Super Micro Computer Inc (SMCI), also known as Supermicro, is a San Jose-based technology company that specializes in designing and manufacturing high-performance server and storage solutions. With a Zacks Rank #1 (Strong Buy), SMCI is well-positioned to capitalize on the growing demand for data center hardware in industries such as enterprise IT, big data, cloud computing, IoT, and AI.

Betting on the AI Revolution

The artificial intelligence market is currently valued at approximately $100 billion and is projected to grow by 20 times to nearly $2 trillion by 2030. While established tech giants like Microsoft (MSFT) and Alphabet (GOOGL) stand to benefit from the widespread adoption of AI, SMCI offers investors a unique opportunity. As a provider of data-center hardware necessary to run AI applications, such as ChatGPT, SMCI plays a critical role in the AI revolution.

The AI Revolution Driving Growth

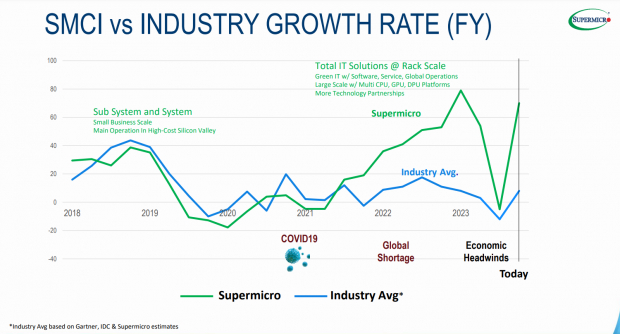

SMCI is a leader in the AI industry, and its recent earnings and revenue growth reflect its strong position. Last quarter, SMCI reported a 34% year-over-year increase in earnings and revenue. Despite challenges like supply limitations, SMCI has demonstrated resilience and is outperforming its peers in terms of relative growth rate.

Image Source: Super Micro Computer Inc.

Supply Limitations and Expansion

The increasing adoption of AI is driving explosive demand for SMCI’s servers. However, the company has faced challenges meeting this demand, leading to a pullback in its stock. Currently, SMCI has the capacity to generate a maximum of $15 billion in revenue annually. However, with the upcoming launch of a new production facility in Malaysia in 2024, SMCI will be able to double its production capabilities. Additionally, SMCI’s partnership with NVIDIA (NVDA), the leader in AI, further strengthens its position in the market.

High Growth and Efficiency

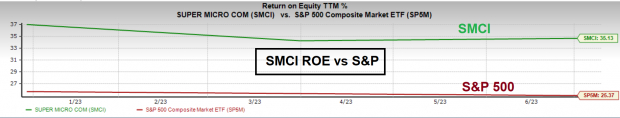

SMCI’s high earnings growth is complemented by strong operational efficiency. The company boasts a return on equity (ROE) of 35, outperforming the S&P 500’s ROE of 25. This indicates that SMCI effectively utilizes shareholder equity to generate profits.

Image Source: Zacks Investment Research

Relative Strength and Small Float

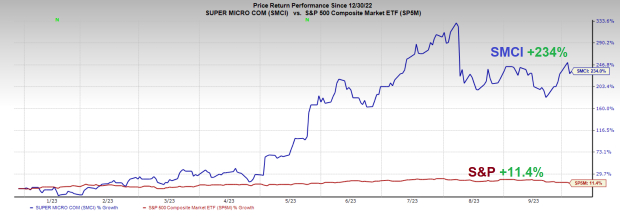

SMCI’s stock has shown significant strength, outperforming the S&P 500 by 234%. Furthermore, SMCI has a relatively small float of 45 million shares, which can contribute to further momentum in its stock price. Limited supply makes it easier for demand to exceed supply, potentially driving share price growth.

Image Source: Zacks Investment Research

Conclusion

With its strong position in the AI industry and impressive earnings growth, SMCI is poised for future success. While supply limitations have posed challenges, the company’s expansion plans and strategic partnership with NVIDIA position it well to capture a larger share of the server market. Investors looking to benefit from the AI revolution should keep an eye on Super Micro Computer Inc (SMCI).

Zacks Names #1 Semiconductor Stock

A new top chip stock with tremendous growth potential, poised to benefit from the demand for AI, Machine Learning, and IoT. Global semiconductor manufacturing is projected to reach $803 billion by 2028, and this stock is positioned to flourish in this industry.

Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the official position of Nasdaq, Inc.

Sources: