Legendary investors Warren Buffett and Charlie Munger recommend starting with $100,000 to build a passive dividend portfolio. This article analyzes the logic behind their strategy and two proven methods to implement it.

Why $100k is the Critical Start for Passive Income

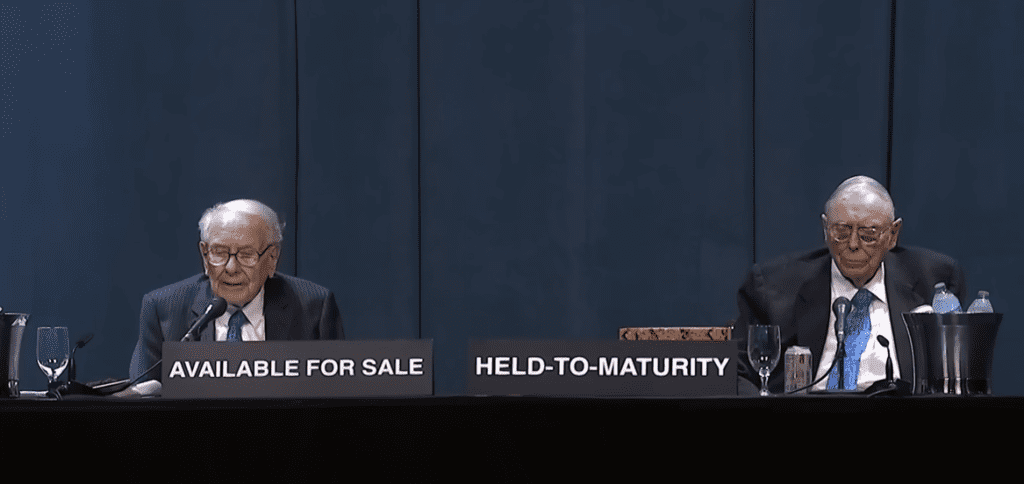

As Berkshire Hathaway’s Buffett and Munger explain, the first $100,000 in capital is the hardest part, but absolutely essential. As Charlie Munger said:

“The first $100,000 is a ***** but you gotta do it. I don’t care what you have to do – if it means walking everywhere and not eating anything that wasn’t bought with a coupon, find a way to get your hands on $100,000.”

This amount is so important because in the early stages of portfolio growth, passive income is minimal since the investment principal is still small. But once savings reach $100k, the compounding returns start snowballing. At that point, the passive income alone can quickly grow the nest egg without much additional capital input required.

Munger knew this from his own experience. He emphasizes working extremely hard early on to build a sizable “snowball” as quickly as possible. That way, it can do the heavy lifting for the rest of your life, enabling relaxing your own efforts later if desired.

Buffett uses the analogy of a snowball – as it rolls downhill it accumulates more snow, growing exponentially. The key inputs are time and consistent compounding returns.

Let Your Money Snowball Through Compounding Returns

As Buffett explains, investing to build passive income is like rolling a financial snowball down a hill:

“Life is like a snowball, all you need is wet snow and a very long hill.”

The “wet snow” is your invested capital, and the “long hill” is the compound returns from reinvesting dividends and capital gains over decades. Given enough time, the snowball effect grows your portfolio exponentially.

This concept applies equally to personal finance and investing: Any small boost in nest egg size early in your investing lifetime gets multiplied enormously by the power of compound returns over time.

While paths to accumulating the initial $100k vary based on individual circumstances, implementing an effective passive income investment strategy once you have the capital can be more straightforward.

2 Proven Methods to Build a $100k Dividend Portfolio

Now let’s examine two proven methods for building a $100k dividend portfolio as recommended by Buffett and Munger:

1. Dividend ETFs: More Passive, Lower Risk, Lower Reward

The simplest way to build a passive income snowball is to invest the $100k into dividend ETFs. These allow investing in the broader dividend stock universe with instant diversification, minimal knowledge needed, and professional management. ETFs provide passive exposure to the sector without the hassle of buying/selling individual securities.

However, there are some tradeoffs to consider with dividend ETF investing:

- Expense Ratios – ETFs charge annual management fees called expense ratios. While passively managed ETFs tracking a rules-based strategy tend to have low expense ratios, those fees still reduce net returns over time, slowing the compounding effect. Actively managed ETFs often charge higher expense ratios which further dampen total returns.

- Overdiversification – Many ETFs hold hundreds of dividend stocks, leading to “diworsification.” While diversification reduces risk, overdiversifying can worsen returns by diluting exposure to the highest quality opportunities.

- Lack of Security Selection – Passive dividend ETFs don’t select individual stocks based on value, quality, growth prospects, or management. They aim to own everything in a sector benchmark indiscriminately. This includes lower quality companies and unsustainable dividend stocks.

- Market Cap Weighting Bias – Many passive ETFs weight holdings by market cap without considering underlying fundamentals. This inflates demand for overvalued large cap dividend stocks relative to small caps.

- Low Dividend Yields – Due to heavy investment in overpriced large caps, ETFs often have low dividend yields, limiting their attractiveness for income investors.

While dividend ETFs may not maximize total returns like individual stocks, their diversification and passive nature do reduce risk substantially. Investing in multiple dividend ETFs can generate steady compound growth around 7-12% for decades.

If seeking a comfortable nest egg and attractive passive dividend income without needing huge capital gains, ETFs like SCHD, VYM, and JEPI are solid options. For purely capital appreciation, S&P 500 funds like SPY and QQQ work as well.

2. Individual Dividend Stocks: More Active, Higher Risk, Higher Reward

Rather than buying dividend ETFs, investors can purchase individual dividend stocks such as Realty Income (O), Enterprise Products Partners (EPD), Ares Capital (ARCC), and Blackstone (BX).

Individual dividend stocks are less passive since success requires thorough due diligence and financial skill development. Investors must study earnings reports, presentations, industry trends, balance sheets, cash flow, management commentary, valuation models, macroeconomics, and more to identify the best opportunities.

Furthermore, a properly researched individual dividend stock portfolio will be far less diversified than a broad ETF. This concentrates risks. If a single stock cuts its dividend or faces business headwinds, the impact on total returns is much greater.

However, picking individual dividend stocks also allows targeting much higher yields along with greater total returns. Investors can filter out overvalued stocks and select the most promising investments with safe dividend payouts.

Expanded Comparison of Dividend ETFs vs. Stocks

Popular dividend ETFs like Vanguard High Dividend Yield ETF (VYM), Schwab US Dividend Equity ETF (SCHD) and iShares Select Dividend ETF (DVY) offer instant diversification across hundreds of stocks. Over the past 10 years, they have delivered solid total returns in the range of 9-11% along with dividend yields around 3-4% currently.

On the other hand, investing in a handful of individual dividend stocks allows for targeting higher yields by cherry-picking quality names. For example, a portfolio of stocks like AT&T (T), Coca-Cola (KO), and Johnson & Johnson (JNJ) could generate a higher dividend yield. These stocks have impressive dividend growth histories averaging 4%+ annually over the past decade.

If investing $100k evenly into VYM, SCHD, DVY, and SPY for simplicity, the portfolio would generate around $3,300 in annual dividend income currently. However, a custom-built portfolio of high quality dividend stocks could provide over $5,000 in annual dividends on a $100k investment. It’s important to note that the dividend yeild can always change and your overall portfolio could be down for the year based off of the underlying equity performance of each individual company in your portfolio.

Step-by-Step Guide to Analyzing Dividend Safety

When researching individual dividend paying stocks, it is crucial to thoroughly analyze the dividend safety using the following metrics:

- Payout Ratio – Evaluate the EPS payout ratio (dividends per share / EPS) and cash flow payout ratio (dividends / operating cash flow). Target ratios below 60-70% for stable companies and under 90% for utilities.

- Cash Flow and Debt – Check that the company generates sufficient operating cash flow to cover the dividend payment, with an ideal cash flow cushion of over 2X the dividend. Make sure debt levels are reasonable, examining the debt/equity ratio and debt/EBITDA ratio. Target less than 3X debt/EBITDA.

- Recession Resilience – Check dividend growth history and financial performance through past recessions and bear markets. Look for companies that maintained or grew their dividend through economic downturns.

Key Tips for Building Your $100k Dividend Stock Portfolio

Here are some additional tips for investors looking to build a $100k dividend portfolio:

- Consider using a financial advisor or portfolio manager for guidance if you are an inexperienced investor or lack confidence in stock picking. An advisor can help select quality dividend stocks and provide oversight.

- When picking individual dividend stocks, analyze the payout ratio, look for consistent dividend increases, target stocks with long dividend growth histories, and favor dividend aristocrats or kings.

- Include a mix of stocks from high yield sectors like real estate, energy, utilities, and financials as well as safe dividend paying stocks from the S&P 500.

- Reinvest all dividends and qualified dividends to allow faster compounding. Enroll in dividend reinvestment plans(aka DRIP).

- Use dollar cost averaging and buy on dips to build position size over time. Have a long investment horizon. Allow time for compounding to work.

Start Rolling Your $100k Dividend Snowball

While paths to the first $100k vary based on personal circumstances, Buffett and Munger make an excellent point – working hard early to build capital and then utilizing it to construct a passive income snowball sets you up for long-term success. The compounding effect is exponential.

But investors must choose wisely in how they structure their snowball, as a poor dividend portfolio can lead to lackluster results. Our view is that picking individual dividend stocks maximizes income and total returns for those willing to research diligently. But passive dividend ETFs work well for simpler hands-off investing.

The key is consistency. Commit to steadily building your capital base first, then let the power of compounding drive growth. Whether using ETFs or dividend stocks, the $100k mark is the critical snowball starting point. Begin building yours today and let it ride into an avalanche of passive dividend income.

TL;DR

- Warren Buffett and Charlie Munger recommend building a $100k dividend stock portfolio as the first step toward major passive income.

- At $100k, dividend compounding starts snowballing, generating exponentially higher income over time.

- Reinvesting dividends is key to the snowball effect. The capital builds on itself.

- Dividend ETFs provide instant diversification but lower yields. Individual stocks require research but offer higher income.

- Consistency is crucial – steadily build the position, allow time for compounding, and let the income grow. $100k is the critical snowball starting point.

- For now, in relation to Munger’s and Buffets advice…we are only talking about stocks. In future we very well maybe talking about adding crypto for dividends. Like when/if blackrock approves their new crypto etf!

FAQ

What are some good dividend ETFs to consider?

Some top-rated dividend ETFs include Vanguard High Dividend Yield ETF (VYM), Schwab US Dividend Equity ETF (SCHD), iShares Select Dividend ETF (DVY), and JPMorgan Equity Premium Income ETF (JEPI).

What are examples of stable dividend aristocrat stocks?

Dividend aristocrats known for consistent payout growth include Johnson & Johnson (JNJ), Coca-Cola (KO), Procter & Gamble (PG), and 3M (MMM).

How often do dividends get paid out?

Most common stocks pay dividends quarterly, typically with payouts each January, April, July, and October. Income investors can choose stocks with payment schedules spread across quarters to receive dividend checks each month.

What sectors tend to have high dividend yields?

Real estate, energy, utilities, and financial sector stocks often have attractive high dividend yields above 4-5%. Telecom stocks also pay reliable dividends.

How do taxes work with dividend income?

Qualified dividends from stocks held over 60 days benefit from preferential tax rates between 0-20% based on income level. Ordinary dividends get taxed at your marginal income tax rate.

Should I choose dividend growth or high yield stocks?

Focus on dividend growth stocks earlier in retirement to fight inflation long-term. Prioritize high yield stocks later in retirement when current income needs are higher. Blend both types throughout.

How are dividends taxed in different account types?

In taxable accounts, qualified dividends are taxed at long-term capital gains rates. In Roth IRAs, all income and distributions are tax-free. In traditional IRAs and 401(k)s, dividends and distributions get taxed as ordinary income when withdrawn.

What is the dividend irrelevance theory?

This theory argues dividends don’t matter because they don’t alter total shareholder returns. But empirical evidence suggests consistent dividend payers outperform non-payers over time.

How can I safely withdraw income from my dividend portfolio?

Withdraw 3-4% of the total portfolio value annually using the cash dividends, leaving the base of shares intact so the underlying income stream remains undisturbed.

If your a visual learner here is a great video done on a 100k dividend portfolio:

4 of The Best ETFs for Inflation: How to Prepare for Rising Prices