Co-authored with “Hidden Alternatives.”

Warren Buffett is a purchaser of property that produce dependable income by the noise that surrounds the monetary markets. This goes with all his investments like Coca-Cola (KO), American Categorical (AXP), or Occidental Petroleum (OXY). The corporate ought to have a tangible moat, it should be capable of increase costs with out shedding market share, and the demand for its items and companies have to be robust by financial cycles.

“Our objective in each types of possession is to make significant investments in companies with each long-lasting favorable financial traits and reliable managers. Please word notably that we personal publicly-traded shares primarily based on our expectations about their long-term enterprise efficiency, not as a result of we view them as automobiles for adroit purchases and gross sales. Charlie and I are usually not stock-pickers; we’re business-pickers” – Warren Buffett, 2023 Berkshire Hathaway Shareholder Letter.

Whereas inventory costs transfer primarily based on the feelings, perceptions, and sentiments of Mr. Market, enterprise fundamentals don’t. Nevertheless, trade fundamentals, the utility trade is doing very properly and efficiently rising its asset base whereas elevating costs to shoppers.

Berkshire Hathaway Power is without doubt one of the largest electrical utilities within the nation with 5.2 million clients and is the second largest proprietor of renewable vitality property and a major investor in liquefied pure fuel amenities. Most significantly, it’s a conglomerate of tangible property, churning usable money for Berkshire Hathaway (BRK.B).

“Every firm [MidAmerican Energy and BNSF] has incomes energy that even beneath horrible financial situations will far exceed its curiosity necessities.” – Warren Buffett.

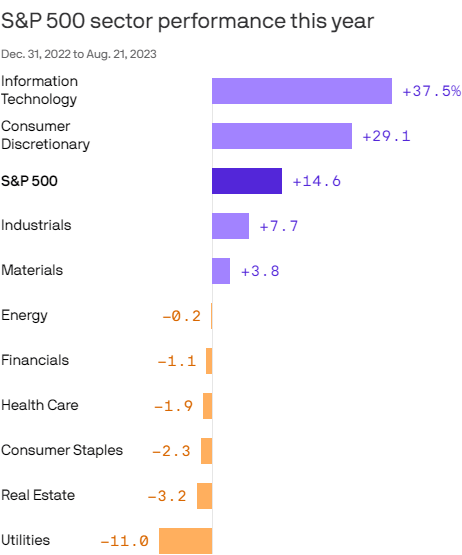

The Utility sector is at present out of favor amongst traders as a result of larger charges and uncertainty over the Fed’s financial actions. Traders have shunned this traditionally steady dividend-friendly sector as a result of availability of risk-free alternate options for earnings, making it essentially the most underperforming S&P sector YTD. Supply.

Let’s study two deeply discounted picks that pay large dividends by the revenue prowess of the utility/vitality infrastructure sector. Let’s dive in!

Choose #1: UTG – Yield 8.7%

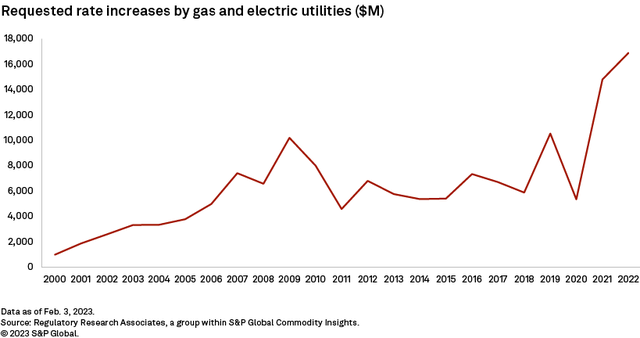

For utility firms, there’s a terminology referred to as “charge base”, which refers back to the whole worth of its regulated property. That is used to find out the charges the corporate can cost its clients for the companies offered and serves as a basic part in value restoration and profitability for this trade.

Due to the push for cleaner vitality and growing the security and reliability of the grid, it has been a document 12 months for requested charge will increase by U.S. utility corporations. Over $3 billion in charge enhance requests have been filed by February 2023, positioning this sector to have a terrific 12 months. Supply.

Charge base will increase add to the long-term worth of the corporate’s property, function an efficient inflation hedge, and supply improved stability to the earnings stream for traders.

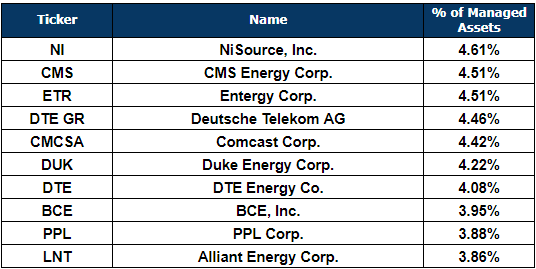

We just like the attractively discounted valuation of this asset-rich and inelastic trade and search diversified publicity with large yields. Reaves Utility Revenue Belief (UTG) is a CEF (Closed-Finish Fund) that has a observe document of offering each since its inception in 2004. UTG is actively managed and holds 44 firms at the moment, primarily U.S. and Canadian utility and telecom firms.

Taking a look at UTG’s high holdings, we see names of regulated utility corporations which have requested/acquired approvals for enormous charge base hikes. Such charge will increase place the corporations properly for sustained dividend development and asset enhancement over the long run, immediately benefiting shareholders.

This CEF pays $0.19/share each month, an 8.7% annualized yield at present costs. UTG’s energetic administration helps it seize low costs from undervalued but essentially robust names. Markets hardly ever transfer in a single course, and the CEF’s energetic balancing permits for the belief of wholesome beneficial properties, which may sustainably gasoline our distributions over the long run.

In its semi-annual report, UTG reported $146.9 million (nearly $1.97/share) in unrealized beneficial properties as of April 2023. Being a CEF, UTG should ultimately notice and distribute these beneficial properties. Along with this, UTG collects $1.30/share yearly from dividends, which is sustainably recurring from its portfolio holdings. The sum is satisfactory to help UTG’s annual distribution for ~1.5 years, making its present yield sustainable.

Choose #2: AM – Yield 7.7%

Antero Midstream Company (AM) is a midstream vitality firm with a large community of gathering pipelines, compression amenities, processing and fractionation crops, and water dealing with techniques within the Appalachian Basin – the Marcellus and Utica Shales. Considerably all of AM’s revenues are derived by offering midstream companies to Antero Sources (AR), which additionally occurs to be a major shareholder, establishing a symbiotic relationship between the 2 entities.

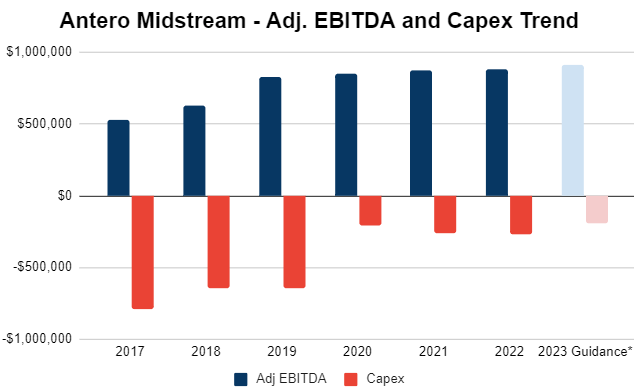

The largest good thing about midstream firms is the insensitivity of their operations to commodity costs by their regular fee-based revenues. Regardless of pure fuel buying and selling at document low costs, AM reported a ten% YoY enhance in Adj. EBITDA throughout Q2 2023. Together with this, the corporate achieved a 31% YoY lower in working bills.

Rising EBITDA and declining capital expenditure is a sight for sore eyes on this inflation-ridden excessive rate of interest financial system that’s staring down fearfully into the recession barrel. AM’s profitability is rising, with the corporate producing $139 million of FCF (Free Money Circulation) earlier than dividends and $31 million FCF after dividends. AM at present pays $0.225/quarter, a 7.7% certified annualized yield. With rising FCF after dividend funds, the subsequent increase is getting nearer.

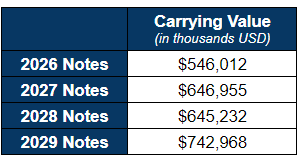

AM is aggressively paying down debt per its authentic dedication to shareholders. Throughout 1H 2023, the corporate diminished its long-term debt by $56 million and introduced its leverage down to three.5x (from 3.7x). AM has senior unsecured notes maturing from 2026 onward, which supplies them satisfactory flexibility with their near-term money flows.

Administration has reiterated their expectation to cut back debt to three.0x adj. EBITDA by 2024, which will increase the probability of dividend will increase within the close to time period.

AM’s earnings are on an upward trajectory, complemented by a strategic discount in each capital and curiosity bills. This may be attributed to the prudent administration navigating the broader dynamics of the vitality sector throughout its darkest days. On account of these actions, the beforehand famous 7.4% yield has not solely gained in stability but in addition reaffirmed its robust potential for sustained long-term earnings enlargement.

Conclusion

Warren Buffett has Berkshire Hathaway Power as a devoted platform to carry and put money into utility and different asset-rich infrastructure firms. This conglomerate contributes 10% of revenues and earnings at Berkshire and is projected to contribute within the mid-teens share in 5 years.

Berkshire Hathaway doesn’t pay dividends to its shareholders, however the mega-cap company immediately collects the income of its vitality conglomerate. Since I search earnings from my investments (very similar to what Berkshire achieves from its portfolio), I select to put money into alternative ways, but studying and adopting Mr. Buffett’s funding methods.

UTG and AM current attractively priced securities with as much as 8.7% yields. With such picks, you may take pleasure in the advantages of inflation resistance, inelastic demand, and robust pricing energy of the utility/midstream trade, akin to Berkshire’s successful formulation.