ANF: A Long-Standing Fashion Icon Roars Back to Life

Stepping back in time to 1892 – when Abercrombie & Fitch Co. was founded – the annals of retail history would record the birth of a retail powerhouse that has weathered the tides of time. Fast forward to the present, and this iconic brand has once again captured the hearts of consumers, soaring high after a robust holiday quarter. Proving its mettle, this Zacks Rank #1 (Strong Buy) behemoth is gearing up for a stellar performance, with expected double-digit earnings growth in fiscal 2024 on the horizon.

Resilience Through the Ages: A Storied Legacy Reinvented

Abercrombie & Fitch, a venerated specialty retailer renowned for its diverse array of apparel and accessories catering to men, women, and kids, remains a beacon of style and quality across the globe. With its 760 physical stores spanning North America, Europe, Asia, and the Middle East, alongside a robust e-commerce presence, the brand exemplifies resilience and adaptability in the ever-evolving retail landscape.

Empire Strikes Back: ANF Triumphs in Q4 Fiscal 2023

In a resounding victory, Abercrombie & Fitch recently unveiled its fiscal fourth-quarter and full-year fiscal 2023 results, clinching a magnificent fourth consecutive win against the Zacks Consensus estimate. Earnings of $2.97 easily surpassed the forecast of $2.81, showcasing a beat of $0.16. Driven by a stellar performance by the Abercrombie brands, which witnessed a jaw-dropping 28% surge in comparable sales, the retail giant also saw a strong showing from Hollister brands, encompassing Gilly Hicks, which reported a 6% uptick. With company-wide comparables up by a striking 16% in Q4, Abercrombie & Fitch is setting new standards of excellence in the retail domain.

Financial Fortitude: Weathering Challenges, Navigating Growth

For the full fiscal year, Abercrombie & Fitch witnessed a remarkable 13% rise in company-wide comparables, with Abercrombie brands soaring by 23% and Hollister brands ascending by 4%. Net sales surged to $4.28 billion, marking a substantial 16% upswing from the previous year. Adding to the financial prowess, gross profit climbed by 600 basis points to 62.9%, propelled by a 340 basis points increase in average unit retail and a 300 basis points boost from reduced freight costs and enhanced raw materials quality. Despite a 30 basis points setback from currency exchange rates, the brand remains resilient in the face of adversity.

Riding the Momentum: ANF Foresees a Bright Fiscal 2024

As the curtain rises on fiscal 2024, Abercrombie & Fitch is poised for continued success, with a bullish projection outlining a net sales growth trajectory of 4% to 6%. The company remains optimistic about the dominance of the Abercrombie brands over Hollister brands, with the Americas spearheading geographic performance. With a promising first-half growth outlook, fueled by calendar shifts from the 53rd week in 2023, ANF stands tall as a beacon of fiscal prosperity and unwavering growth potential.

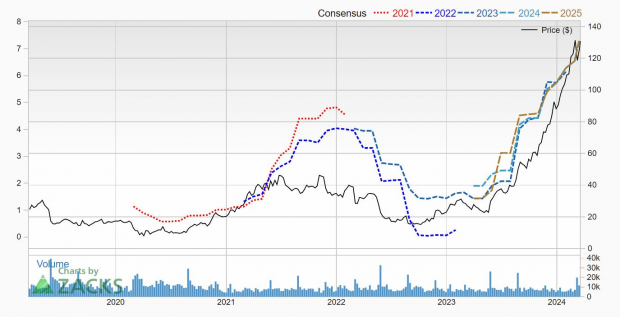

Wall Street’s Applause: ANF’s Steady Bull Run

The Wall Street fraternity has been quick to take note of Abercrombie & Fitch’s triumphant narrative, reflected in the soaring shares that have escalated by a whopping 402% over the course of the past year. Outshining the S&P 500, which recorded a 30.3% uptick in the same period, ANF’s meteoric rise is a testament to its indomitable spirit and unwavering market appeal.

Tempered Flames: ANF’s Unparalleled Value Proposition

Amidst the scorching heat of its success, Abercrombie & Fitch stands firm with a forward P/E ratio of just 17.2, positioning itself as a beacon of value amid turbulent market waters. For investors seeking a retail gem with a blend of strong momentum and attractive valuations, ANF shines brightly on the investment horizon.