Caesars Entertainment Prepares for Earnings Report Amid Mixed Stock Performance

Investor Expectations and Historical Context Leading Up to Q3 Announcement

Caesars Entertainment, Inc. (CZR), based in Reno, Nevada, is a major player in the gaming and hospitality industry, with a market cap of $9.9 billion. The company operates well-known brands like Caesars, Harrah’s, Horseshoe, and Eldorado, offering various gaming, entertainment, and lodging services. Caesars is anticipated to announce its fiscal third-quarter earnings for 2024 following the close of the market on Tuesday, October 29.

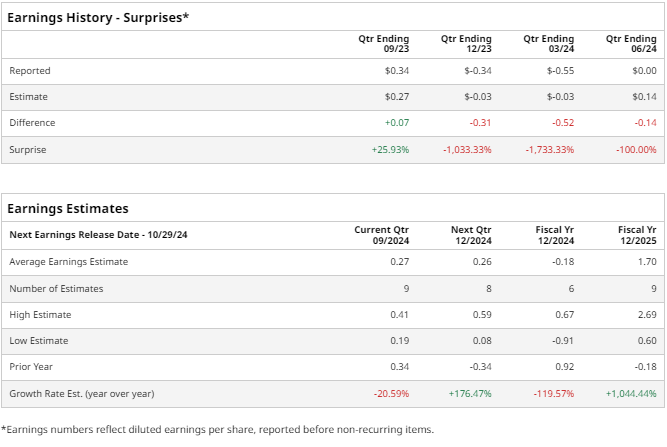

Leading up to this report, analysts predict CZR will present a profit of $0.27 per share on a diluted basis, representing a 20.6% decline compared to $0.34 per share in the same quarter last year. The company has been inconsistent in meeting analyst expectations, achieving better results in only one of the past four quarters.

Forecasting Fiscal 2024 and 2025 Earnings

For the fiscal year 2024, analysts forecast CZR will show a loss per share of $0.18, marking a significant decline of 119.6% from an EPS of $0.92 in fiscal 2023. There is, however, optimism for a recovery in fiscal 2025, where earnings are projected to rise to $1.70 per share, an astounding year-over-year increase of 1,044.4%.

Stock Performance vs. Market Indices

CZR’s stock has risen 6.2% over the past year, underperforming compared to the S&P 500’s ($SPX) gain of 34.4% during the same timeframe. It has also lagged behind the Consumer Discretionary Select Sector SPDR Fund’s (XLY) 24.5% rise.

Market Dynamics Impacting Stock Price

The stock’s lackluster performance can largely be attributed to macroeconomic challenges. Nevertheless, CZR shares jumped over 5% on October 2 after the company unveiled a $500 million stock buyback program, becoming one of the top gainers in the S&P 500 that day.

Contrarily, shares took a hit, declining more than 8% on August 5 due to rising recession concerns that worried investors about the travel and casino industries.

Analyst Ratings and Future Outlook

Currently, the consensus opinion on CZR stock is cautiously optimistic, reflected in a “Moderate Buy” rating. From 16 analysts monitoring the stock, 12 suggest a “Strong Buy,” three recommend a “Hold,” and one analyst proposes a “Strong Sell.”

The average analyst price target for CZR stands at $52.38, indicating a potential upside of 16.4% from its current price.

More Stock Market News from Barchart

On the date of publication, Kritika Sarmah did not hold positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information, please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.