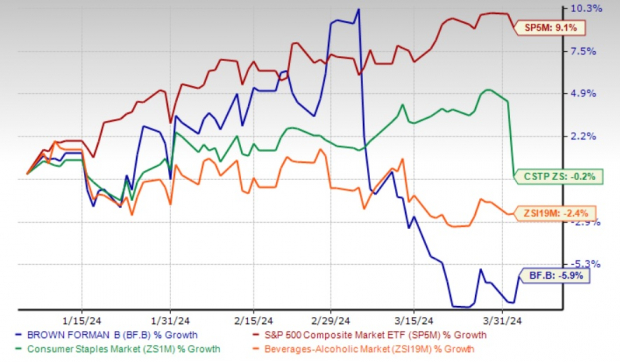

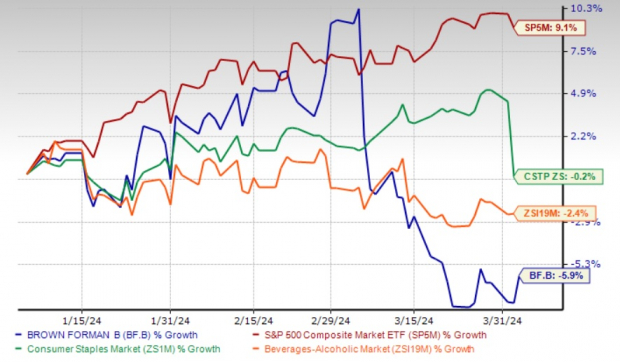

Over the last three months, shares of this Zacks Rank #3 (Hold) entity have been on a downtrend, shedding 5.9%, a figure that pales in comparison to the industry’s decline of 2.4%. Moreover, the stock’s performance has trailed the sector decline of 0.2% and the S&P 500’s growth of 9.1% within the same timeframe.

Image Source: Zacks Investment Research

Navigating the Waters: Promising Stock Picks

Highlighting three stocks with brighter prospects from the Consumer Staple sector, namely Vita Coco Company COCO, Molson Coors TAP, and Diageo DEO.

Vita Coco, known for its coconut water products in multiple regions, is standing strong with a Zacks Rank #1 (Strong Buy). COCO shares have seen a rise of 1.4% in the past three months. The Zacks Consensus Estimate for Vita Coco’s sales and earnings per share for the current financial year indicates a growth of 1.8% and 24.3% as compared to the previous year. COCO boasts an average trailing four-quarter earnings surprise of 31.3%.

Molson Coors, a global beer and beverage company flaunting a diverse range of owned and partner brands, holds a Zacks Rank #2 (Buy). With an average trailing four-quarter negative earnings surprise of 37.2%, TAP is showing signs of promise. The Zacks Consensus Estimate for Molson Coors’ sales and earnings for the current financial year point towards a growth of 1.4% and 4.2%, respectively.

Diageo, engaged in the production, distillation, brewing, bottling, packaging, and distribution of spirits, wine, and beer, maintains a Zacks Rank #2. The Zacks Consensus Estimate for DEO’s current financial-year sales hints at a 5.6% growth from the previous year. DEO shares have seen a commendable rise of 4.4% in the past three months.

“Could oil stocks hold the golden ticket?”

“Oil profits are soaring high amid challenges faced by oil producers. With oil prices showing a downward trend from recent highs, could companies in the oil sector reap significant rewards?”

“In the special report, ‘Oil Market on Fire,’ Zacks Investment Research unveils four unexpected oil and gas stocks poised for significant gains in the near future. Missing out on these recommendations is not an option!”

Don’t miss out on these recommendations. Download your free report today!

For a Free Stock Analysis Report of Vita Coco Company, Inc. (COCO), click here.

Get your Free Stock Analysis Report of Molson Coors Beverage Company (TAP) now by clicking here.

Desiring a Free Stock Analysis Report of Diageo plc (DEO)? Click here to get one now.

To read this article on Zacks.com, click here.

Visit Zacks Investment Research here.

Please note, the views and opinions expressed in this article are solely those of the author and do not necessarily reflect the views of Nasdaq, Inc.